Knowing your property’s current value and available equity is essential whether you're refinancing, investing, or simply tracking capital growth. Fortunately, several Australian banks and property data providers offer free online tools to estimate your property's worth using CoreLogic and other valuation engines.

Below are 5 of the most reliable and easy-to-use platforms for checking your property value and equity—completely free. Curated by PropMax.com.au.

Table of Contents

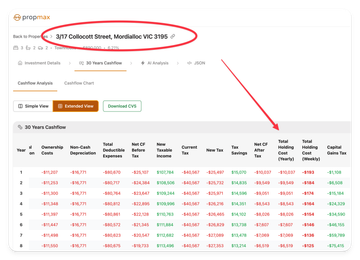

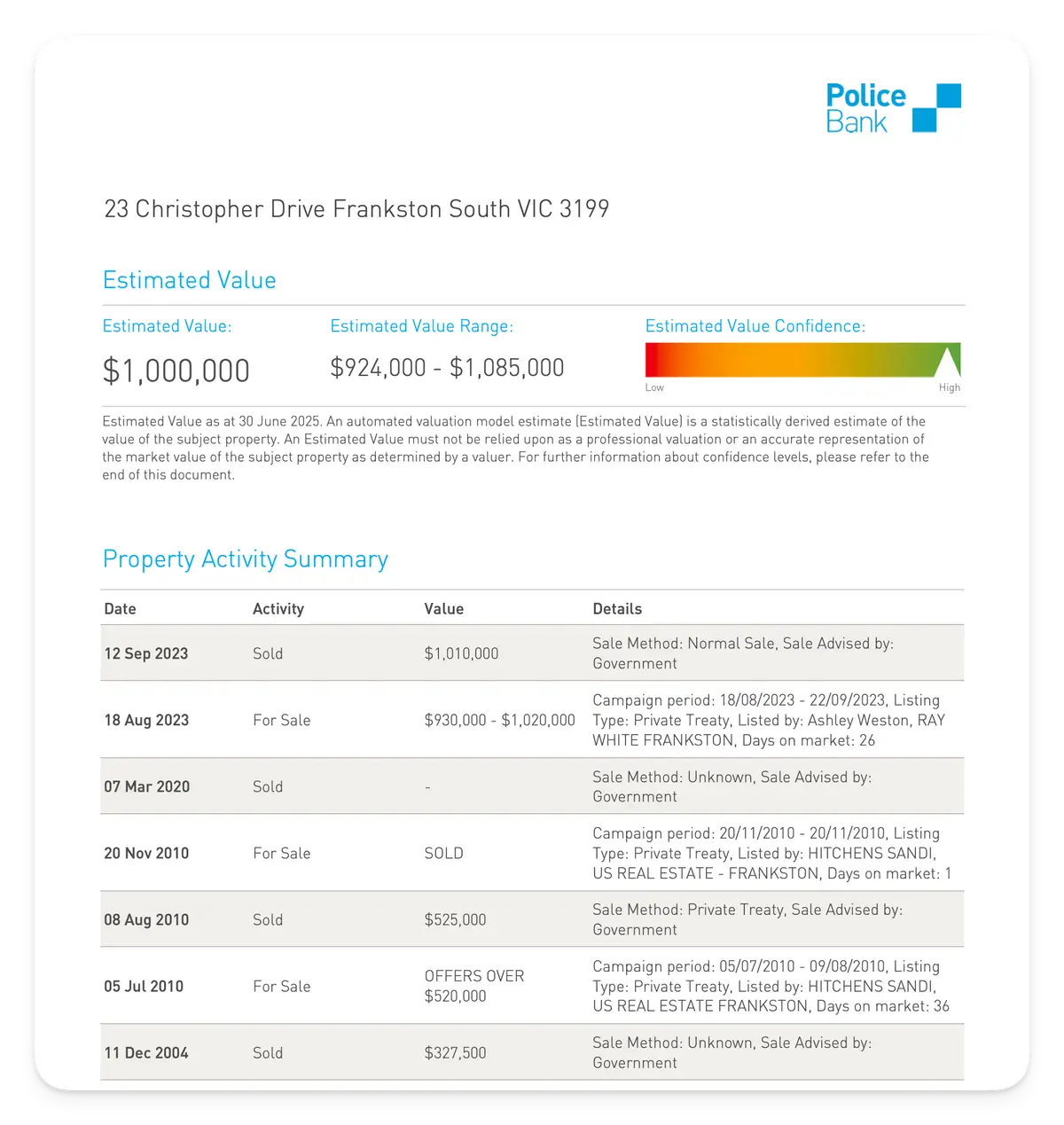

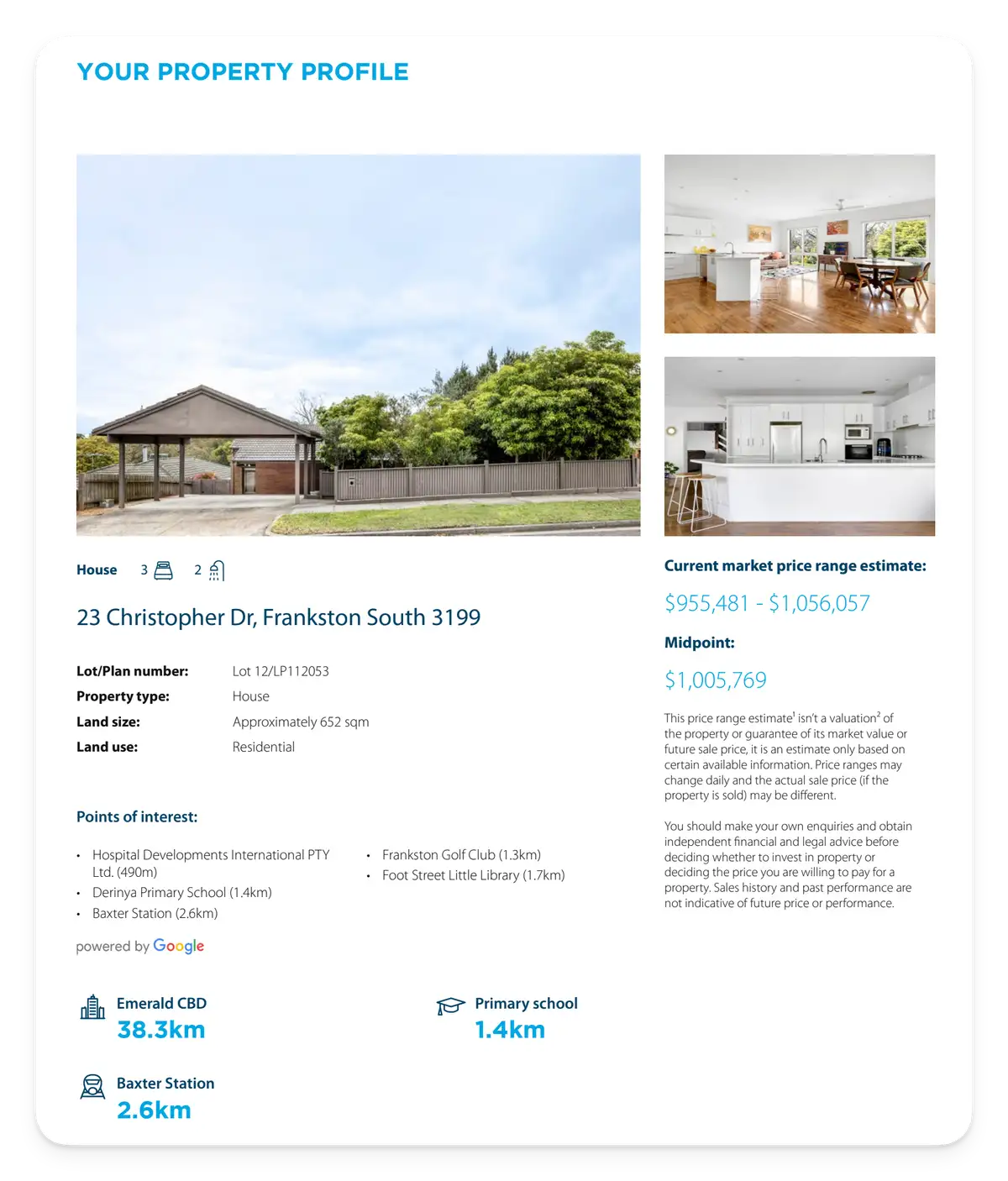

1. CoreLogic PropertyValue (Police Bank Edition)

Link: PropertyValue Police Bank free valuation tool

