Land Tax on Investment Properties in Victoria: Thresholds, Trusts & Pitfalls

Investing in Victoria means dealing with some of Australia’s most complex land tax rules. Between the new 2025 threshold changes, the trust surcharge, and rolling reforms from the State Revenue Office (SRO), even experienced buyers can get caught out. This guide walks through the current thresholds, how to calculate your bill, and what happens when you hold property in a discretionary or unit trust.

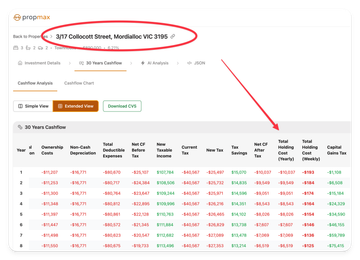

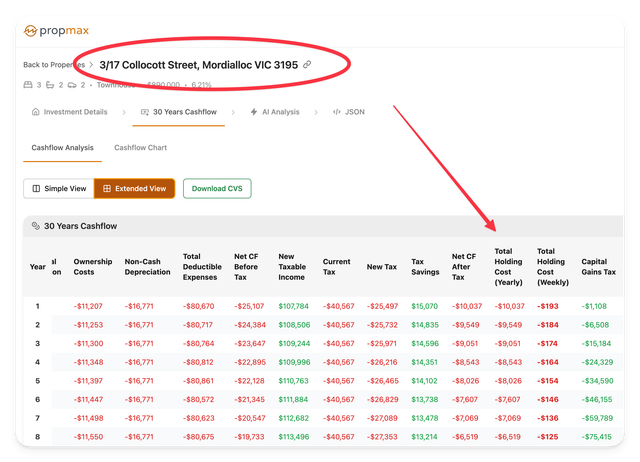

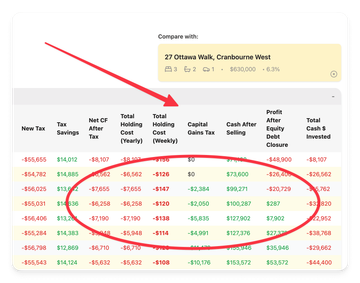

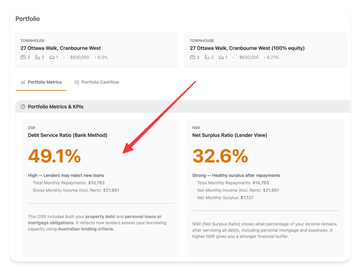

We will also compare different land tax scenarios directly inside PropMax so you can see the impact on cashflow, ROI, and holding costs before you commit.

Table of Contents

- Why land tax matters for investors

- Victorian land tax thresholds for 2025

- Trusts, land tax surcharges, and the “absentee” trap

- Worked examples (individual vs trust)

- Modelling land tax inside PropMax

- Next steps for Victorian investors

Why Land Tax Matters for Investors

Land tax is not a deal breaker—it is simply another holding cost that should be captured in your feasibility. But missing it can destroy your after-tax cashflow. Example:

- $900k townhouse in Point Cook (site value $520k)

- $650k unit in Cheltenham (site value $300k)

- Combined site value: $820k

At the 2025 rates, that portfolio pays roughly $6,600 p.a. in land tax. If you assumed “$0” during analysis, you are out of pocket $127 per week. PropMax lets you model this upfront so your investment strategy remains realistic.

Victorian Land Tax Thresholds for 2025

The State Revenue Office now indexes the general threshold. For 2025:

| Site Value Range (Aggregated) | General Rate | Approx. Tax |

|---|

| $0 – $50,000 | Nil | $0 |

| $50,000 – $100,000 | 0.2% of SV | $100 – $200 |

| $100,000 – $300,000 | $275 + 0.3% over $100k | $275 – $875 |

| $300,000 – $600,000 | $935 + 0.4% over $300k | $935 – $2,135 |

| $600,000 – $1,000,000 | $2,135 + 0.5% over $600k | $2,135 – $4,135 |

| $1,000,000 – $1,800,000 | $4,135 + 0.8% over $1m | $4,135 – $10,535 |

| $1,800,000+ | $10,535 + 1.3% over $1.8m | $10,535+ |

Remember, the SRO uses the aggregated Site Value of all taxable land you own in Victoria (excluding your principal place of residence).

