IRR vs ROI vs Cash-on-Cash: The Metrics Australian Investors Must Understand

Most Australian investors rely on simple metrics like yield or “cashflow after tax.” But once you start comparing multiple properties, modelling long-term growth, or analysing leveraged returns, you quickly realise you need stronger tools.

Three of the most important investment metrics—used by professional funds, analysts, and sophisticated property investors—are:

- ROI (Return on Investment)

- Cash-on-Cash Return

- IRR (Internal Rate of Return)

This article explains each metric in plain English and shows how PropMax.com.au can calculate all three using your real investment numbers.

1. ROI — Return on Investment (Simple but Limited)

ROI answers:

“How much total profit did I make as a percentage of the money I put in?”

ROI = (Total Profit ÷ Total Cash Invested) × 100

Where:

Total Profit = (Sale Proceeds + Cumulative Net Cashflow) – Total Cash InvestedTotal Cash Invested = Deposit + Purchase Costs + Any Extra Cash Tipped In

ROI includes things like:

- Capital gains

- Net cashflow (rent minus expenses)

- Selling costs

- Loan payoff outcome

But ROI does not care about time. A 100% ROI over 2 years and 100% ROI over 10 years look identical—even though the 2-year deal is clearly better.

1.2 How ROI behaves over time

For a typical leveraged investment property:

- Early years: ROI is often negative (deposit + stamp duty + setup costs dominate).

- Middle years: ROI turns positive as capital growth and rent increases kick in.

- Long term: ROI becomes very large as your original cash in stays fixed while equity compounds.

ROI is great for a simple snapshot, but it’s not enough to compare deals with different timeframes.

2. Cash-on-Cash Return — The “Real Life Investor” Metric

Cash-on-Cash answers:

“How much annual cashflow am I getting as a percentage of my cash invested?”

It focuses on money in your pocket, not just paper gains.

Cash-on-Cash = (Annual Net Cashflow ÷ Total Cash Invested) × 100

Where:

Annual Net Cashflow = (Rent – All Annual Expenses) ± Tax EffectsTotal Cash Invested is usually your deposit + upfront costs (and any later cash injections).

Cash-on-cash is critical for:

- Investors who want passive income

- Planning buffers and holding power

- Comparing cashflow-heavy strategies vs growth-heavy ones

- Checking whether a property is self-funding or a cash drain

2.2 How cash-on-cash typically looks

For a new or highly leveraged investment:

- Year 1–3: Often negative cash-on-cash (top-ups required).

- Mid-term: Moves towards breakeven, then positive, as rent grows.

- Long-term: Can reach strong positive cash-on-cash as debt is repaid and rent keeps rising.

Cash-on-cash tells you whether the deal fits your monthly budget and risk appetite.

3. IRR — Internal Rate of Return (The Gold Standard)

IRR answers:

“What is my true annualised return, once I account for all cash in and out, and when it happens?”

IRR considers:

- Your initial deposit and purchase costs

- Negative cashflow years

- Positive cashflow years

- Capital growth

- Sale proceeds and selling costs

- Loan payoff and remaining equity

- The timing of every dollar moving in or out

3.1 IRR concept (no scary algebra)

Technically, IRR is the discount rate r that makes the net present value (NPV) of all cashflows equal to zero:

NPV = Σ (Cashflowₜ ÷ (1 + r)ᵗ) = 0

You don’t have to solve this manually—PropMax (and Excel) do it numerically. The important bit:

- Bigger, earlier cash inflows → higher IRR

- Bigger, earlier cash outflows → lower IRR

3.2 Why IRR is powerful

IRR is the best metric for:

- Comparing different properties with different holding periods

- Comparing property vs ETFs or other asset classes

- Evaluating renovation projects vs turnkey investments

- Deciding between high-yield vs high-growth strategies

It’s the closest thing to:

“If this property were a single investment fund, what annual return would it be delivering?”

4. ROI vs Cash-on-Cash vs IRR (Side-by-Side)

| Metric | Measures | Considers Timing? | Best For | Key Weakness |

|---|

| ROI | Total profit vs cash invested | ❌ No | Simple high-level snapshot | Misleading for long or uneven deals |

| Cash-on-Cash | Annual cashflow vs cash invested | ❌ No | Cashflow planning & holding power | Ignores capital growth |

| IRR | True annualised return on all cashflows | ✅ Yes | Comparing investments over different timeframes | More complex; needs proper modelling |

You ideally want all three:

- ROI for big-picture, “was it worth it?”

- Cash-on-cash for “can I afford to hold it?”

- IRR for “is this the best use of my money versus other options?”

