Negative Gearing For Property Investors Guide: After-Tax Cashflow Explained (2026 Update)

Negative gearing remains one of Australia's most powerful wealth-building strategies for property investors, yet many struggle to understand the actual mechanics of how tax benefits translate into improved cashflow. This comprehensive guide walks you through the complete calculation process using a real investment property example, demonstrating exactly how to model negative gearing scenarios in PropMax.

Understanding Negative Gearing Fundamentals

Negative gearing occurs when your investment property expenses exceed rental income, creating a taxable loss that reduces your overall tax liability. The Australian Taxation Office permits property investors to offset these losses against other income sources, effectively subsidizing a portion of holding costs through tax savings.

The core principle: When rental income fails to cover all property expenses, the shortfall becomes tax-deductible, reducing your taxable income and consequently your tax payable.

Real-World Example: 14 Basque Walk, Cranbourne South

Let's examine a practical scenario using actual PropMax data. This three-bedroom townhouse demonstrates typical negative gearing dynamics for metropolitan investment properties.

Property Fundamentals

Purchase Details:

- Property Address: 14 Basque Walk, Cranbourne South VIC 3977

- Purchase Price: $630,000

- Property Type: 3-bedroom, 2-bathroom, 1-car space townhouse

- Property Size: 170 sqm

- Purchase Structure: 5% deposit, off-plan acquisition

Investment Structure:

- Deposit: $130,000 (comprising $35,000 savings + $110,000 equity release)

- Loan Amount: $500,000

- Loan Interest Rate: 5.75% per annum

- Loan Term: 30 years (interest-only)

- LMI: $0 (avoided through sufficient equity)

Rental Performance:

- Weekly Rent: $590

- Annual Rent: $30,220

- Vacancy Rate: 1.5%

- Rent Growth: 3.0% per annum

- Capital Growth: 4.5% per annum

Breaking Down Year 1 Cashflow

Understanding negative gearing requires dissecting every component of annual cashflow. Let's examine the first year in detail.

Income Components

Gross Rental Income: $30,220

- Weekly rent of $590 × 52 weeks = $30,680

- Less vacancy allowance (1.5%): -$460

- Net rental income: $30,220

This represents the total income generated by the property before any expenses.

Expense Components

1. Loan Interest: $28,750

- Loan amount of $500,000 × 5.75% = $28,750

- Fully tax-deductible as the loan finances an income-producing asset

2. Equity Loan Interest: $6,325

- Equity release of $110,000 × 5.75% = $6,325

- Tax-deductible as equity was released specifically to acquire investment property

3. Annual Ownership Costs: $8,062

Breaking down the ownership expenses:

- Body Corporate: $640

- Council Rates: $1,800

- Water Rates: $720

- Land Tax: $975

- Property Management (7.7% of rent): $2,327

- Landlord Insurance: $400

- Maintenance: $1,200

Total Annual Ownership Costs: $8,062

Total Deductible Expenses

Deductible Expenses: $53,475

- Loan Interest: $28,750

- Equity Loan Interest: $6,325

- Ownership Costs: $8,062

- Depreciation: $10,000

- Loan Cost Deduction: $338

The depreciation component deserves special attention. The building depreciation of $10,000 represents capital allowance deductions based on construction costs, providing significant tax benefits without requiring actual cash outlay.

Calculating Pre-Tax Cashflow

Net Cashflow Before Tax: -$12,917

This calculation follows a straightforward formula:

Rental Income - Loan Interest - Equity Interest - Ownership Costs

$30,220 - $28,750 - $6,325 - $8,062 = -$12,917

Expressed weekly: -$248.41 per week

At this point, the property costs $12,917 annually more than it generates in rent. This represents the negative gearing loss that will reduce taxable income.

The Tax Benefit Calculation

Here's where negative gearing becomes powerful. The investment loss reduces your overall taxable income, generating tax savings that substantially improve actual cashflow.

Baseline Tax Position

Current Taxable Income: $150,000

- Tax Payable (2024-25 rates): $40,567

This represents your tax obligation without the investment property.

