Geelong Cashflow & Holding Cost Report

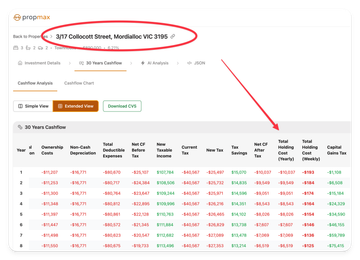

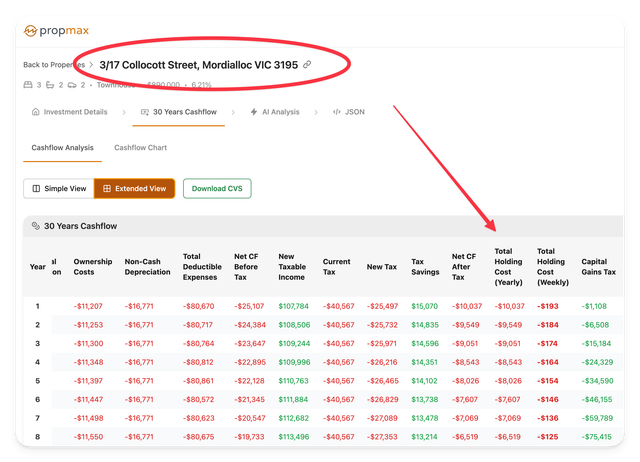

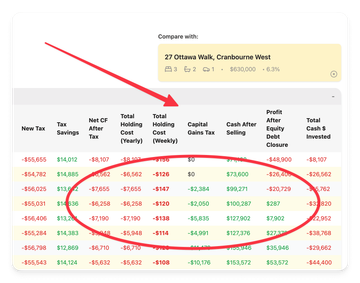

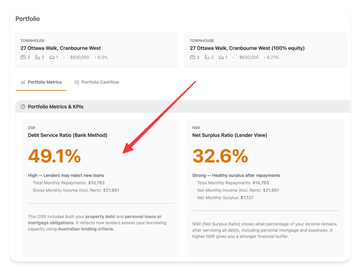

This comprehensive Geelong Cashflow & Holding Cost Report models the long-term financial performance of a quality townhouse in Geelong, featuring 30-year cashflow projections, equity growth, tax impact, and full depreciation breakdowns — all powered by Propmax.com.au.

2/4-6 Hazel Street, Geelong, Belmont VIC 3216 is a well-positioned 3-bedroom, 2-bathroom, 2-car townhouse with a modern 170 sqm layout, purchased at $700,000.

- Weekly Rent: ~$550 (yield ~4.08%) in a tight market with 1% vacancy

- Capital Growth: ~5.4% p.a. | Rent Growth: ~2% p.a

- Annual Holding Costs: ~$10,789 after tax, or ~$207/week after tax (in year of purchase)

- Depreciation Benefits: ~$6,250 per year (building depreciation only)

- Land Tax Exposure: Moderate, due to townhouse configuration

For investors earning around $150,000, this property offers significant depreciation-driven tax savings, with negative gearing reducing after-tax holding costs to ~$10,789/year or ~$207/week in the year of purchase. Belmont, located in the heart of Geelong, is one of the hottest markets in regional Victoria, attracting strong internal migration from Melbourne due to its affordability, proximity to the Geelong CBD, and lifestyle amenities like the Barwon River and Waurn Ponds Shopping Centre.

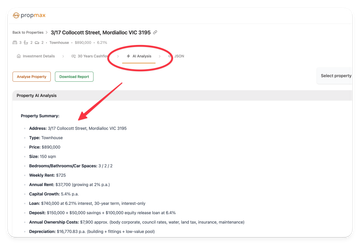

This Geelong Cashflow & Holding Cost Report is based on actual property data and built using Propmax.com.au’s Investment Property Cashflow Calculator.