This tool is powered by CoreLogic and partnered with Police Bank, offering free access to a detailed valuation report. Simply enter your property address to receive:

- Estimated market value

- Price trends and comparable sales

- Recent nearby sales and suburb insights

It’s perfect for owner-occupiers or investors wanting a CoreLogic-backed estimate without paying for a full report.

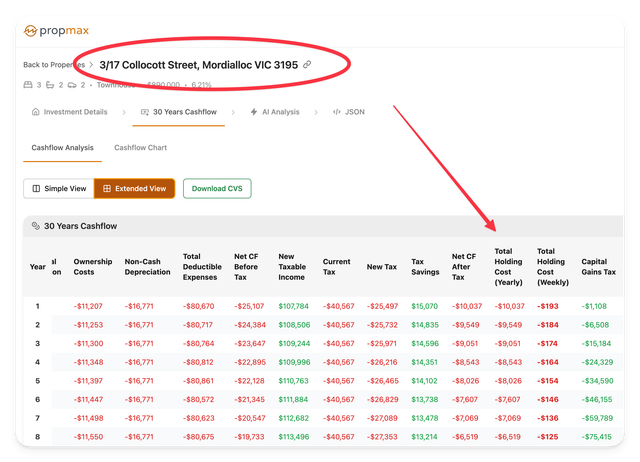

2. ANZ Property Profile Report

Link: ANZ Property Profile Report (CoreLogic)

ANZ’s free tool lets you download a comprehensive PDF property report powered by CoreLogic. You’ll receive:

- Estimated property value

- Property photos, last sale date, and land size

- 12-month suburb price movement

- Comparable sales analysis

Ideal for anyone researching a home loan or considering property investment.