Adjusted Tax Position

New Taxable Income: $126,744

Calculation:

Personal Income - Rental Loss

$150,000 - ($30,220 income - $53,475 expenses) = $126,744

New Tax Payable: $31,962

The rental loss of $23,255 reduces taxable income by the same amount, calculated as:

Total Expenses - Rental Income

$53,475 - $30,220 = $23,255

Tax Savings Generated

Annual Tax Savings: $8,605

Original Tax - New Tax

$40,567 - $31,962 = $8,605

This tax saving of $8,605 significantly improves cashflow. Instead of paying $40,567 in tax, you pay only $31,962, effectively receiving an $8,605 subsidy from the ATO for holding the investment property.

Net After-Tax Cashflow

Final Position: -$4,313 per annum

Breaking down the complete picture:

Rental Income: $30,220

Less: Loan Interest: -$28,750

Less: Equity Interest: -$6,325

Less: Ownership Costs: -$8,062

Pre-Tax Loss: -$12,917

Plus: Tax Savings: +$8,605

Net After-Tax Cashflow: -$4,313

Weekly holding cost: $82.93 per week

This represents your actual out-of-pocket cost after accounting for tax benefits. While the property still costs money to hold, the tax system subsidizes approximately 67% of the shortfall ($8,605 of $12,917).

Understanding the Marginal Benefit

The effectiveness of negative gearing directly correlates with your marginal tax rate. Higher income earners receive greater benefit because each dollar of deductible loss saves more in tax.

Year 1 Tax Savings Breakdown:

- Rental loss component: $23,255

- Marginal tax rate (combined federal): 37%

- Tax benefit: $8,605 (approximately 37% of the loss)

This demonstrates why negative gearing particularly benefits middle to high-income earners in the 37% and 45% tax brackets.

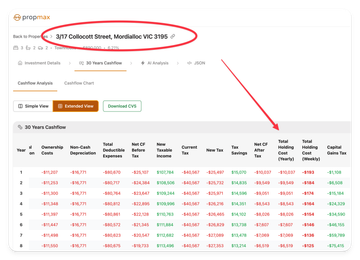

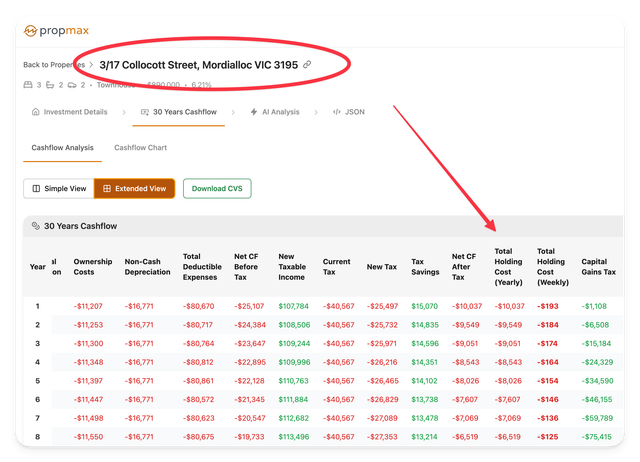

Cashflow Progression Over Time

Negative gearing dynamics evolve as property performance changes. Let's examine how cashflow improves over subsequent years.

Year 2 Performance

Rental Income: $31,126 (3% growth)

Total Deductible Expenses: $53,545

Net Cashflow Before Tax: -$12,080

Tax Savings: $8,295

Net After-Tax Cashflow: -$3,785

Improvement of $528 compared to Year 1, driven primarily by rental growth.

Year 3 Performance

Rental Income: $32,061 (3% growth)

Total Deductible Expenses: $53,617

Net Cashflow Before Tax: -$11,218

Tax Savings: $7,976

Net After-Tax Cashflow: -$3,242

Year 5 Performance

Rental Income: $35,033

Total Deductible Expenses: $53,508

Net Cashflow Before Tax: -$8,475

Tax Savings: $6,836

Net After-Tax Cashflow: -$1,639

By Year 5, annual holding costs have decreased to just $1,639, or $31.52 per week. The property approaches cashflow neutral as rental growth compounds while expenses remain relatively stable.

Year 8: Cashflow Positive Territory

Rental Income: $38,282

Total Deductible Expenses: $53,758

Net Cashflow Before Tax: -$5,476

Tax Savings: $5,726

Net After-Tax Cashflow: +$250

This marks a significant milestone—the property generates positive cashflow after tax. While technically still negatively geared (expenses exceed income), tax benefits push net cashflow into positive territory.

Building Wealth Through Negative Gearing

The true power of negative gearing emerges when examining total investment returns, not merely annual cashflow.

