Victoria Land Tax Calculator & Investor Guide (2025 Update)

Looking for a Victoria land tax calculator to work out your annual property holding costs? You’re in the right place. This guide explains how land tax works in Victoria, how to find your property’s site value, and how to calculate your tax liability using the free PropMax Victoria Land Tax Calculator.

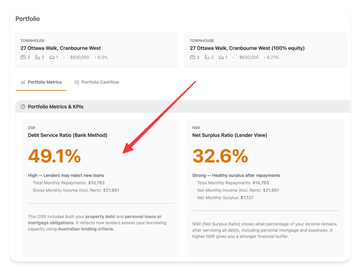

For property investors, land tax isn’t a deal breaker — it’s simply another holding cost like insurance or maintenance. And if it’s an investment property, your land tax is 100% tax-deductible. Put simply: land tax is an annual charge based on the combined Site Value of all your Victorian properties (excluding your home). Site values are assessed by the Valuer-General as of 31 December each year, and these values determine your land tax bill for the following year.

Table of Contents

Step 1. Understanding Land Tax Rules in Victoria

Before using any Victorian land tax calculator, make sure you understand the basics. The official State Revenue Office Victoria is the source of truth.

Key factors that affect your calculation:

- Which tax year applies

- Whether the property is held in a trust

- The combined Site Value of all taxable land you own in Victoria

- Whether you’re classed as an Absentee Owner

Step 2. How to Find Your Property’s Site Value

To use a land tax calculator in Victoria, you need your Site Value first.