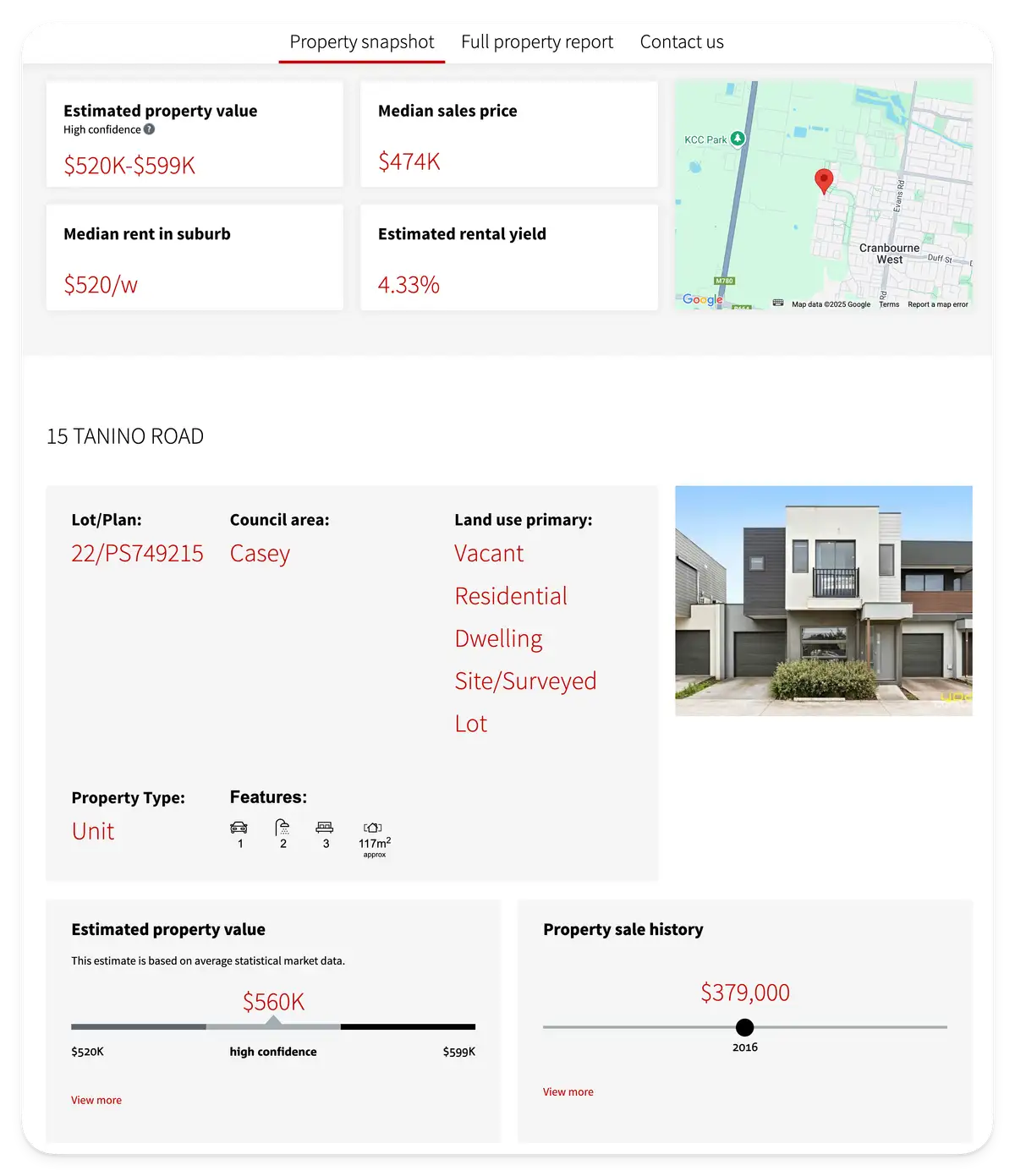

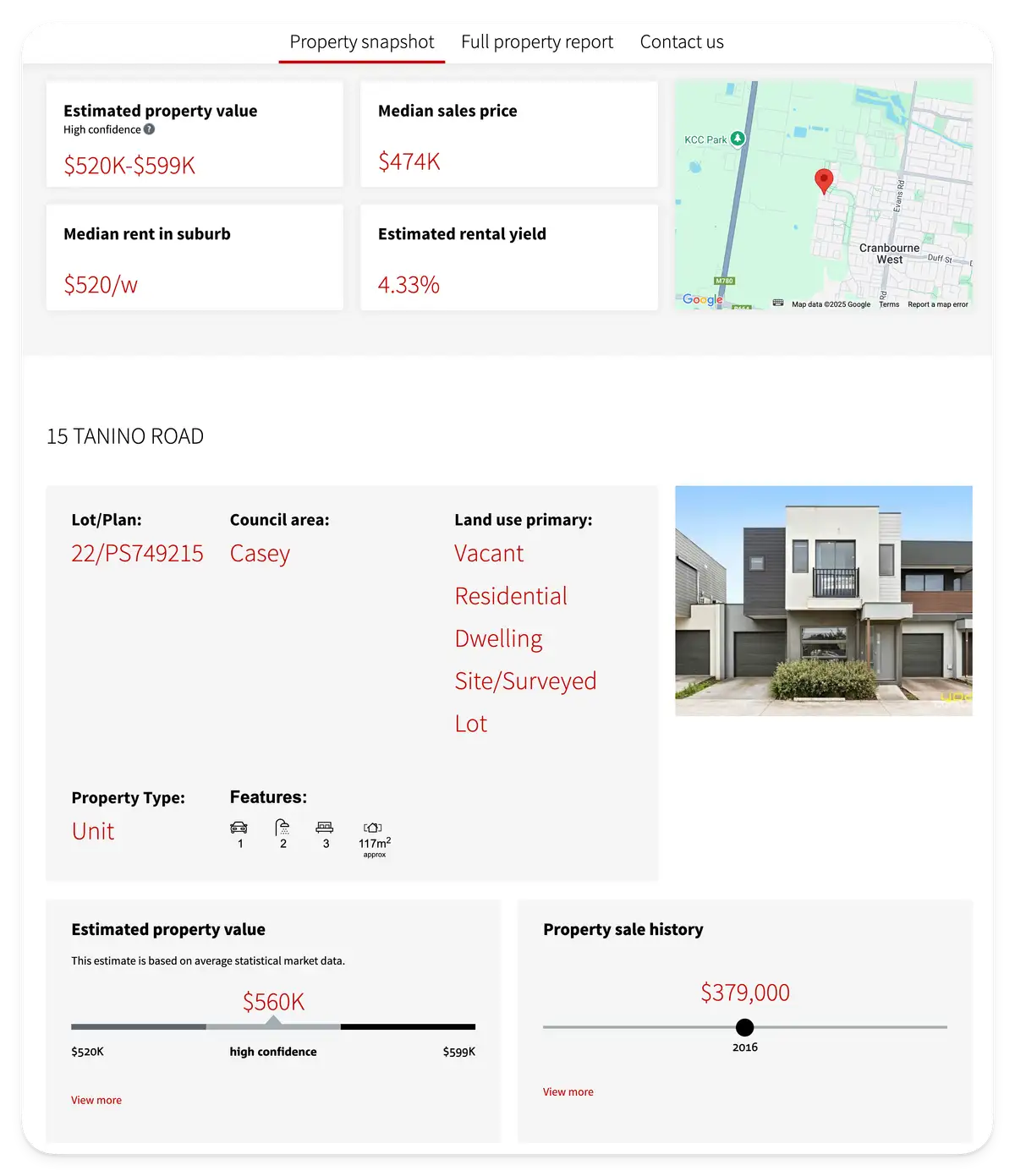

3. BOQ Property Report by CoreLogic

Link: BOQ Property Report by CoreLogic

Bank of Queensland (BOQ) offers this sleek tool in partnership with CoreLogic. You’ll get a similar PDF report to the ANZ version, containing:

- Property details and history

- Suburb performance metrics

- CoreLogic estimated market value

- Local sales trends and statistics

It’s a fast, professional report—great for pre-approval or negotiation prep.

