How Depreciation Reduces Your Investment Property Holding Costs

Depreciation is one of the most powerful tax deductions available to Australian property investors, yet it's often misunderstood or overlooked. Understanding how Division 40 and Division 43 depreciation work can significantly reduce your actual holding costs and improve your property's cashflow.

What is Property Depreciation?

Depreciation allows you to claim a tax deduction for the natural wear and tear of your investment property and its assets over time. In Australia, there are two main types of depreciation:

Division 43 – Capital Works Deduction

Division 43 covers the structural elements of the building itself:

- The building structure (walls, floors, roof)

- Fixed structural improvements

- Certain renovations and extensions

Deduction rate: 2.5% per year for properties constructed after 15 September 1987

Example: If your property has $400,000 in eligible Capital Works, you can claim $10,000 per year in depreciation.

Division 40 – Plant & Equipment Deduction

Division 40 covers removable assets and fittings within the property:

- Air conditioning units

- Ceiling fans and light fittings

- Carpets and window coverings

- Hot water systems

- Kitchen appliances (ovens, dishwashers)

- Security systems

Important: Since May 2017, second-hand properties (previously owned) can only claim plant & equipment depreciation on assets purchased by the current owner. Brand new properties and newly purchased assets are fully claimable.

Low-Value Pool

Assets costing less than $1,000 can be placed in a low-value pool and depreciated at accelerated rates:

- Year 1: 18.75% (half of 37.5%)

- Subsequent years: 37.5%

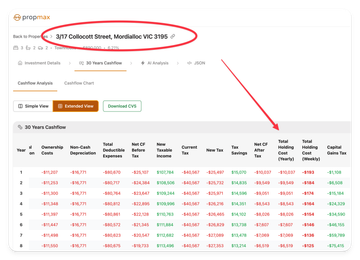

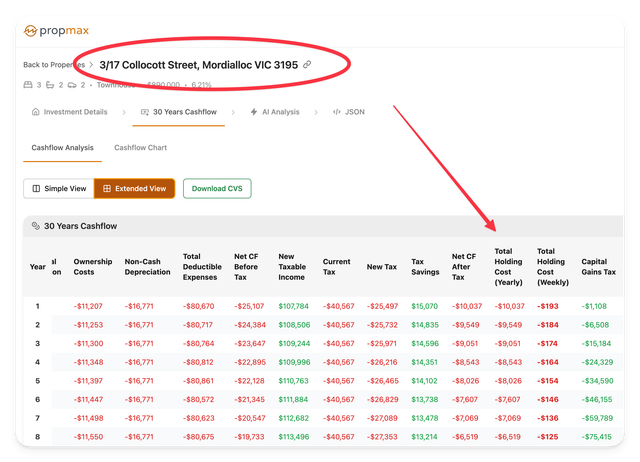

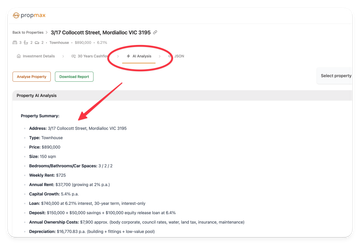

Real Impact on Holding Costs: A Case Study

Let's look at a practical example using a $630,000 investment property with the following parameters:

Property Details:

- Purchase price: $630,000

- Capital Works (Div 43): $400,000

- Annual depreciation: $10,000

- Loan: $500,000 at 5.75%

- Annual rent: $30,219

- Taxable income: $139,662

- Tax rate: 29.1% (includes Medicare Levy)

Year 0 (First Year) Financial Breakdown

Income:

- Rental income: $30,219.80

Expenses:

- Interest on investment loan: $28,750

- Other deductible expenses: $24,725.32

- Depreciation (Div 43): $10,000

Tax Impact:

- Deductible expenses (including depreciation): $53,475.32

- Net cashflow before tax: -$12,917.12 (-$248.41/week)

- Tax savings from depreciation and other deductions: $8,604.54

- Net cashflow after tax: -$4,312.58 (-$82.93/week)

The Depreciation Effect

Without depreciation, the tax savings would be approximately $5,694.54, resulting in:

- Net cashflow after tax: -$7,222.58 (-$138.90/week)

By claiming the $10,000 depreciation:

- Additional tax saving: $2,910

- Reduced weekly holding cost by $55.97

- Annual holding cost improvement: 40.2%

Long-Term Benefits

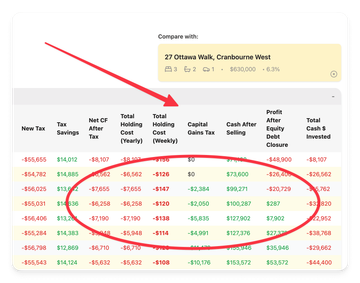

Looking at this property over a 5-year period with depreciation:

| Year | Depreciation | Tax Savings | Holding Cost/Week | Cumulative Savings |

|---|

| 0 | $10,000 | $8,604 | $82.93 | $8,604 |

| 1 | $10,000 | $8,295 | $72.80 | $16,899 |

| 2 | $10,000 | $7,976 | $62.35 | $24,875 |

| 3 | $10,000 | $7,648 | $51.60 | $32,523 |

| 4 | $10,000 | $7,309 | $40.52 | $39,832 |

Over just 5 years, depreciation saves this investor $39,832 in tax, dramatically reducing the holding costs and helping the property move toward positive cashflow faster.

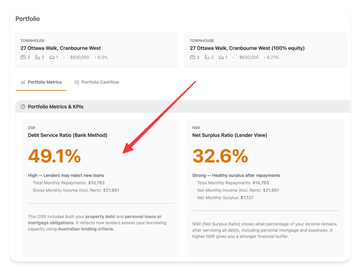

Key Takeaways

- Depreciation is real money – It reduces your taxable income without any out-of-pocket expense

- Get a quantity surveyor's report – Professional depreciation schedules typically cost $600-800 and often pay for themselves in the first year

- Don't assume zero depreciation – Even older properties may have eligible Capital Works and recent renovations

- Claim it every year – Depreciation is "use it or lose it" – you can't go back and claim missed years beyond 2 years

- Factor it into your purchase decision – Newer properties with higher depreciation can have significantly lower holding costs

When to Get a Depreciation Schedule

You should order a depreciation schedule:

- As soon as you settle on a new investment property

- After completing renovations or improvements

- If you've owned a property for years but never claimed depreciation (you can backdate claims up to 2 years)

The Bottom Line

In our example, depreciation transformed a property with a holding cost of $138.90/week into one costing just $82.93/week – a difference of $2,910 per year. Over a typical investment timeframe, this can mean tens of thousands of dollars in improved cashflow.

For most investors, ignoring depreciation is like leaving $3,000+ per year on the table. Make sure you're claiming every deduction you're entitled to – your future self will thank you.