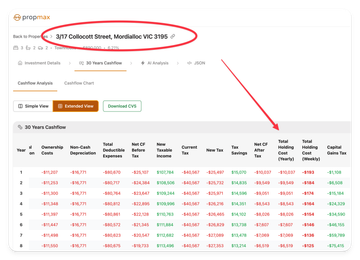

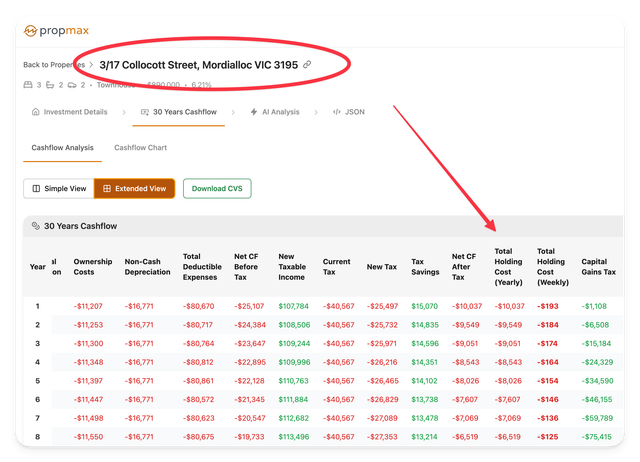

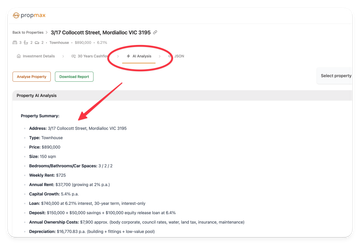

5. How PropMax Calculates These Metrics Using Real Property Data

When you plug an Australian investment property into PropMax, the engine builds a full cashflow timeline:

- Year 0: Purchase price, deposit, stamp duty, legals, lender costs, QS, etc.

- Each year: Rent, vacancy, interest, principal, repairs, insurance, OC fees, land tax, depreciation.

- Optional: Sale year with agent fees, CGT assumptions, loan payout, and equity release.

From there, PropMax can compute:

5.1 ROI inside PropMax

- It sums:

- Total net cashflow over the hold period; plus

- Net proceeds from sale (after paying off the loan and selling costs).

- It divides that by your total cash invested (deposit + costs + extra tips).

Displayed as:

- Overall ROI % at year 5 / 10 / 20 / 30.

5.2 Cash-on-Cash inside PropMax

For each year:

- Numerator: Net cashflow after all costs (and optionally after-tax if you toggle tax).

- Denominator: Your cumulative cash invested so far.

PropMax lets you see:

- Year-by-year cash-on-cash %

- When the property turns from negative to positive

- How sensitive cashflow is to interest rate changes or rent changes

5.3 IRR inside PropMax

PropMax takes the full vector of yearly cashflows:

- Year 0: Negative (deposit + costs)

- Years 1–N: Positive or negative (net cashflow)

- Sale Year: Usually a big positive, net of loan payout and selling costs

Then it solves:

Σ (Cashflowₜ ÷ (1 + IRR)ᵗ) = 0

The result is your IRR over that horizon.

You can:

- Change the holding period (sell at year 10 vs 15 vs 20)

- Change growth assumptions (e.g. 3% vs 5% vs 7%)

- Compare IRR across multiple properties or strategies

All without touching a spreadsheet.

6. How to Use These Metrics in Real Decisions

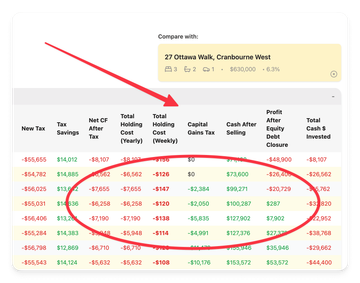

6.1 Choosing between two properties

Say you have:

- Property A: Cashflow slightly negative, blue-chip suburb, strong projected growth.

- Property B: Cashflow positive, regional, modest growth.

You can:

- Compare cash-on-cash → which one strains your monthly budget less?

- Compare IRR → which one actually delivers the better long-term annualised return?

Sometimes the higher IRR asset is not the one with the best cashflow today.

6.2 Comparing property vs ETFs or paying down PPOR

You can use PropMax outputs to ask:

- “If I instead put this $120k into ETFs with a 7% expected return, how does that compare to the property’s IRR?”

- “What if I use extra cash to pay down my PPOR instead—what’s the ‘return’ on that versus buying this investment?”

IRR is the key metric that lets you compare apples-to-apples across asset classes.

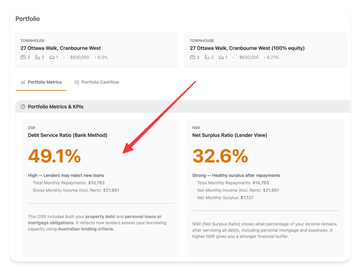

6.3 Stress-testing your plan

Inside PropMax you can quickly adjust:

- Interest rates (e.g. +1–2%)

- Rental growth

- Vacancy assumptions

- Maintenance spikes

And watch:

- Cash-on-cash swing from positive to negative

- IRR drop as holding costs increase

This is how you check:

“Can I survive a few bad years and still come out ahead?”

7. How PropMax Presents These Metrics to You

In a typical PropMax property view, you’ll see:

- ROI at different years (5 / 10 / 20 / 30), often on a summary tile.

- IRR for your chosen holding period, next to ROI so you can compare both.

- Cash-on-cash in the cashflow table and summaries, so you know your year-by-year pain/benefit.

You can also:

- Save different scenarios (e.g. “Base Case”, “High Rates”, “Reno + Rent Uplift”)

- Compare metrics across scenarios for the same property

- Export data for your broker, accountant, or investment partner

8. Final Takeaways for Australian Investors

- ROI tells you how much you made relative to what you put in.

- Cash-on-cash tells you how the property feels in your day-to-day budget.

- IRR tells you how the property stacks up against other opportunities over time.

For serious Australian investors, especially those planning multi-property portfolios, all three metrics matter.

PropMax.com.