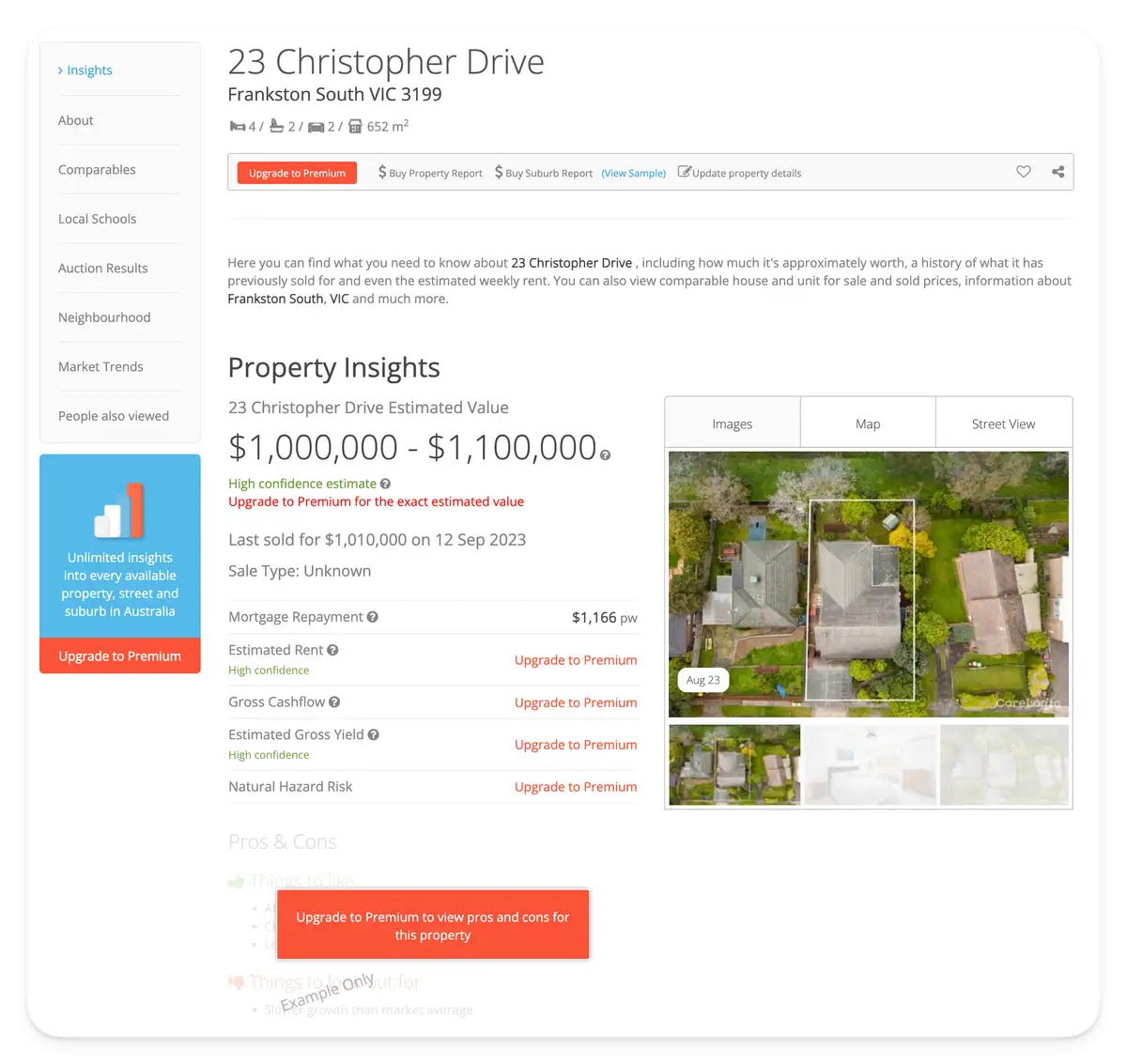

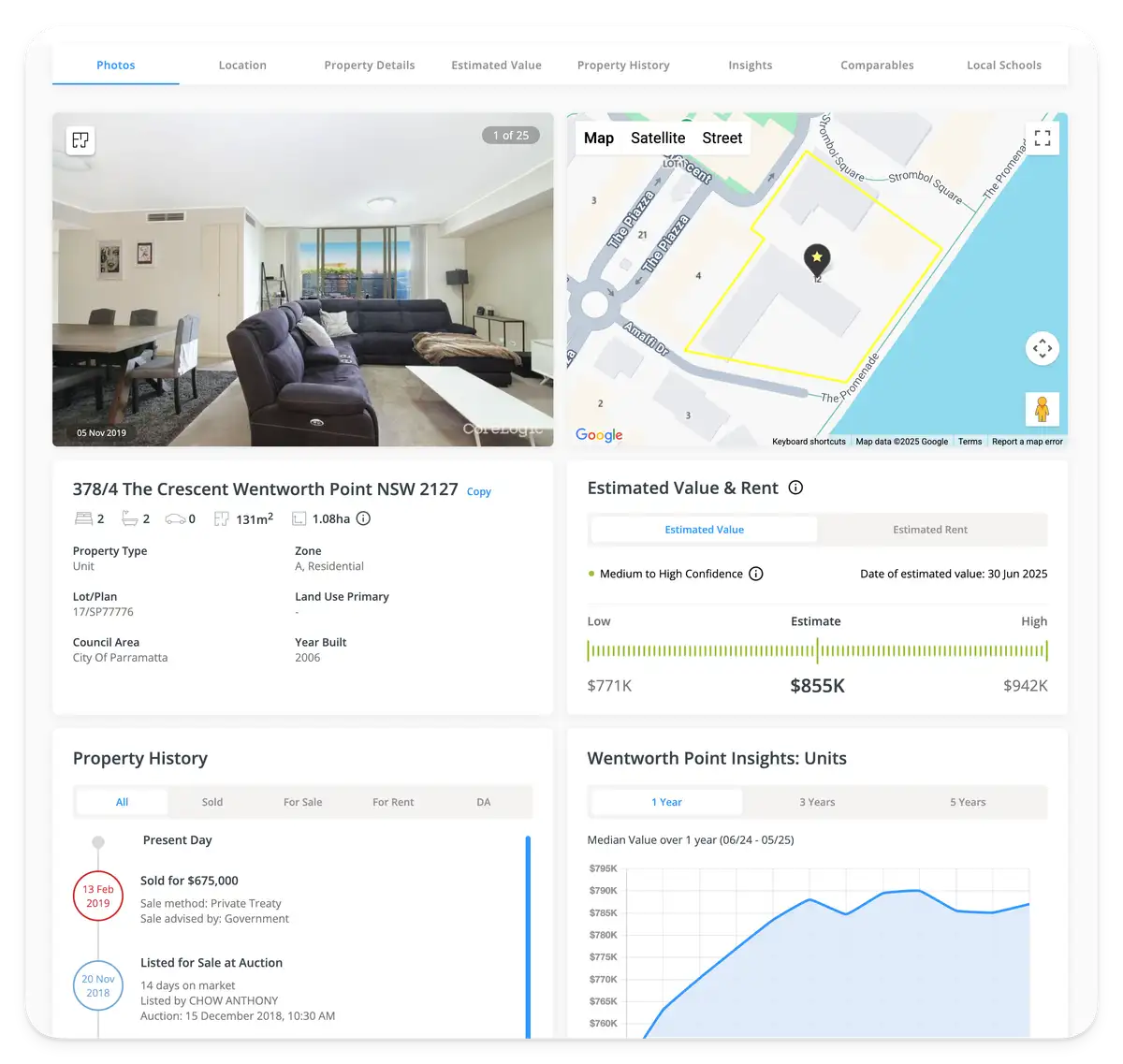

4. NAB Property Insights

Link: NAB Property Insights report

NAB offers an interactive web-based report (no download required). This tool is particularly strong for:

- Real-time estimated value and confidence range

- Property history and market comparison

- Local area price trends and rental data

The platform also works great on mobile, offering a modern and intuitive experience.