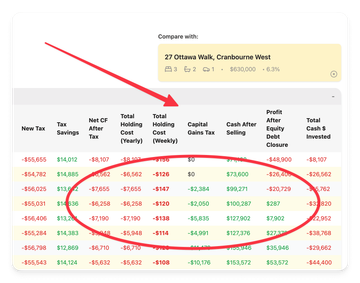

10-Year Wealth Creation Analysis

Property Value Growth:

- Initial Value: $630,000

- Year 10 Value: $978,371

- Capital Gain: $348,371

- Total Appreciation: 55.3%

Equity Position:

- Initial Equity: $130,000

- Year 10 Equity: $478,371

- Equity Growth: 268%

Total Investment Required:

- Initial Deposit: $130,000

- Cumulative Cashflow (Years 1-7): $19,196

- Total Cash Invested: $149,196

Cash After Selling (Year 10):

- Gross Sale Proceeds: $978,371

- Less Loan Payoff: $500,000

- Less CGT: $75,983

- Net Proceeds: $373,036

Net Profit After All Costs: $208,841

This represents a 140% return on total cash invested of $149,196 over 10 years.

Return Metrics:

- ROI: 385%

- CAGR: 17.1%

- IRR: 19.0%

PropMax Modeling Capabilities

PropMax's comprehensive analysis platform enables investors to model these exact scenarios with precision. The platform automatically calculates:

Cashflow Analysis Features

30-Year Projections:

- Annual rental income accounting for growth assumptions

- Complete expense tracking including loan interest, ownership costs, and depreciation

- Automatic tax benefit calculations based on personal income

- Net after-tax cashflow for every year of ownership

Property Comparison Tools:

- Side-by-side analysis of multiple properties

- Different financing structure comparisons

- Scenario modeling (various interest rates, rental growth, capital growth)

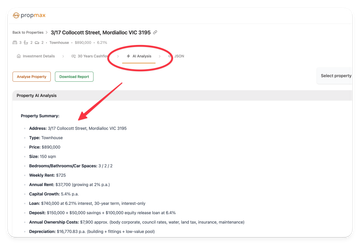

AI-Powered Insights

PropMax's AI Analysis feature automatically generates:

- Property summary with key metrics

- Detailed cashflow projections

- ROI calculations across multiple timeframes

- Capital gains tax implications

- Depreciation schedules

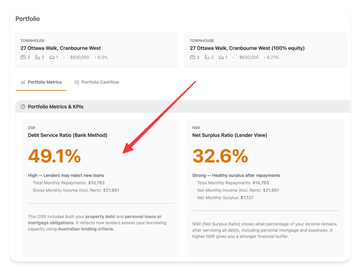

Portfolio-Level Metrics

For investors with multiple properties, PropMax aggregates:

- Portfolio Debt Service Ratio (DSR)

- Net Surplus Ratio (NSR)

- Combined tax benefits across all holdings

- Portfolio cashflow position

Common Negative Gearing Misconceptions

Myth 1: "Negative gearing loses money"

Reality: While properties cost money to hold initially, the combination of tax benefits, rental growth, and capital appreciation typically generates substantial wealth over investment timeframes of 7-10+ years.

In our example, cumulative cashflow costs of $19,196 over seven years ultimately contributed to building $348,371 in equity over 10 years.

Myth 2: "Only high-income earners benefit"

Reality: While higher marginal tax rates increase benefits, investors earning $90,000+ in the 32.5% tax bracket still receive meaningful subsidies. The key is ensuring total returns (cashflow + capital growth) justify the investment.

Myth 3: "Interest-only loans are always better"

Reality: Interest-only maximizes tax deductions and preserves cashflow but builds no equity through principal reduction. The optimal strategy depends on individual circumstances, debt capacity, and long-term goals.

Myth 4: "Depreciation is free money"

Reality: While depreciation provides real tax benefits without cash outlay, it reduces the property's cost base for CGT purposes. When selling, you'll pay capital gains tax on a larger gain if you've claimed substantial depreciation. However, the time value of money typically favors claiming maximum depreciation.