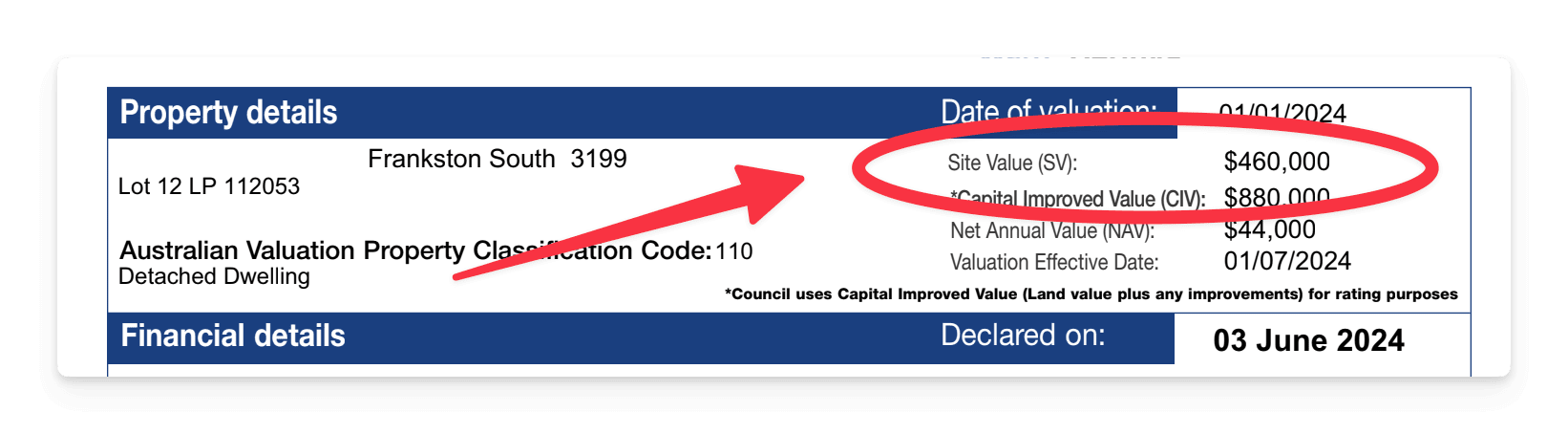

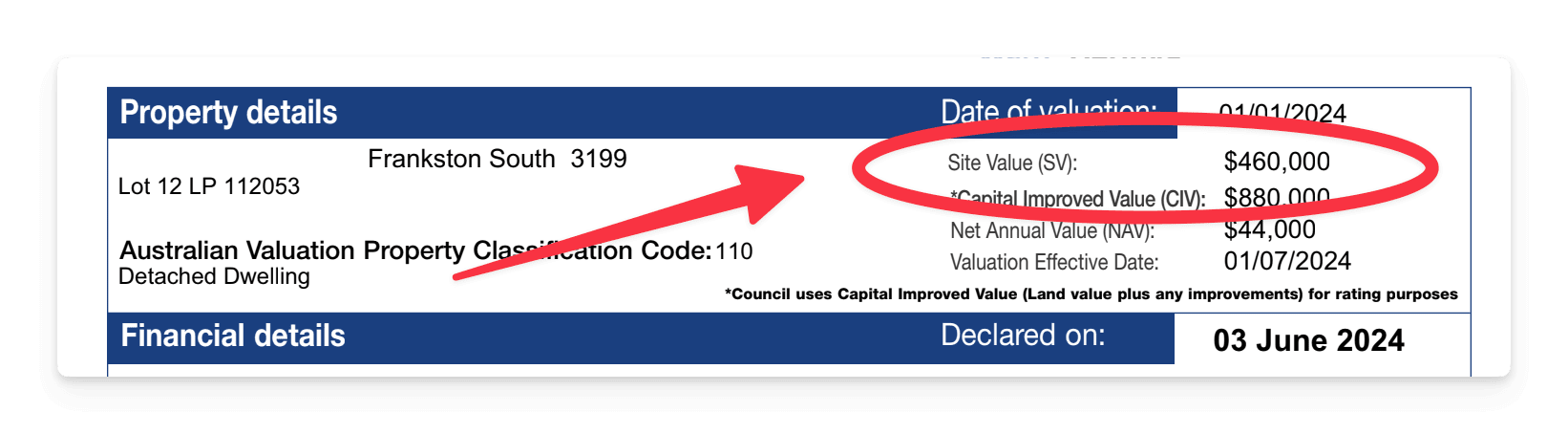

🔍 Option 1: Council Valuation Notice

- Already own the property? Check