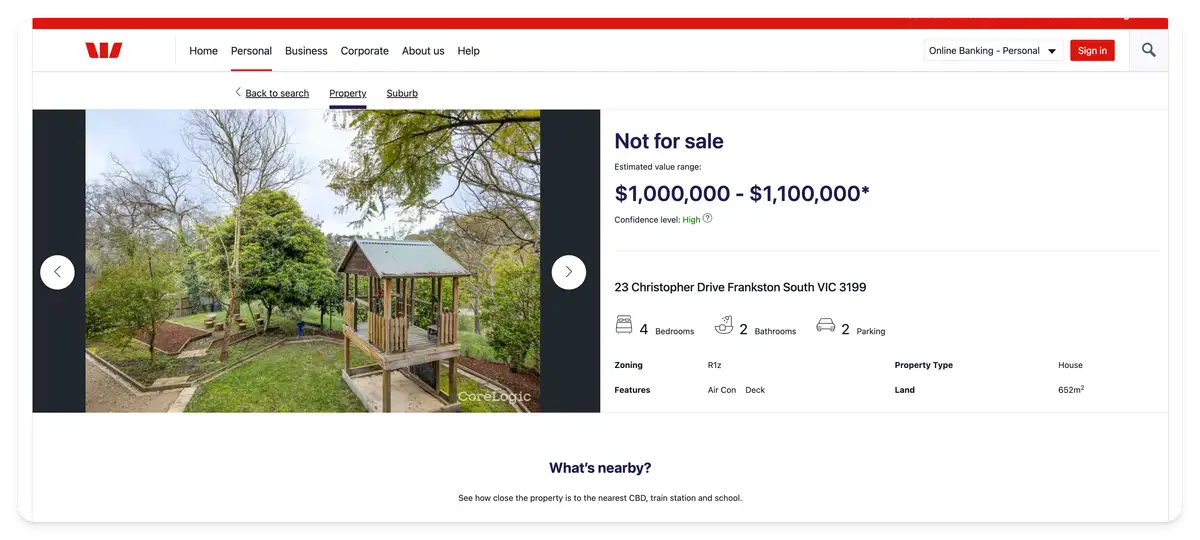

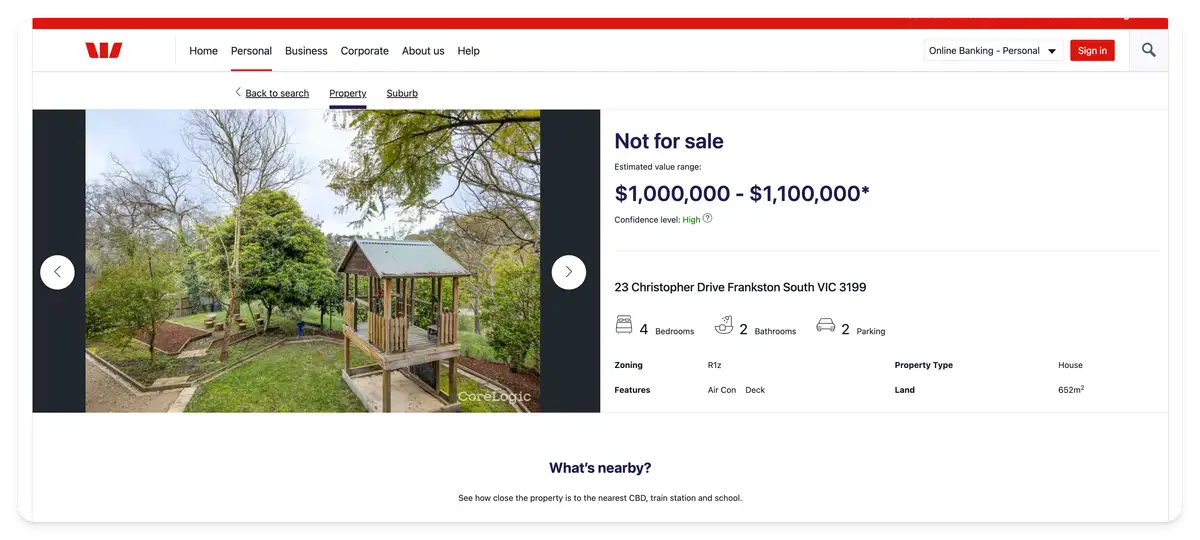

Link: Westpac Property Research Tool

Westpac’s tool gives users a summary property value, suburb insights, and price trend chart right from the browser. While it doesn’t offer a downloadable report, it’s useful for:

- Quick value snapshot

- Nearby sales browsing

- Price movement trends

It’s one of the fastest ways to get a quick value check with no sign-up required.

