Debt Recycling vs Savings vs Equity Release: What’s Best for Property Investors?

Building a property portfolio in Australia requires more than picking the right suburb — it demands choosing the right funding and wealth-building strategy. Three of the most effective approaches for investors are Debt Recycling, Savings, and Equity Release. Each one changes your cashflow, tax efficiency, portfolio timeline, and long-term wealth differently.

In this post, we break down how these strategies work, who each one is best for, and how PropMax.com.au helps you model all three scenarios for the SAME property side-by-side — instantly revealing which path builds wealth fastest for your financial situation.

🧠 1. What Are the Three Strategies?

A. Debt Recycling

Debt Recycling converts non-deductible PPOR debt into tax-deductible investment debt while building an income-producing portfolio (property or ETFs).

How it works:

- You channel surplus cashflow into your PPOR loan (reducing non-deductible interest).

- You borrow back the repaid amount through a loan split.

- You invest the borrowed funds into property deposits or ETFs.

- Investment income + tax deductions accelerate the cycle.

Best for:

Homeowners with strong income, stable cashflow, and a long investment horizon.

B. Savings (Traditional Path)

You build a deposit from after-tax savings, typically 5–20% of the property value.

How it works:

- Save cash gradually.

- Avoid taking on additional debt early.

- Lower interest costs at settlement.

- Slower portfolio building due to waiting time.

Best for:

First-time investors, risk-averse investors, or people with high living expenses / lower free cashflow.

C. Equity Release

You unlock growth in your PPOR or an existing investment property to fund a new purchase — often via a split loan or line of credit.

How it works:

- Bank revalues your property.

- You extract 20%–30% equity for your next deposit.

- No need to save cash.

- Portfolio grows earlier (power of compounding).

Best for:

People whose properties have grown significantly OR investors wanting to scale quickly.

📊 2. Side-by-Side Comparison of the Strategies

Table 1 — Summary Comparison

| Strategy | Speed to Next Property | Tax Benefits | Risk Level | Cashflow Impact | Best For |

|---|

| Debt Recycling | Fast–Medium | ⭐⭐⭐⭐ High (interest deductibility) | Medium | Depends on surplus cashflow | High-income earners with PPOR debt |

| Savings | Slow | ⭐ Low | Low | Strong cash drain while saving | First-timers, conservative investors |

| Equity Release | Fastest | ⭐⭐⭐ Moderate | Medium–High (higher leverage) | Extra interest cost on released equity | Investors with high capital growth properties |

Table 2 — Effect on Long-Term Wealth

| Metric | Debt Recycling | Savings | Equity Release |

|---|

| Portfolio Growth | Fast ⚡ | Slow 🐢 | Very Fast 🚀 |

| Tax Deductions | Strong | None | Moderate |

| Debt Profile | Converts bad debt → good debt | No change | Increases deductible debt |

| Cashflow Stress | Medium | High (long saving period) | Medium–High |

| Entry Timing | Early | Late | Very Early |

💡 3. Which Strategy Actually Builds the Most Wealth?

There is no universal winner. It depends entirely on:

- Your PPOR equity

- Your income & tax bracket

- Extra repayment capacity

- Risk appetite

- Investment horizon

- Target suburbs & yields

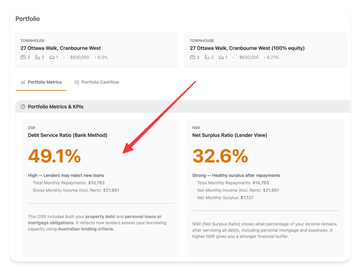

- Bank lending conditions

And that’s exactly what PropMax.com.au helps you decide.