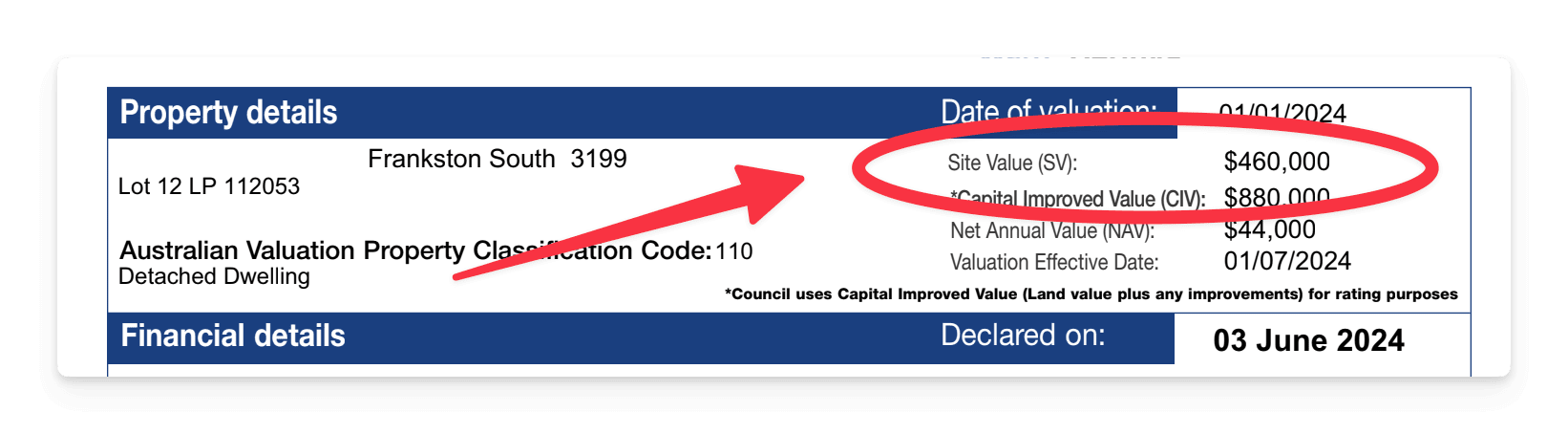

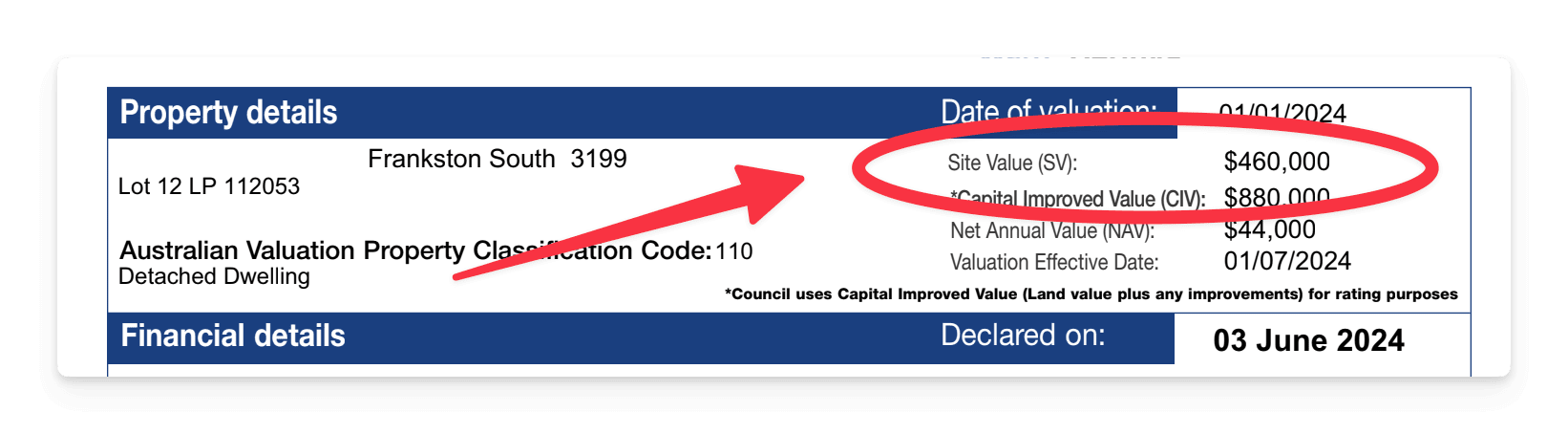

How to Find Your Site Value Before You Calculate

You cannot model Victorian land tax accurately until you know the Site Value (SV) of each property. Here are two reliable ways to grab it:

🔍 Option 1: Council Valuation Notice

- Already own the property? Check your latest Council Rates & Valuation Notice.

- No notice? Ask the selling agent to send a copy during the campaign.

- Look for the Site Value (SV) field — e.g. $460,000.

If you’re inspecting multiple properties, screenshot or photograph this page so you can run quick PropMax scenarios later.