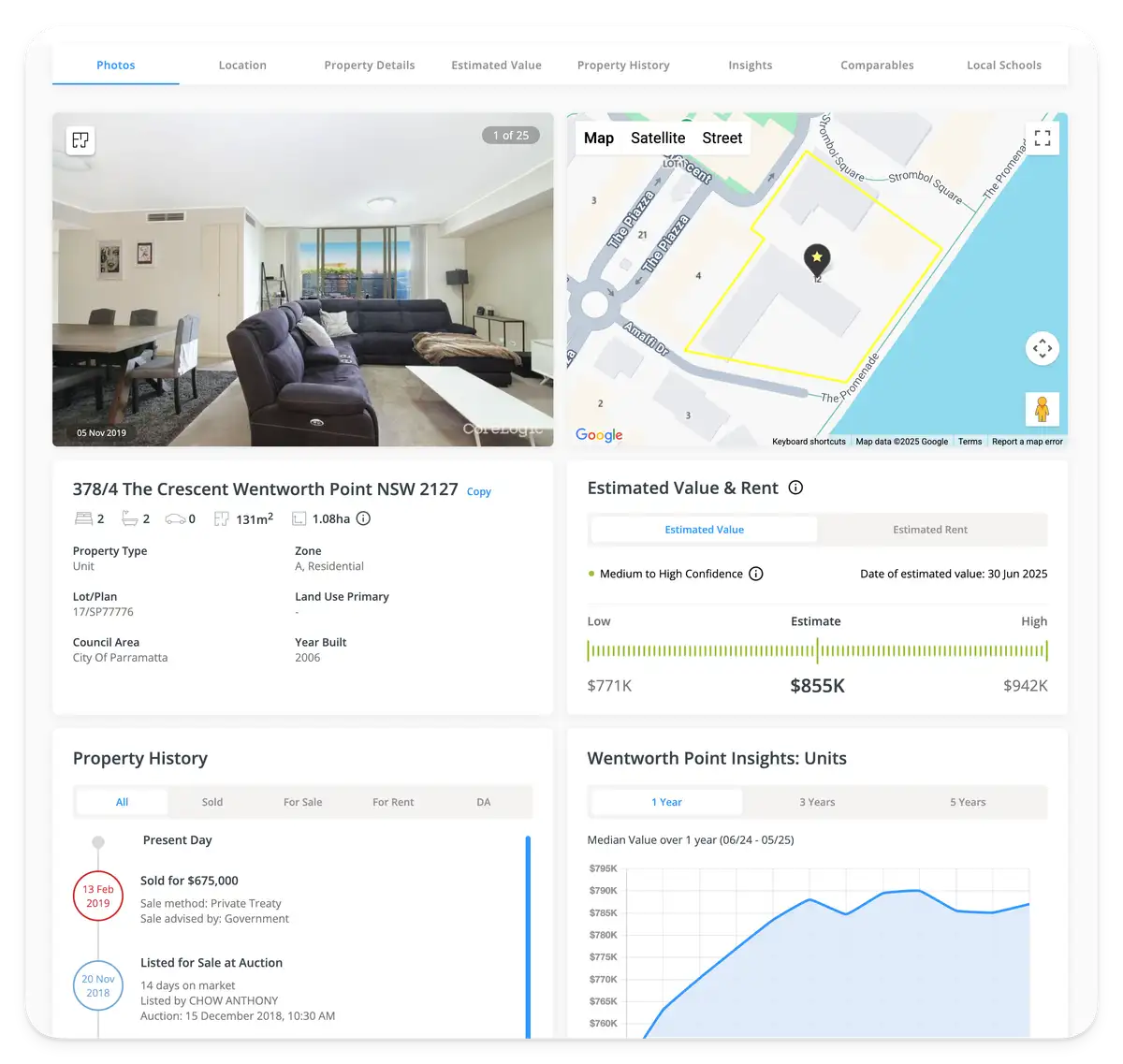

Bonus: Core PropertyValue.com.au (Direct)

Link: CoreLogic PropertyValue (direct)