your Council Rates & Valuation Notice

- No notice? Ask the selling agent during inspection

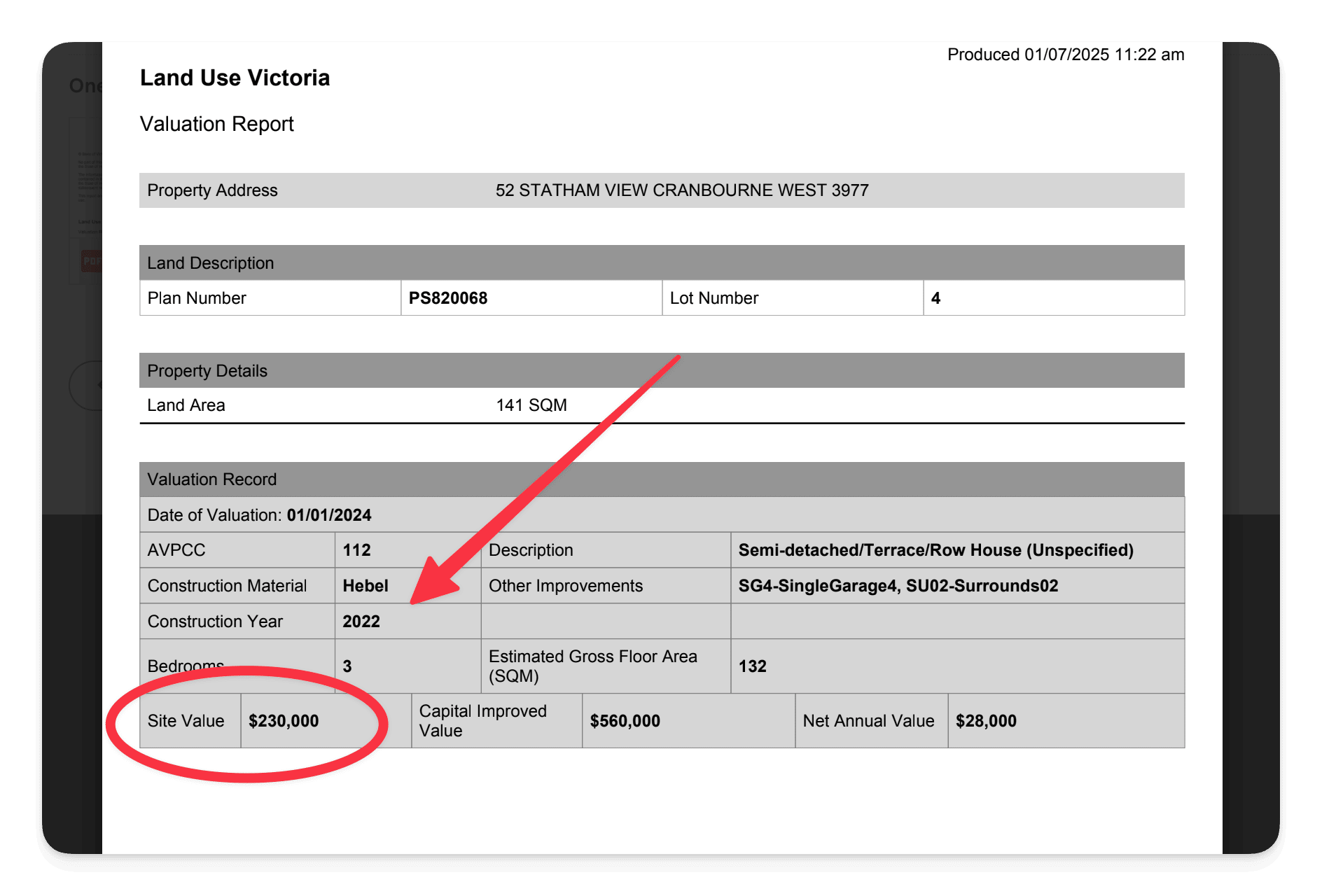