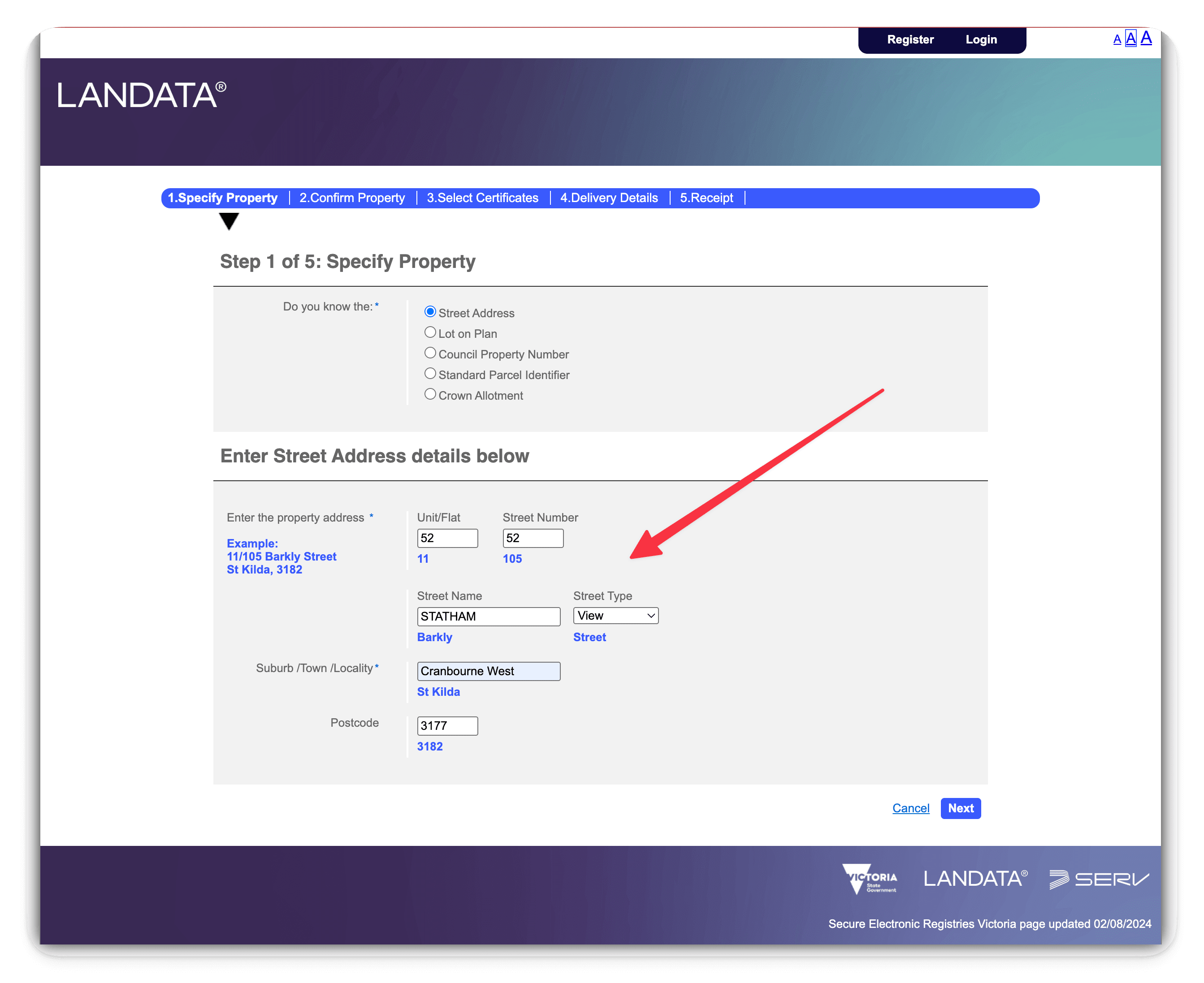

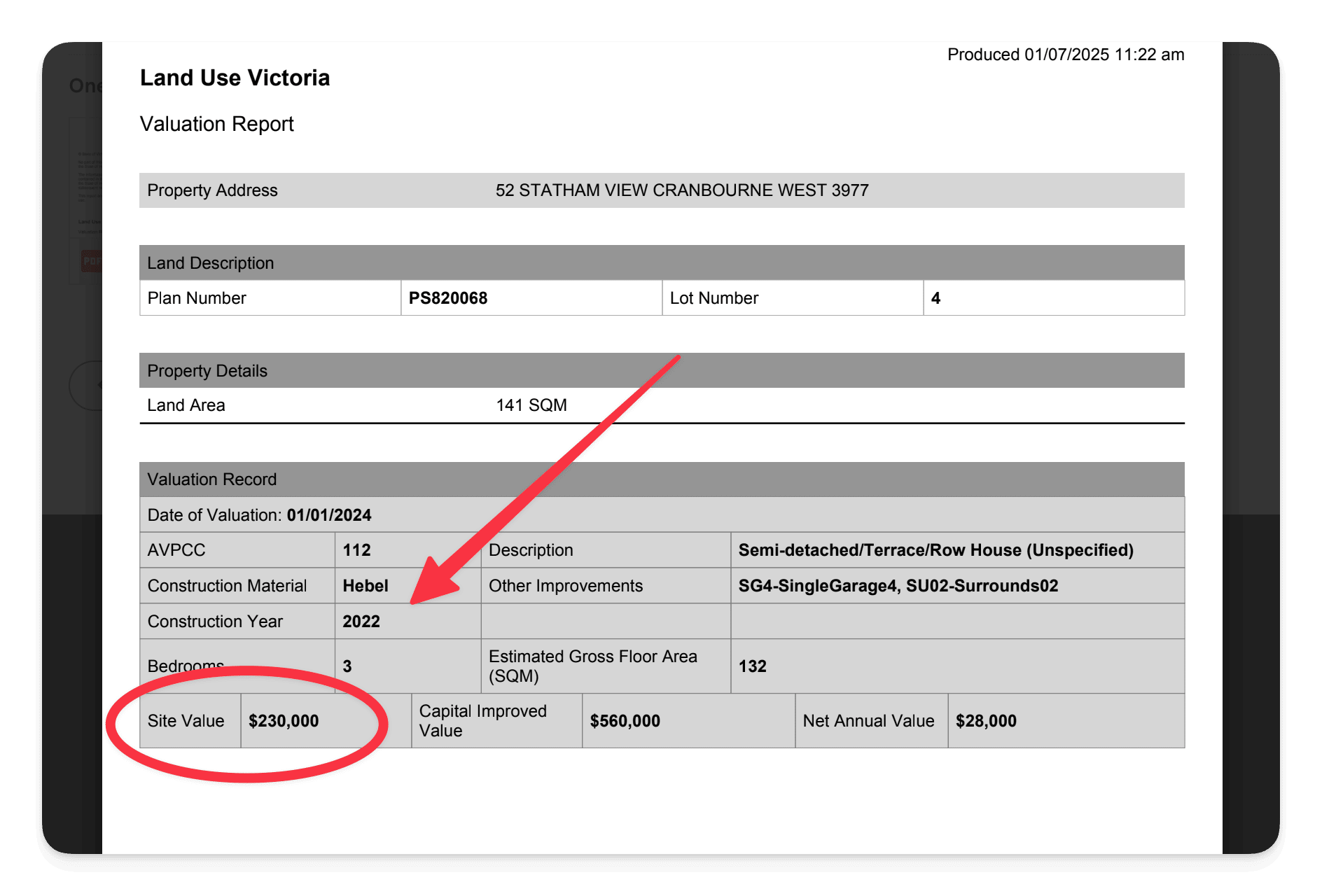