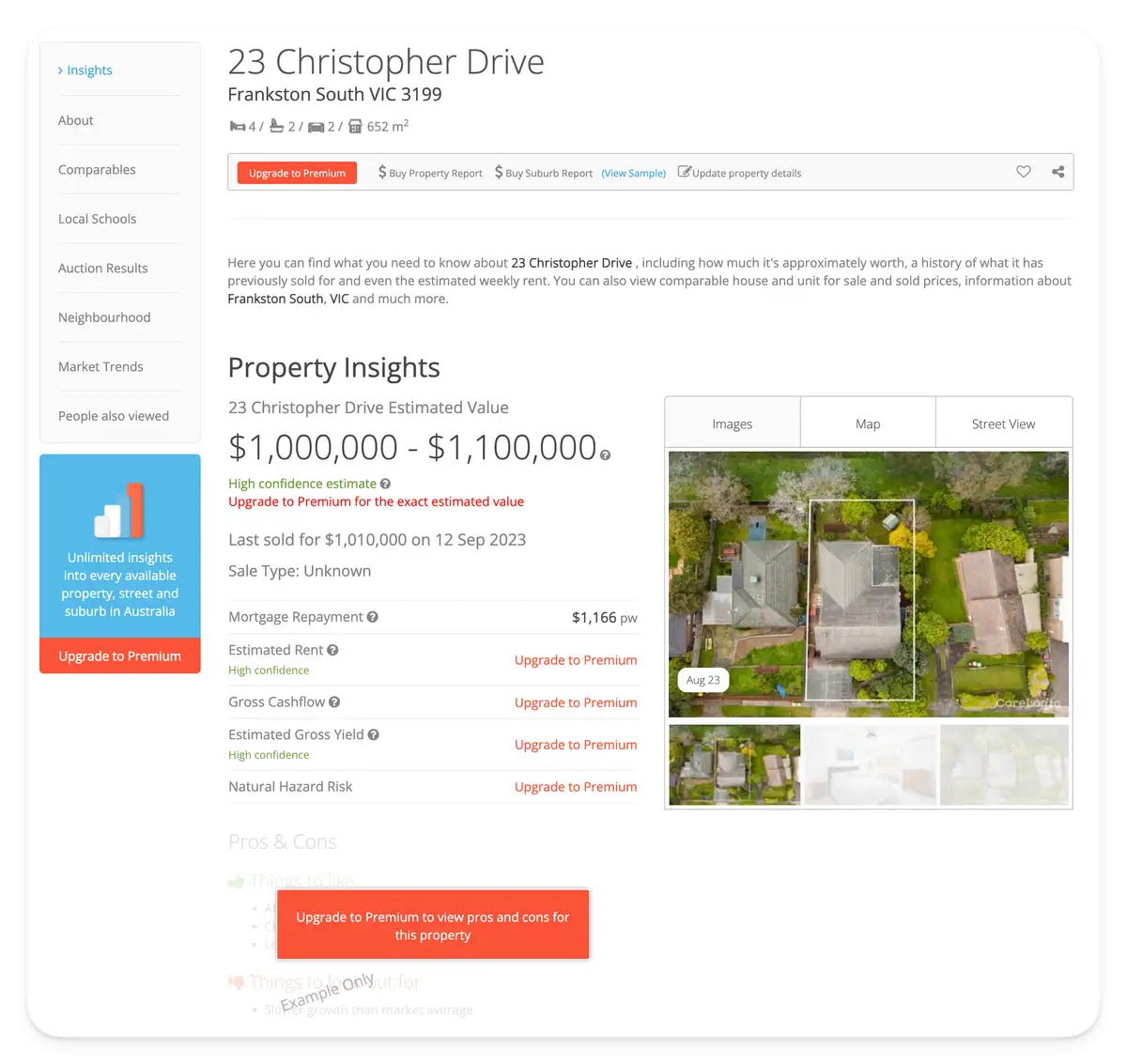

This is the flagship CoreLogic property valuation site. It offers free basic searches and paid advanced reports. The basic lookup gives:

- Market estimate and recent sales

- Estimated rental range

- Suburb-level insights

While advanced reports are behind a paywall, this is the most comprehensive source of CoreLogic data for Australian properties.

💡 Final Tip

Use multiple tools to compare estimates and get a more accurate view of your property’s market position. Even small variances can make a big difference when negotiating or refinancing.