- Look for the Site Value (SV) field — e.g. $460,000

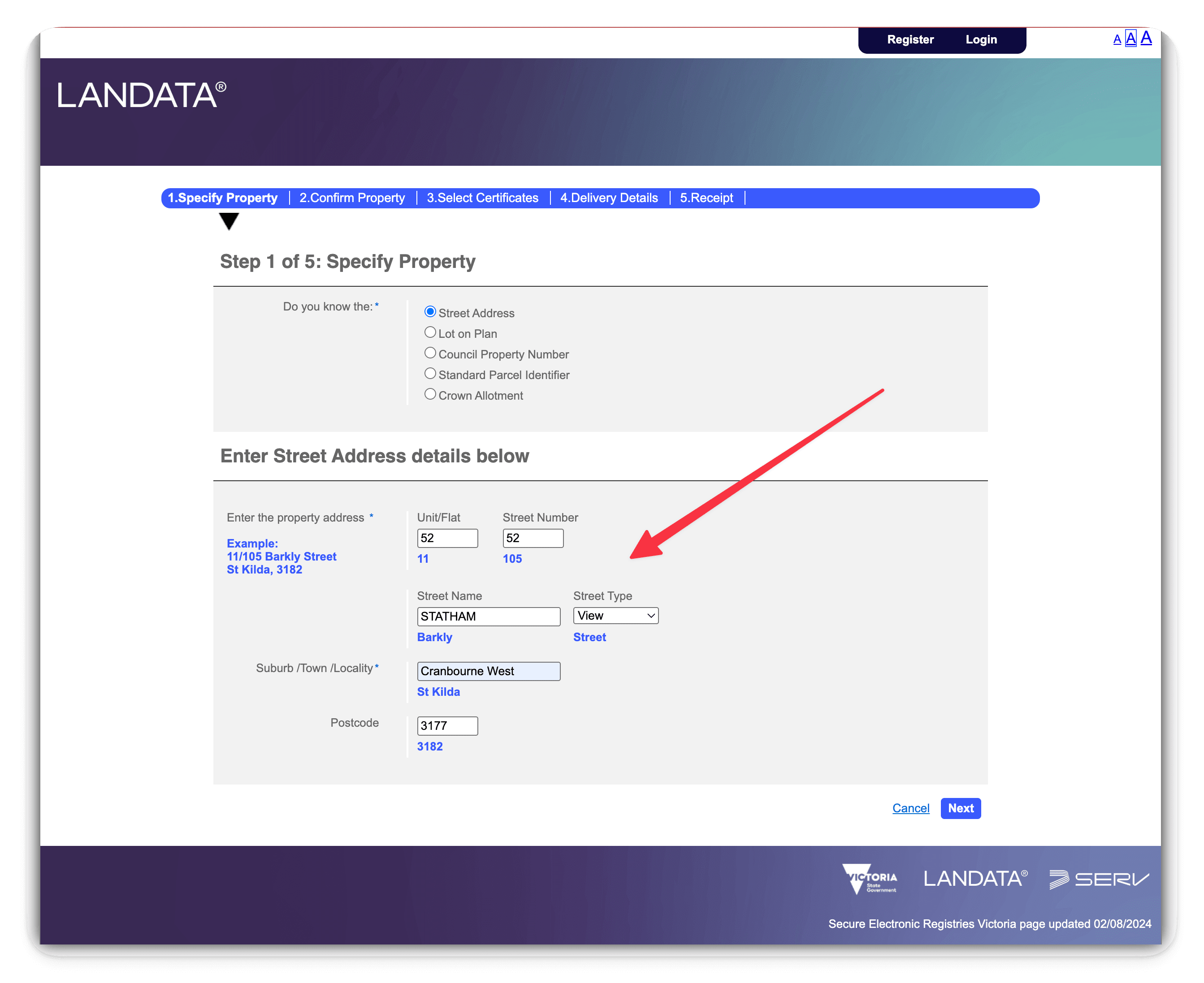

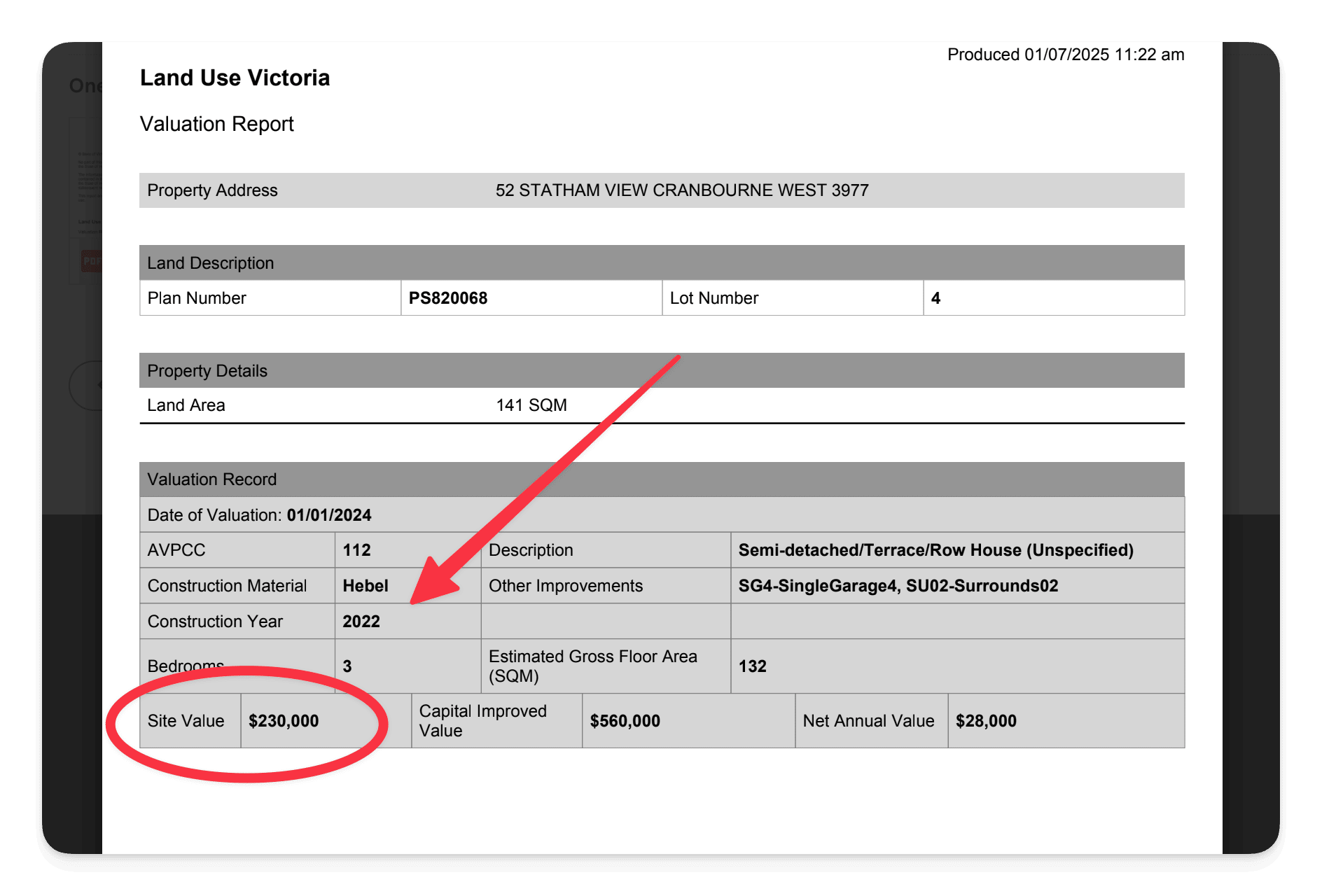

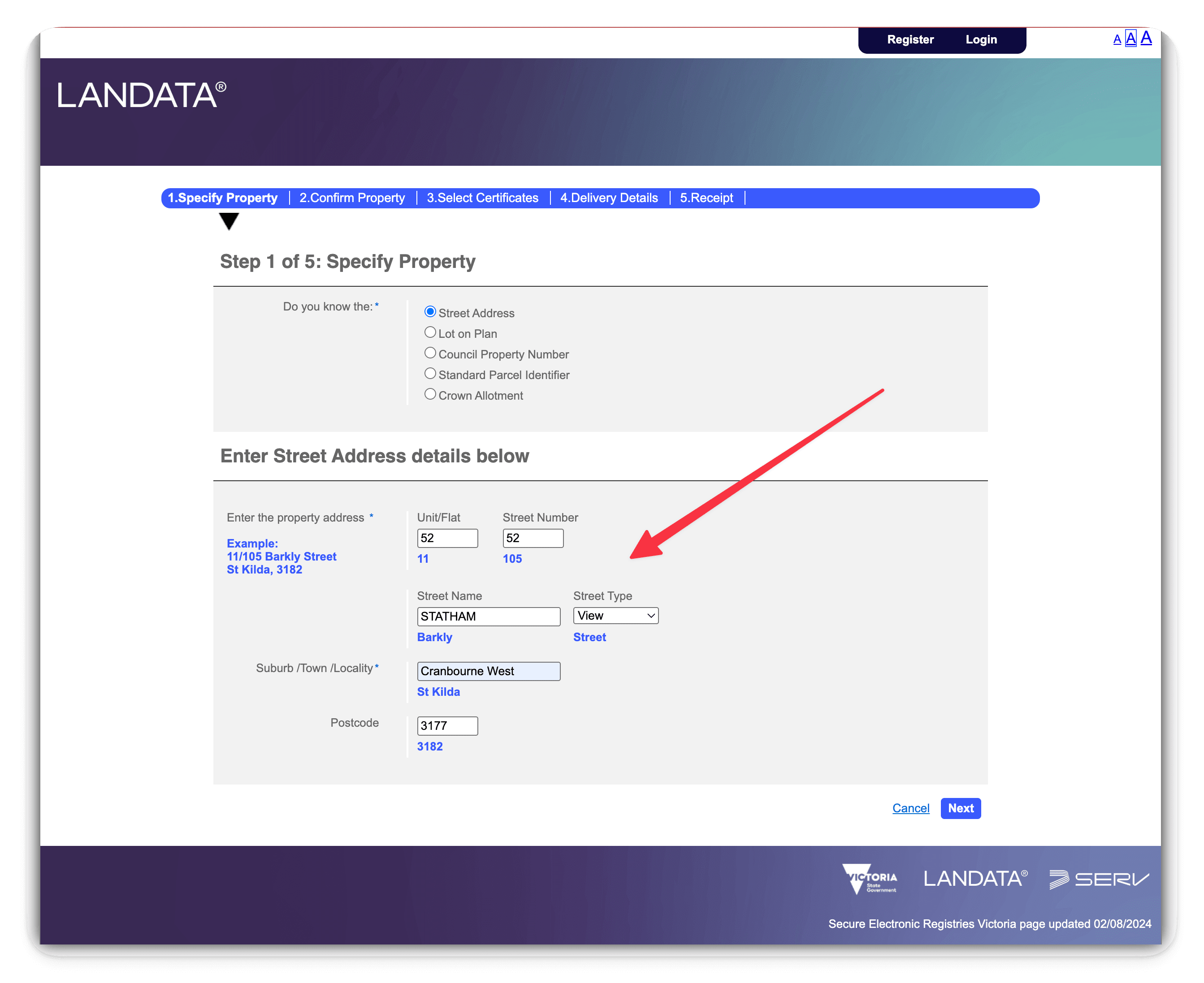

💻 Option 2: Landata Valuation Report

No paperwork handy? Order a quick digital valuation. Use Landata (~$11 AUD) for pre-purchase checks.

Steps:

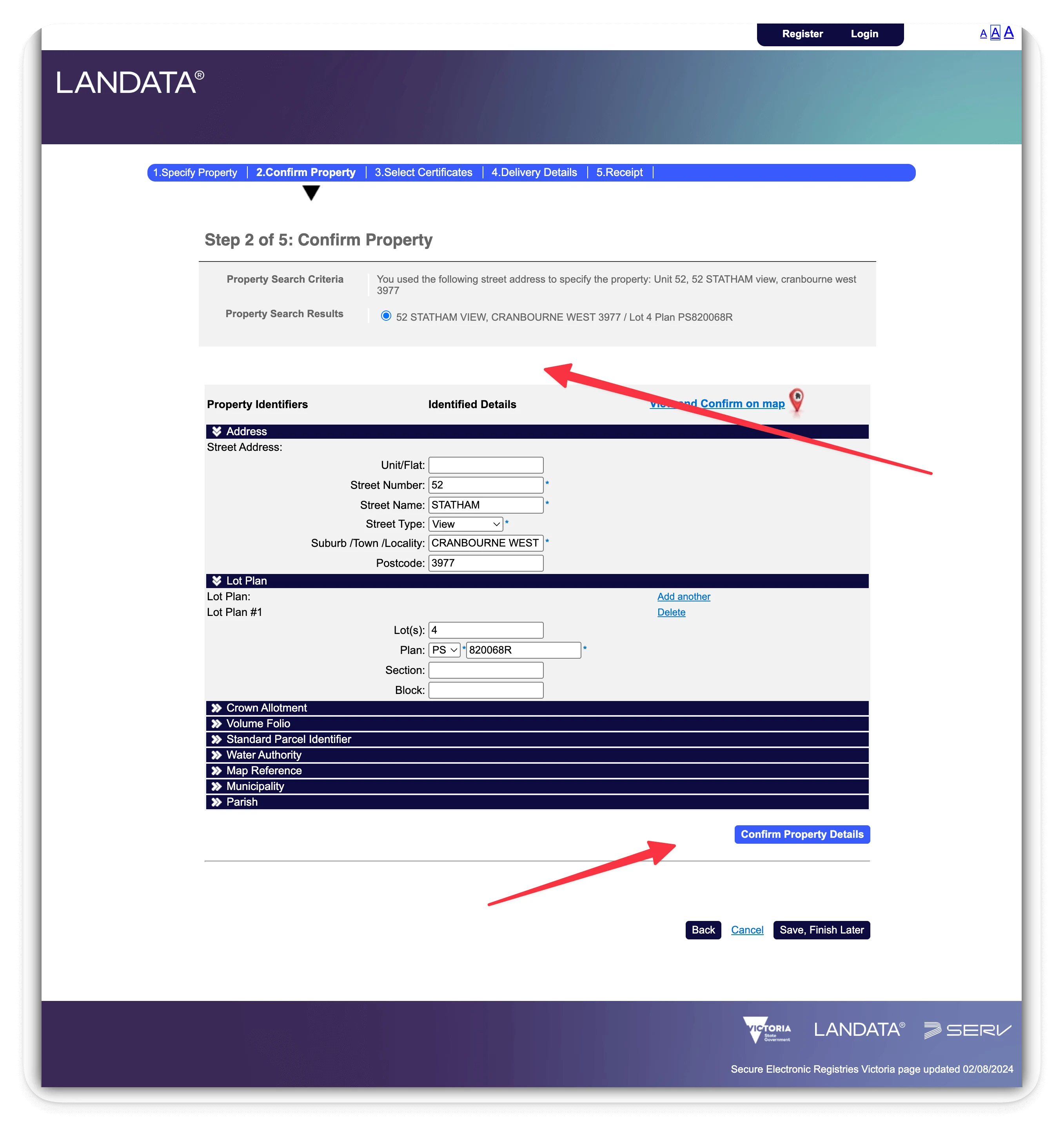

- Visit Landata’s Property Reports page

- Enter the property address

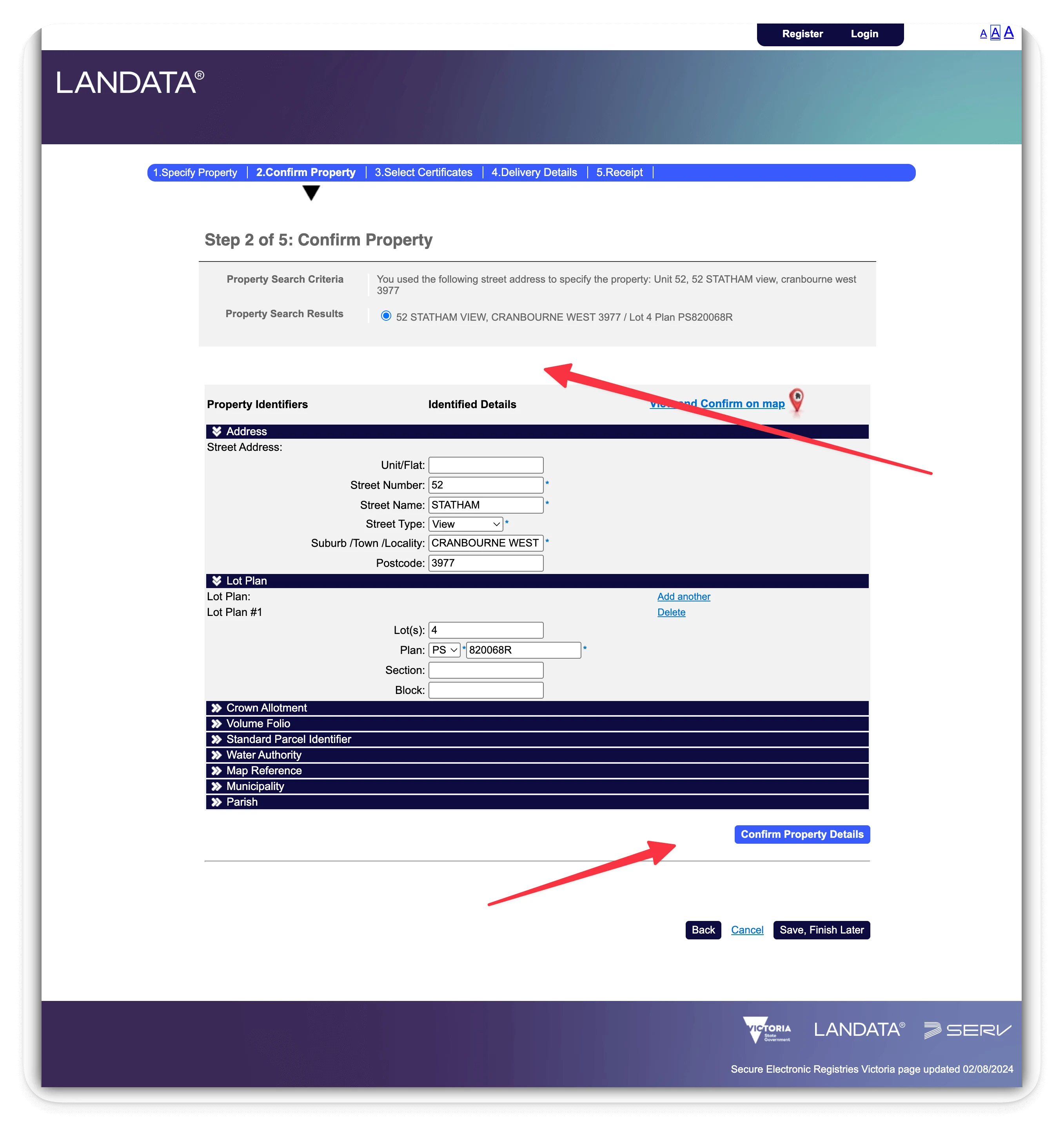

- Confirm the correct property

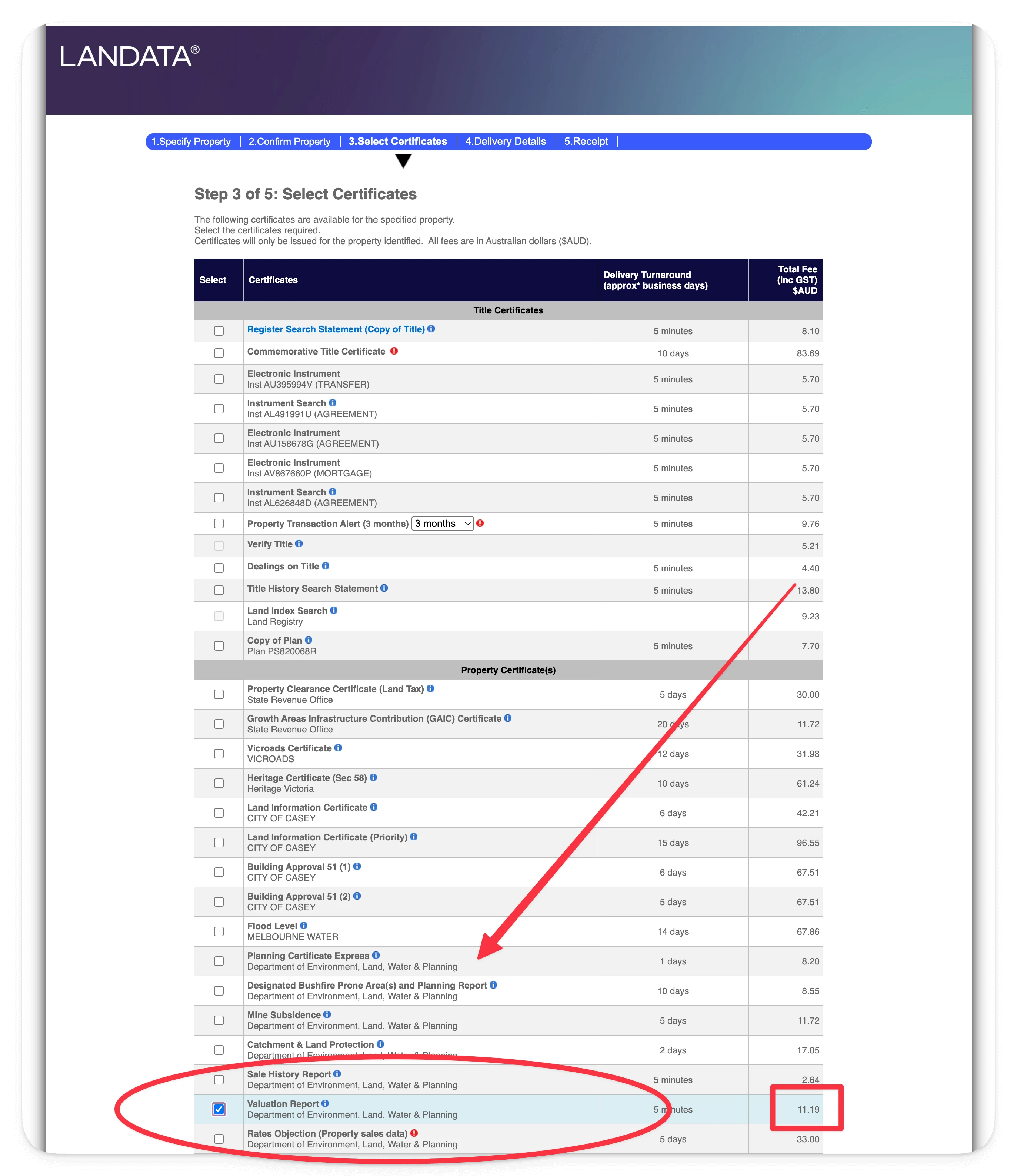

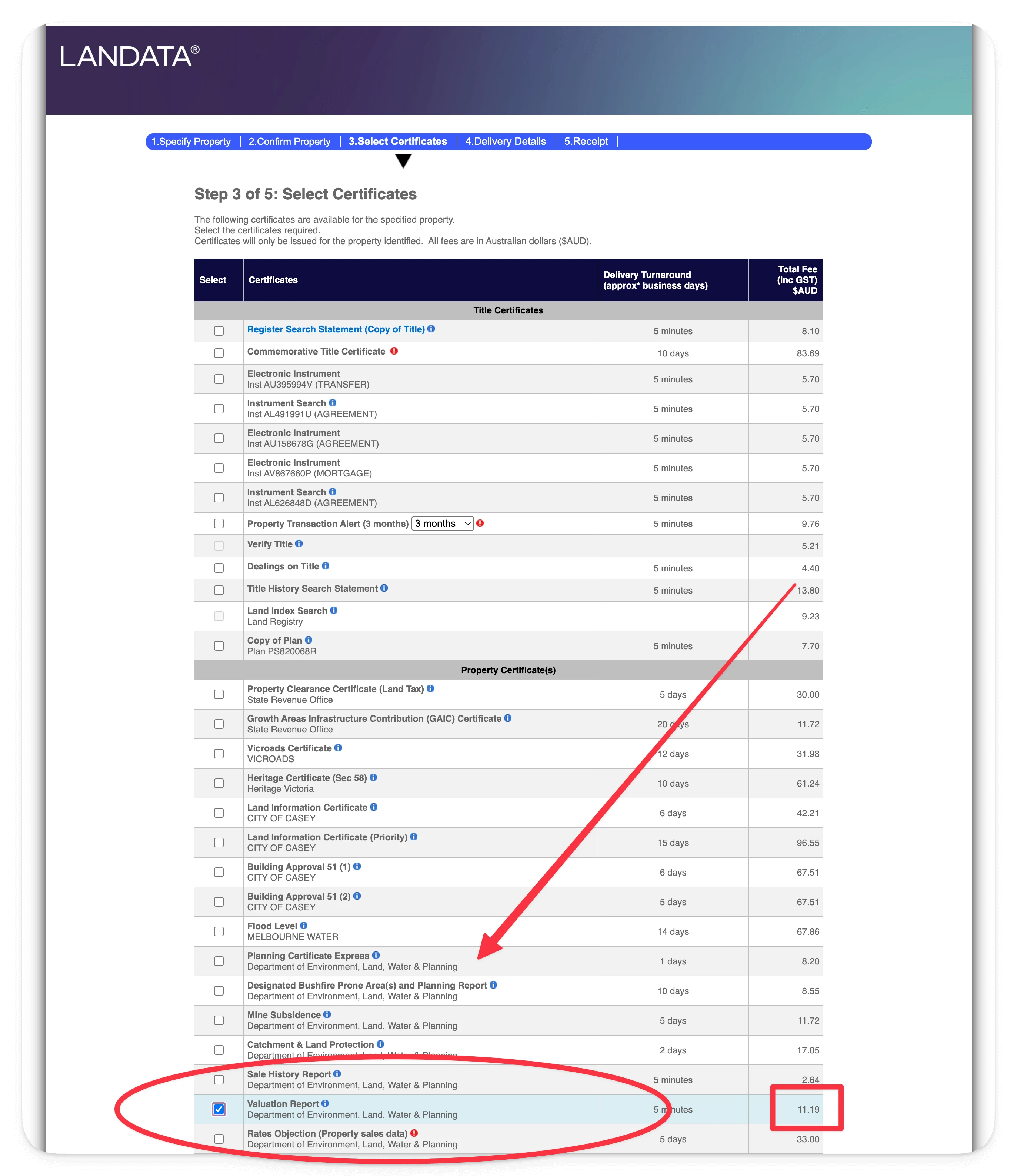

- Select Valuation Report

- Pay and download the PDF

- Look for Site Value in the report

Step 3. Land Tax & Absentee Owners

Most Australian-based investors don’t pay the surcharge. But if you’re overseas or classified as an