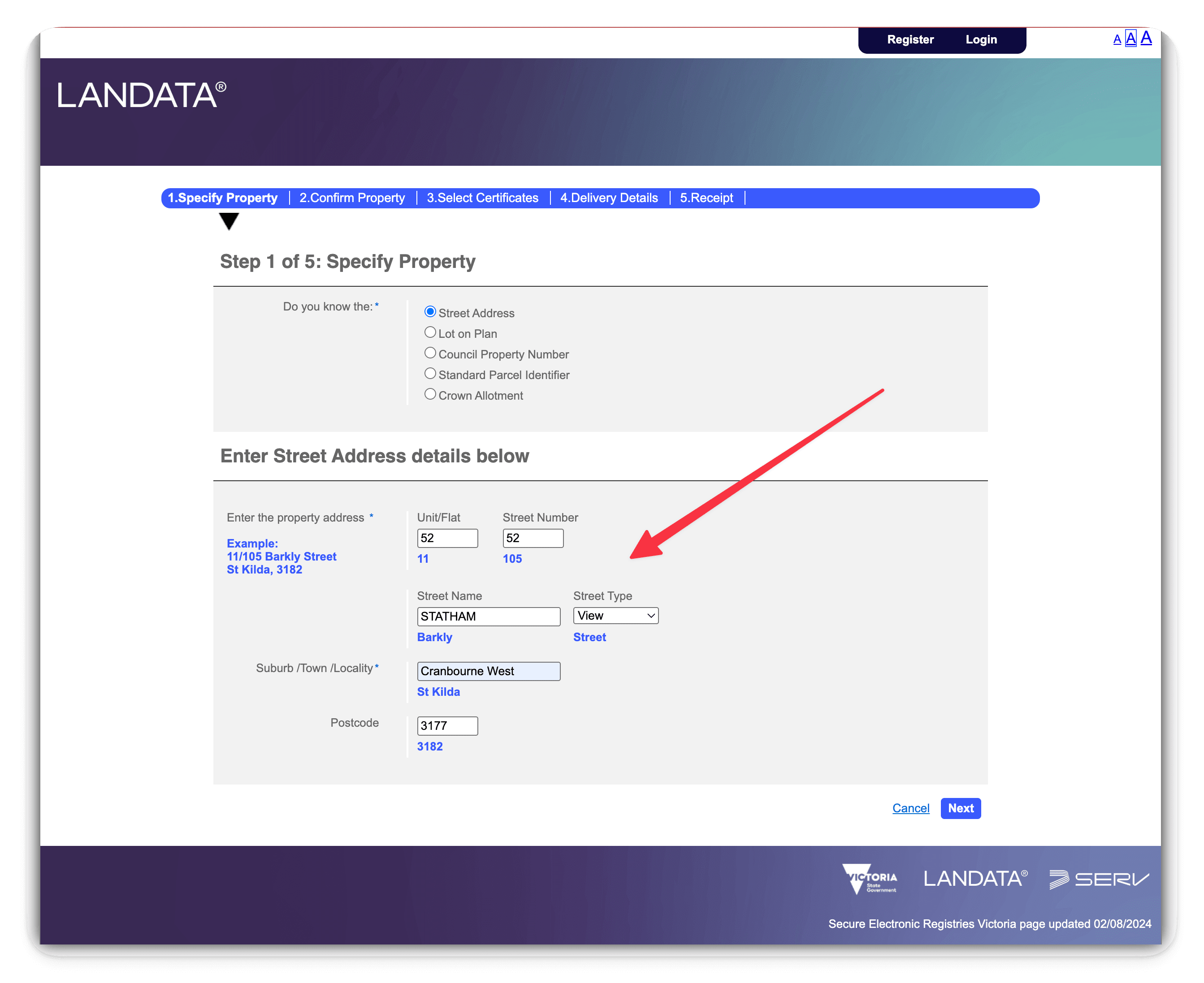

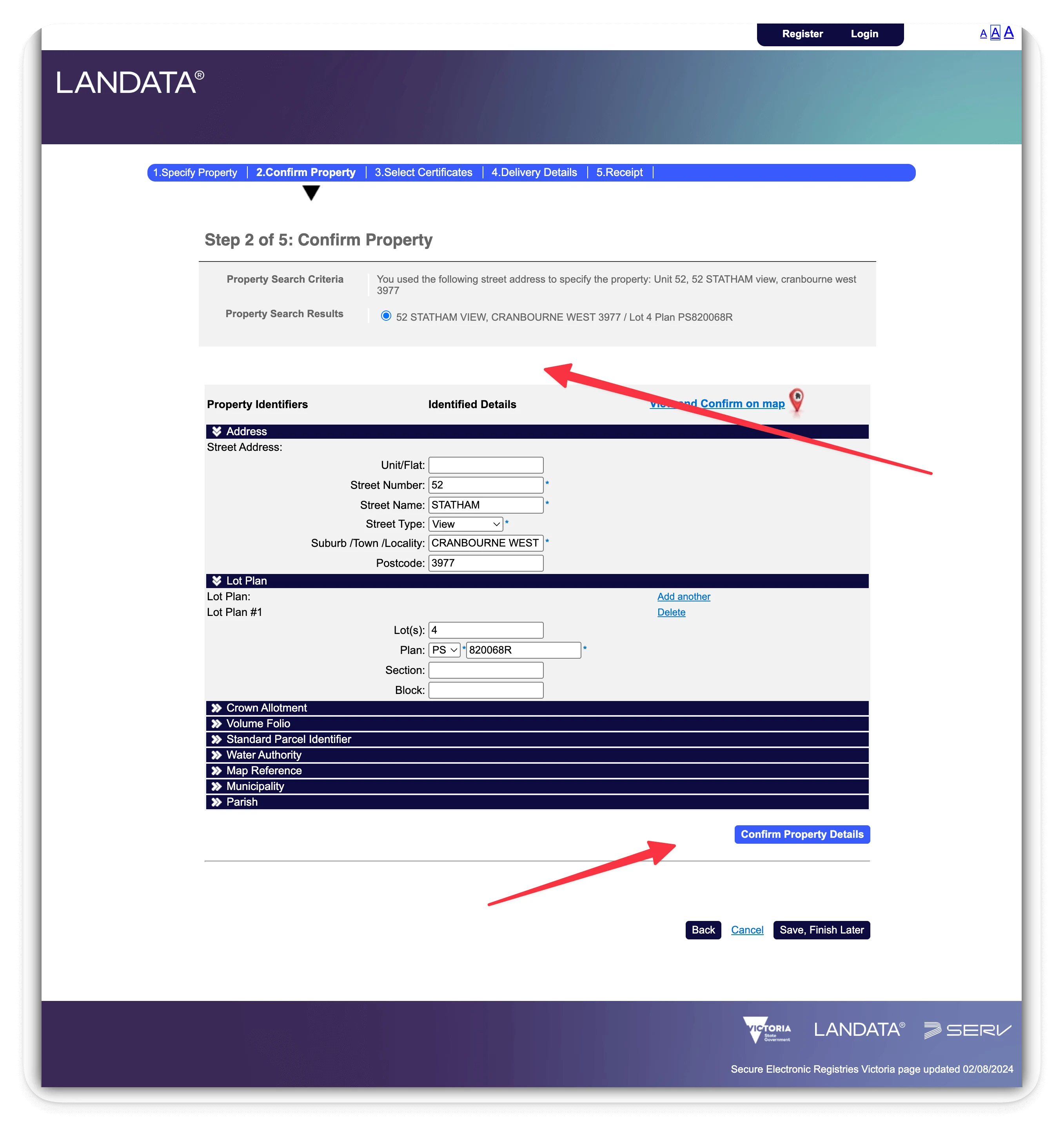

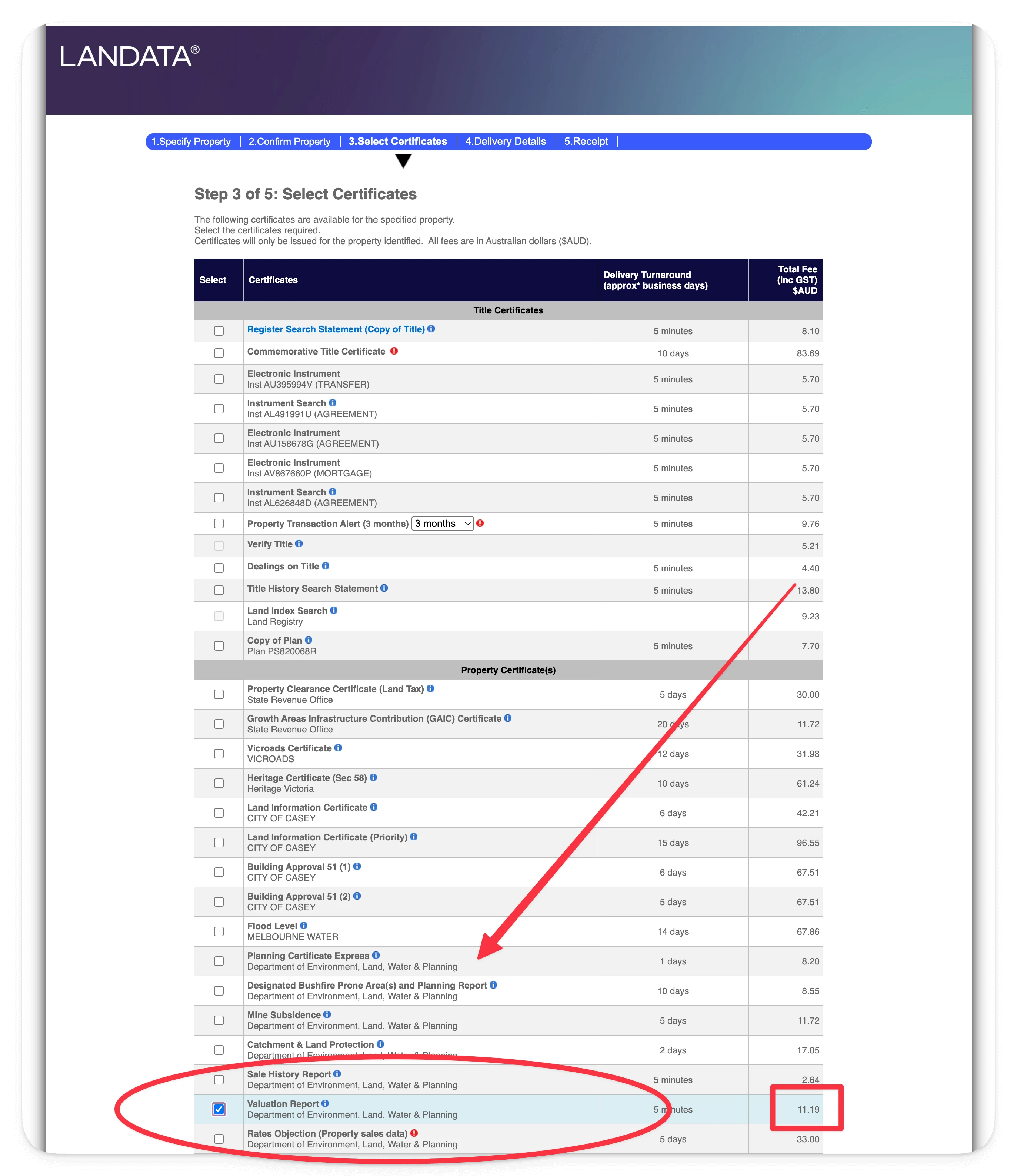