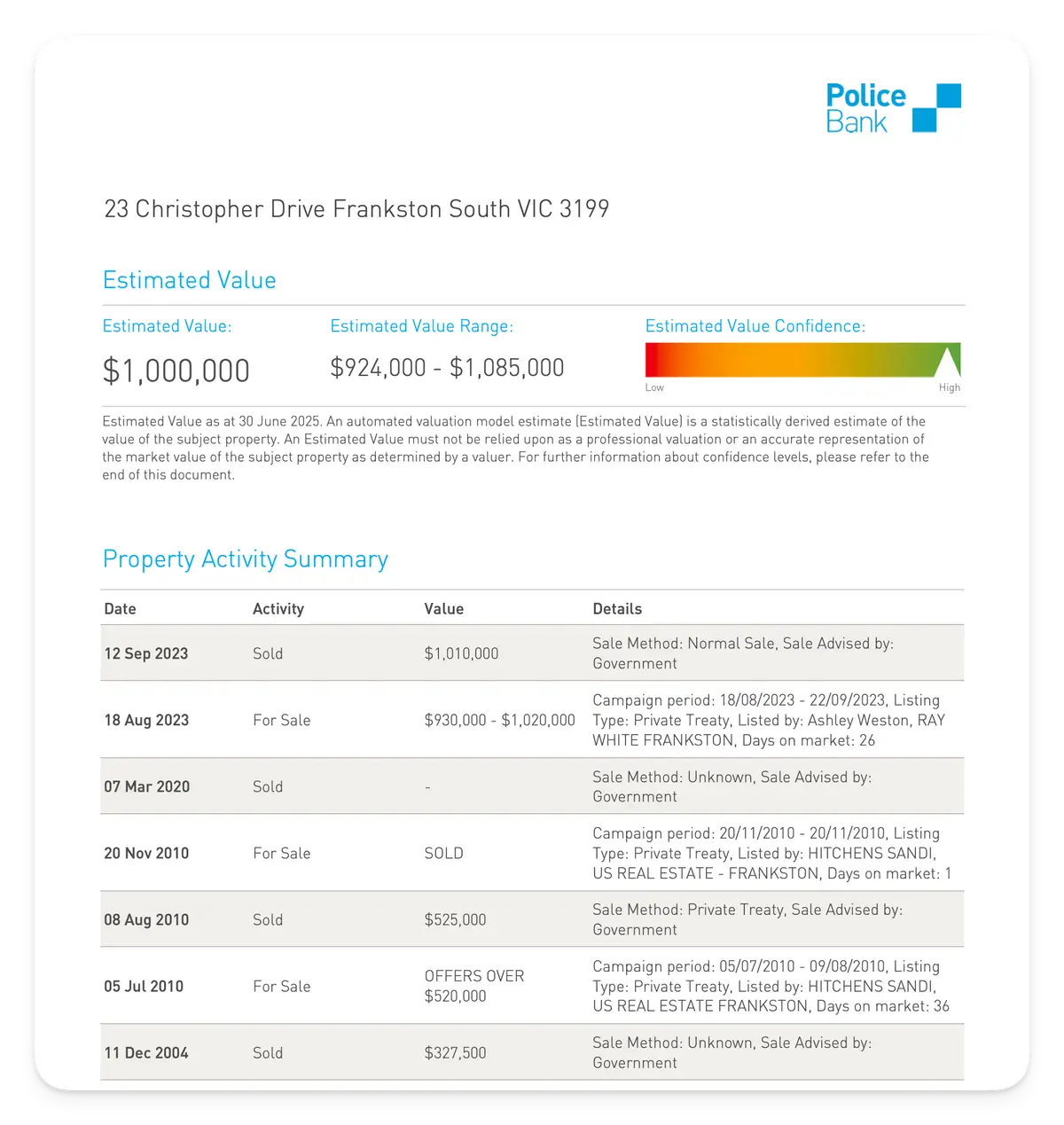

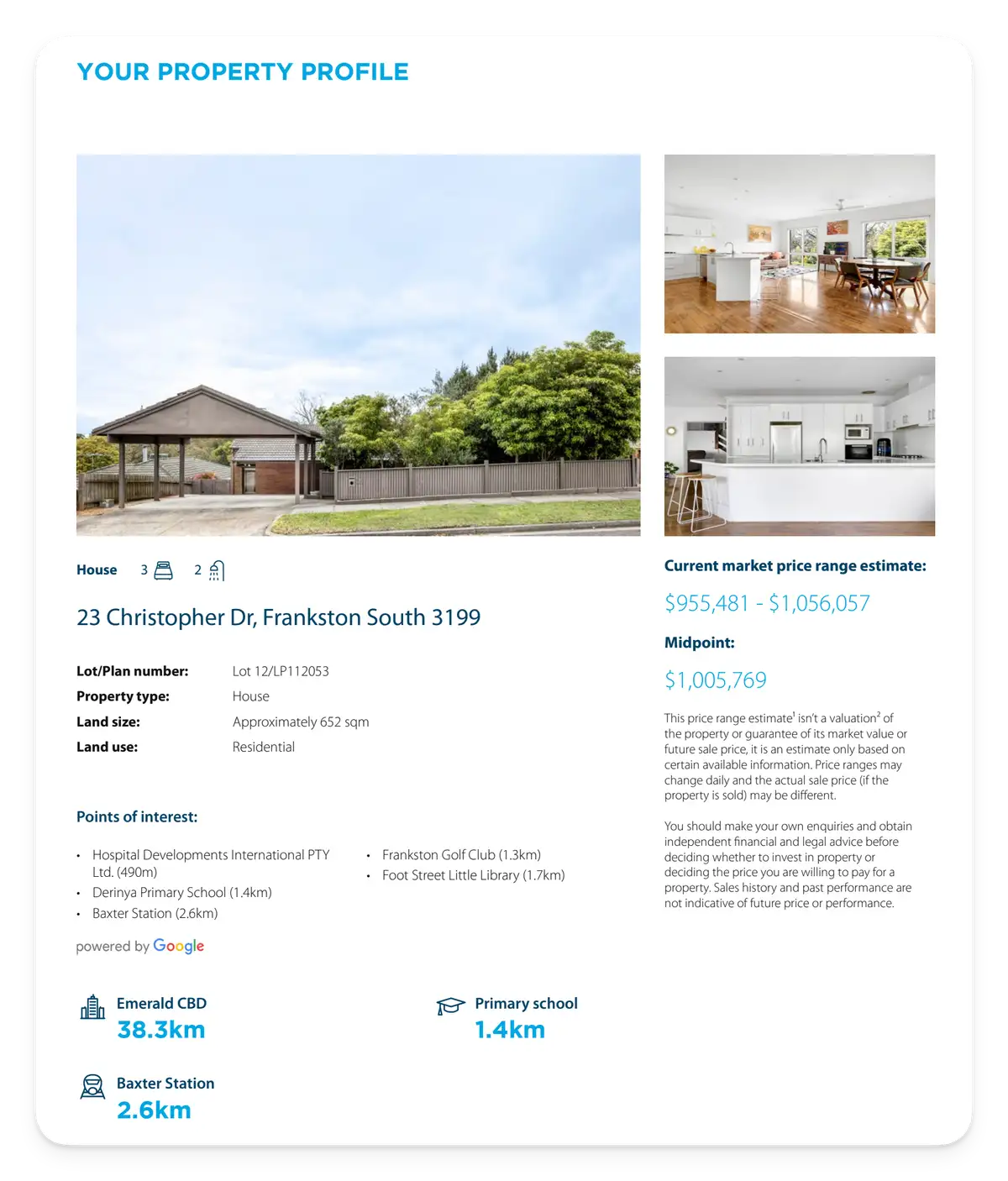

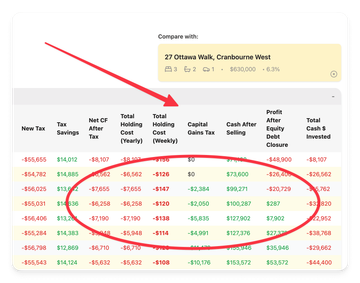

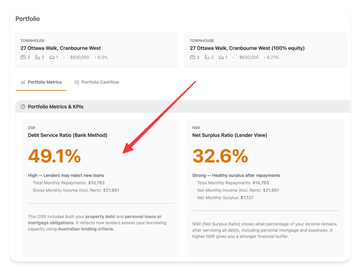

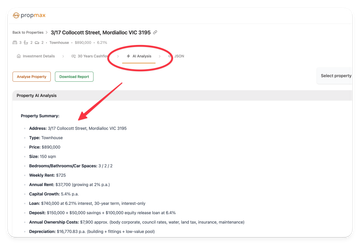

Need a smarter way to track your portfolio performance? Try our free property investment calculator with equity tracking and capital growth forecasting built in.

PropMax.com.au — Smarter investment decisions start here.