Optimizing Negative Gearing Strategy

1. Maximize Deductible Expenses

Ensure all legitimate expenses are claimed:

- Property management fees

- Maintenance and repairs (but not capital improvements)

- Insurance premiums

- Council rates, water rates, body corporate

- Loan interest (including any equity loan interest)

- Depreciation (engage a quantity surveyor)

- Travel to inspect property (within ATO guidelines)

2. Structure Loans Appropriately

- Keep investment debt separate from personal debt

- Consider interest-only loans to maximize deductions

- Avoid cross-collateralization where possible

- Ensure equity release loans are clearly for investment purposes

3. Time Purchases Strategically

- Consider purchasing before June 30 to claim deductions in current financial year

- Settle in July to maximize first-year depreciation claims

- Structure deposits to optimize tax position across financial years

4. Select High-Growth Properties

Negative gearing works best when strong capital growth compensates for cashflow costs. Target properties with:

- Strong historical capital growth (7%+ annually)

- Rental yields of 4%+ to minimize cashflow drain

- Quality locations with infrastructure investment

- Scarcity factors (limited land supply, heritage restrictions)

5. Model Different Scenarios

Use PropMax to evaluate:

- Interest rate sensitivity (test at +1%, +2% above current rates)

- Rental growth assumptions (conservative vs optimistic)

- Capital growth scenarios

- Different financing structures (10% vs 20% deposit)

- Impact of principal and interest vs interest-only

Tax Planning Considerations

Prepaying Interest

Consider prepaying 12 months of loan interest before June 30 to:

- Bring forward tax deductions to current financial year

- Reduce immediate tax payable

- Improve after-tax cashflow in the following year

Requirements:

- Loan must be investment property only

- Interest must relate to current financial year + up to 12 months ahead

- Cannot prepay if loan is principal and interest

Capital Gains Tax Management

When selling negatively geared properties:

50% CGT Discount: Hold properties 12+ months to access the 50% discount on capital gains.

Offset Capital Losses: Capital losses from other investments can offset property gains, reducing CGT payable.

Timing Disposal: Consider selling in a low-income year (sabbatical, retirement) to minimize CGT at lower marginal rates.

In our example, Year 10 CGT of $75,983 represents approximately 22% of the $348,371 gain, effectively 43.5% of the gain after the 50% discount ($174,186).

Managing Cashflow During Negative Gearing

While tax benefits improve the picture, properties still require capital. Here's how successful investors manage cashflow:

1. Build Cash Buffers

Maintain reserves equivalent to 6-12 months of holding costs. For our example property, that means $2,600-$5,200 in readily accessible funds.

2. Offset Accounts

Park cash in offset accounts linked to investment loans to:

- Reduce interest charges without reducing deductibility

- Maintain liquidity for unexpected expenses

- Improve pre-tax cashflow without sacrificing tax benefits

Note: Money in offset reduces loan balance for interest calculation but doesn't reduce deductible interest.

3. Maximize Rental Income

- Keep property well-maintained to attract quality tenants

- Set competitive but market-appropriate rents

- Minimize vacancy through responsive property management

- Consider minor upgrades that increase rental value

4. Review and Refinance

- Review loan rates annually—savings of 0.25% = $1,250 annually on $500,000

- Refinance when rate differences exceed 0.50%

- Consider fixed vs variable based on market outlook

- Negotiate rate reductions with existing lender before switching

Negative gearing remains a powerful wealth-building tool for Australian property investors, but success requires understanding the complete cashflow picture—not just the attractive tax benefits.

Key Takeaways:

- Tax benefits typically subsidize 30-37% of holding costs depending on marginal tax rate

- Properties transition from negative to neutral to positive cashflow as rents grow

- Total returns combine cashflow, tax benefits, and capital growth—not any single metric

- PropMax's comprehensive modeling enables accurate scenario analysis before committing capital

- Risk management through interest rate sensitivity testing remains essential

Whether you're evaluating your first investment or expanding an existing portfolio, PropMax provides the analytical tools to model exact scenarios, compare alternatives, and make data-driven decisions with confidence.

Visit PropMax.com.au to analyze potential investments with the same precision demonstrated in this guide. Input your specific circumstances, test various scenarios, and identify opportunities that align with your wealth-building goals.

Disclaimer: This article provides general information only and does not constitute financial, tax, or legal advice. Negative gearing outcomes depend on individual circumstances including income, tax position, and property performance. Consult qualified professionals before making investment decisions. Tax rates and regulations cited reflect 2024-25 Australian tax year and may change. Property values, rental income, and expenses shown are illustrative examples based on PropMax data and may not reflect current market conditions.