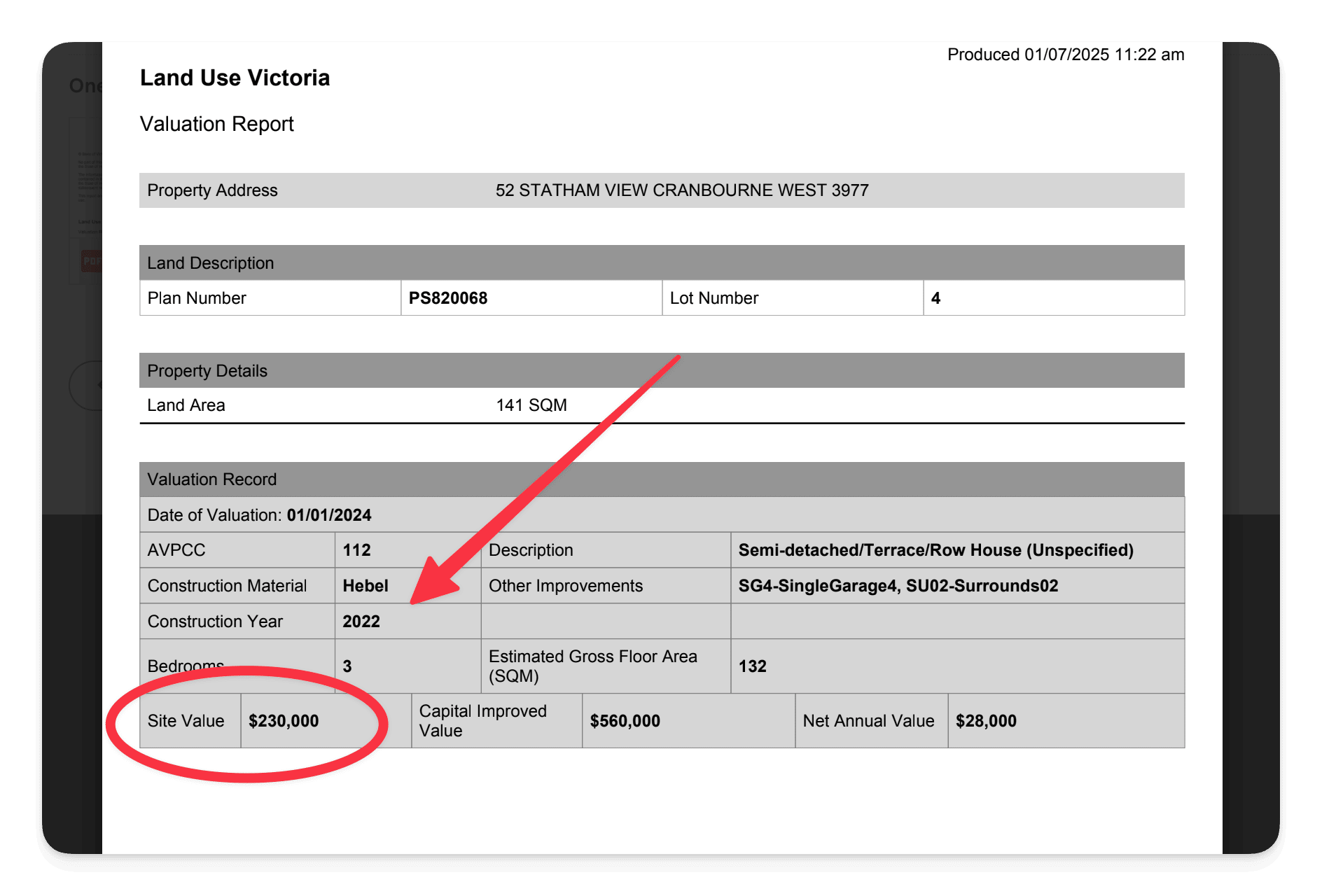

💻 Option 2: Order a Landata Valuation Report (~$11)

Perfect for pre-purchase due diligence if you don’t have access to council paperwork.