Absentee Owner, expect an extra surcharge on top of standard Victoria land tax.

Check the latest rules here: Absentee Owner Surcharge.

Step 4. Land Tax for Trust Structures

Owning a Victorian property in a trust? Land tax thresholds are lower and rates are higher.

- Trust rates apply from just $25,000 in site value

- Always check the current land tax trust rates

- Speak to your accountant before purchasing via a trust

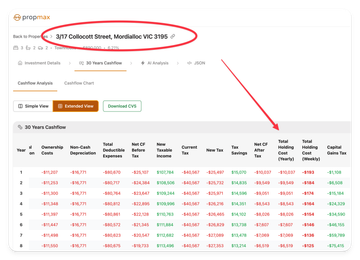

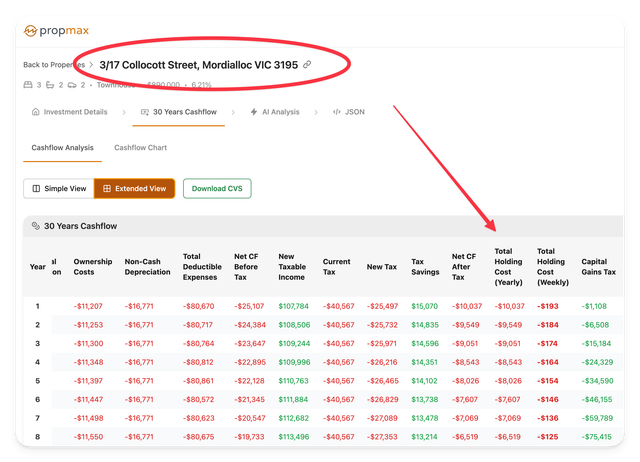

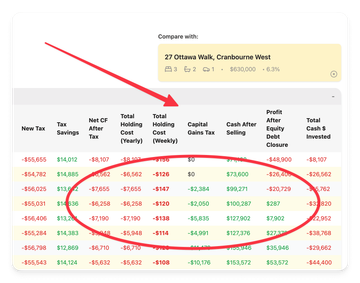

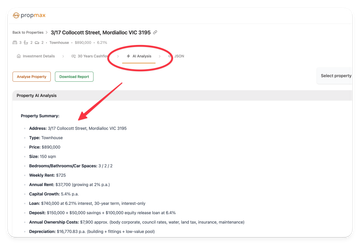

Step 5. Calculate with the PropMax Victoria Land Tax Calculator

Now you’re ready to calculate. You’ll need:

- The total Site Value across all your taxable land

- Whether you own as an individual or trust

- Your absentee owner status

👉 Use the PropMax Victoria Land Tax Calculator to instantly estimate your annual bill. Our calculator is updated for 2025 tax thresholds and designed for property investors.