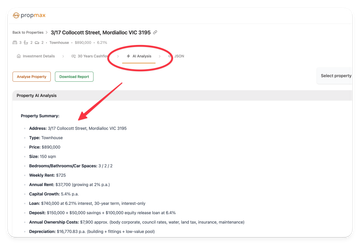

🔍 4. How PropMax.com.au Helps You Compare All Three Scenarios

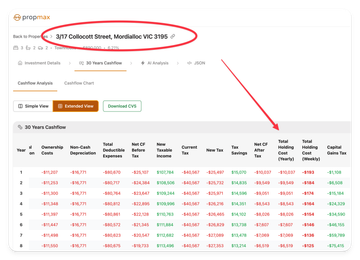

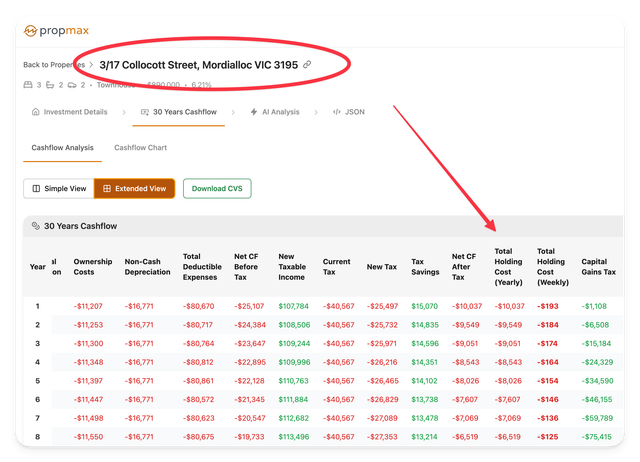

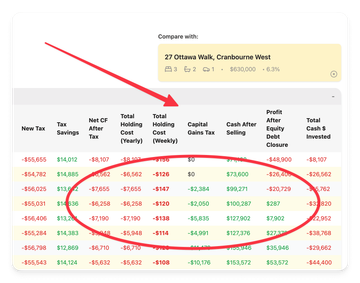

PropMax allows you to model:

➡️ Scenario A: Using Debt Recycling

- Accelerated PPOR debt pay-down

- Loan splits

- Deductible interest calculations

- ETF income or property rental income

- 30-year cashflow impact

➡️ Scenario B: Using Pure Savings

- Time to save deposit

- Monthly saving impact

- Opportunity cost of waiting

- Deferred capital growth

➡️ Scenario C: Using Equity Release

- Borrowable equity based on valuation

- Interest on new loan split

- Portfolio growth acceleration

- Cashflow and holding costs

📐 PropMax Comparison Output Example (for the SAME townhouse)

Below is a simplified sample of how PropMax compares outcomes:

Table — 10-Year Wealth Projection (Example Only)

| Metric (Year 10) | Debt Recycling | Savings | Equity Release |

|---|

| Time to Acquire Property | 18 months | 4 years | Immediate |

| Net Property Equity | $540,000 | $480,000 | $560,000 |

| PPOR Debt Remaining | $210,000 | $345,000 | $310,000 |

| Cumulative Tax Deductions | $85,000 | $0 | $42,000 |

| Total Net Wealth | $730,000 | $525,000 | $780,000 |

Insights:

- Equity Release often creates highest total wealth due to early compounding.

- Debt Recycling aggressively kills PPOR debt → strong tax position.

- Savings loses ground because waiting 3–4 years reduces capital growth exposure.

🧭 5. How to Choose the Best Strategy for Your Situation

Ask yourself:

1. Do I have significant PPOR equity?

- Yes → Equity release may be fastest.

2. Do I have high surplus cashflow and a long runway?

- Yes → Debt recycling maximises tax deductions + accelerates growth.

3. Do I prefer lower leverage and slower risk exposure?

- Yes → Savings is the simplest and safest.

4. Do I want to model the real numbers before committing?

- Use PropMax to test all strategies for the SAME property with:

- Different rents

- Interest rates

- Deposit amounts

- Equity release sizes

- Growth expectations

- Holding costs

🚀 6. Why Smart Investors Use PropMax.com.au

PropMax is purpose-built to answer the question:

“What is the best NEXT MOVE for my financial situation?”

With PropMax you can:

- Run Debt Recycling vs Savings vs Equity Release side-by-side

- Build 10–30 year cashflow forecasts

- See negative gearing & tax impacts

- Model loan splits and equity withdrawals

- Understand break-even yields & holding costs

- Discover risk & stress points before buying

No guessing. Just data.

🏁 Final Takeaway

There is no one-size-fits-all approach to building wealth through property.

- Equity Release maximises speed.

- Debt Recycling optimises tax and accelerates PPOR debt elimination.

- Savings keeps leverage low but delays wealth creation.

The best approach is the one that fits your finances, risk tolerance, and timeline.

PropMax.com.au gives you the tools to make that decision confidently — with real numbers, not assumptions.