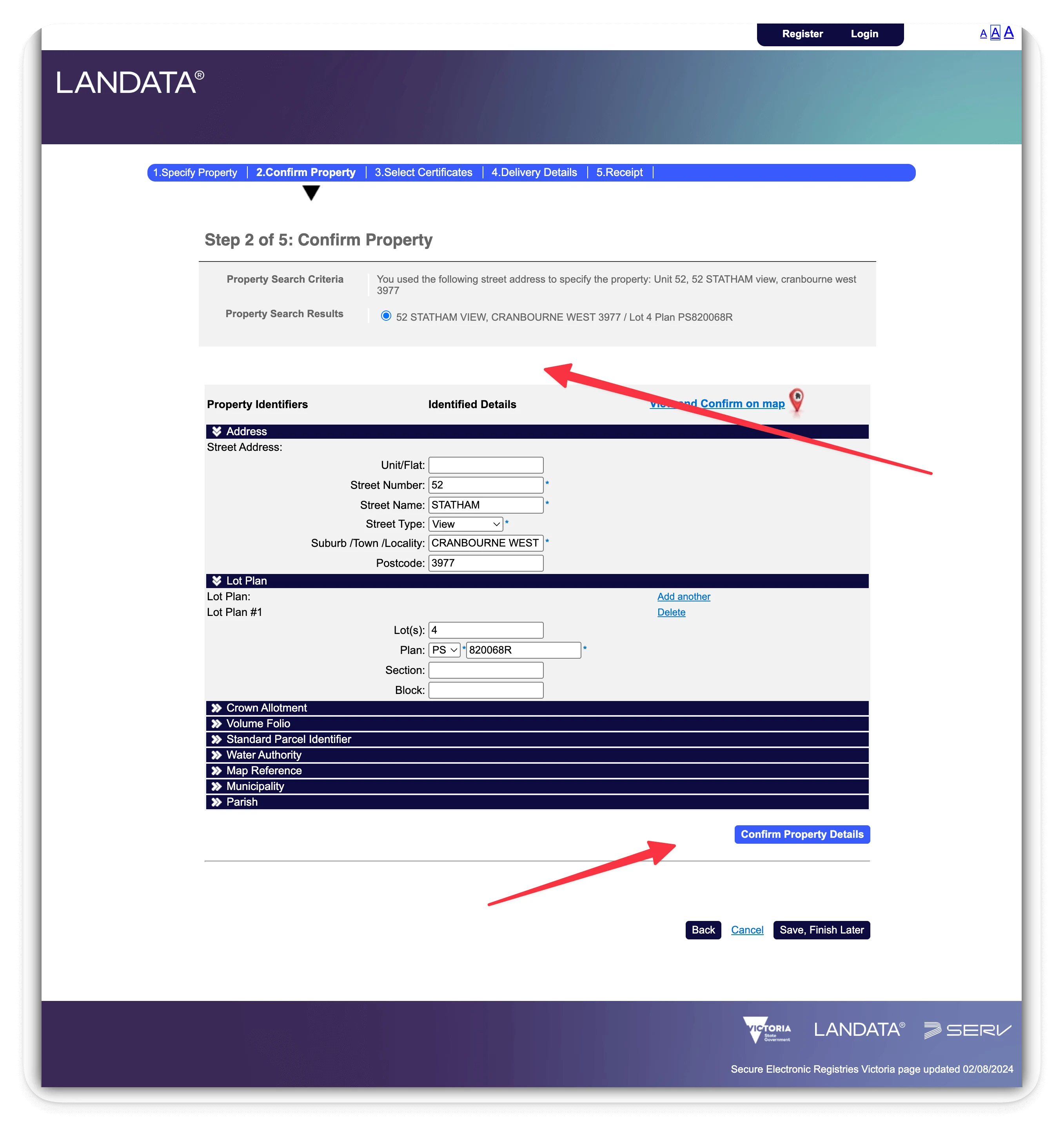

- Head to Landata Property Reports.

- Enter the property address and confirm the result.

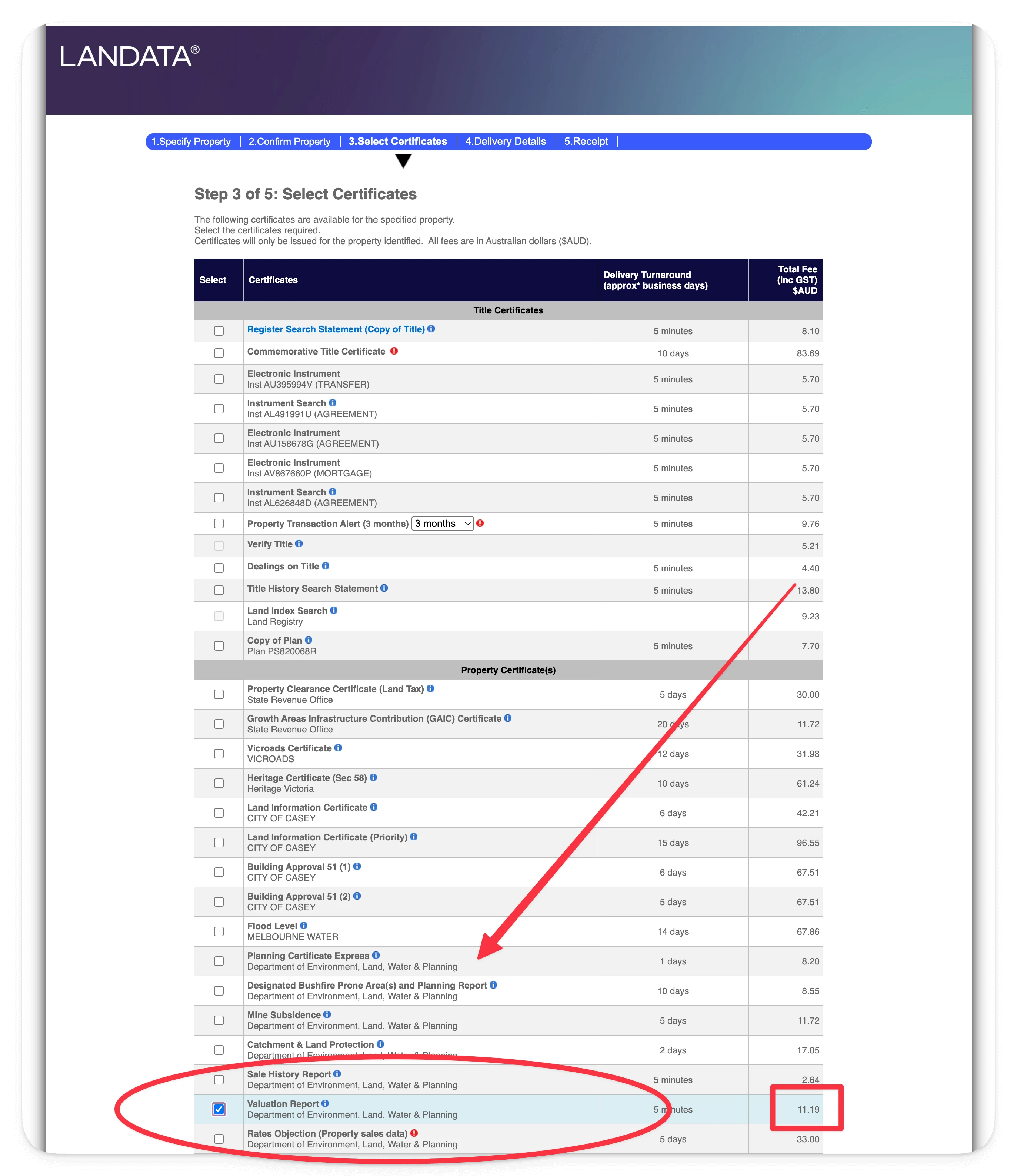

- Select Valuation Report, pay the fee, and download the PDF.

- Open the report, scroll to the valuation section, and record the Site Value.

- PropMax works with any combination of assets, so repeat the process for every Victorian property you own (or plan to own).

With the site values handy, you can now compare individual vs trust ownership or see how an extra property pushes you into the next tax bracket.

Trusts, Land Tax Surcharges, and the “Absentee” Trap

Trust Land Tax

- Trust thresholds start at $25,000 (instead of $50,000).

- Rates are higher, and the SRO requires you to nominate beneficiaries or face a surcharge.

- The discretionary trust surcharge can add thousands per year if you fail to lodge Form LT19A.

Absentee Owner Surcharge

- Applies to investors living overseas.

- Adds up to 4% on top of base land tax.

- Triggered if any of the owners or controllers are absentee.

These compounding surcharges are why many investors search for a “trust land tax calculator VIC” before buying. PropMax lets you compare scenarios quickly so you can decide whether the asset belongs in a trust or in personal names.

Worked Examples (Individual vs Trust)

| Scenario | Ownership | Aggregated SV | 2025 Land Tax |

|---|

| Two townhouses | Individual | $820k | $6,600 |

| Same portfolio | Discretionary trust | $820k | $8,950 |

| One townhouse + vacant land | Individual | $520k | $2,735 |

| One townhouse + vacant land | Trust | $520k | $4,600 |

- In each case the trust pays $1,800–$2,300 more per year.

- Unless asset protection or estate planning demands a trust, investors often keep Victorian property in personal names to leverage the higher threshold.

Modelling Land Tax Inside PropMax

- Create or clone the property scenario inside PropMax.

- Enter the Site Value under Ownership Costs → Land Tax.

- Choose “Individual” or “Trust” to let PropMax estimate the annual charge.

- Use the Sensitivity tab to see how land tax changes cashflow, ROI, and debt coverage.

- Save a trust vs personal version to compare in the dashboard.

Because PropMax recalculates after-tax cashflow automatically, you can see in seconds whether a Victorian asset still clears your minimum yield or ROI hurdle after land tax is applied.

Next Steps for Victorian Investors

- Know your site values — download the valuation from Landata or collect council notices.

- Check 2025 thresholds — new rates take effect each 1 January.

- Model both structures — run PropMax scenarios for personal and trust ownership.

- Talk to your accountant — land tax is just one piece of the structuring puzzle.

Once you understand the numbers, you can make an informed call on whether the trust surcharge is worth the asset protection benefits.

👉 Want help modelling land tax, cashflow, and after-tax ROI? Start a free PropMax account and see every holding cost before you buy.