Every Cost Australian Investors Should Model Before Buying

A PropMax checklist of holding costs, purchase costs, and worst-case buffers so you never underestimate an investment property.

Buying an investment property is not just about the purchase price and the expected rent. Australian investors face a long list of upfront, ongoing, and unexpected costs — and underestimating even a few of them can turn a promising investment into a cashflow drain.

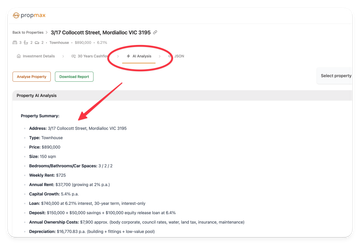

This article breaks down every major cost you should model before you buy — and shows how PropMax.com.au helps you simulate the full financial picture, including cashflow stress-tests, worst-case buffers, and 30-year projections.

🧾 1. Purchase Costs (Upfront Costs Most Investors Forget)

These are the expenses payable at or before settlement. PropMax automatically adds these into your Year 0 calculations.

1.1 Stamp Duty

- Biggest upfront cost in most states.

- Varies depending on property value and state.

- PropMax automatically calculates it OR lets you override manually.

1.2 Conveyancing & Legal Fees

- Typically $1,000–$2,500.

- Includes contract review, searches, settlement management.

1.3 Building & Pest Inspection

- $300–$900 for existing houses.

- New builds/off-the-plan may not require (but still recommended).

1.4 Loan Establishment Fees & LMI

- Application fees: $200–$600.

- Lenders Mortgage Insurance (LMI) applies if borrowing >80%.

- PropMax models:

- LMI capitalisation

- Higher monthly repayments

- Long-term impact on cashflow

1.5 Buyers’ Agent Fees

- Usually 1.5–2.5% of purchase price.

- PropMax includes them in holding cost analysis.

1.6 Adjustments at Settlement

- Council rates

- Water rates

- Owners corporation fees (if applicable)

- PropMax lets you input exact prorated amounts.

🔧 2. Renovation & Initial Setup Costs

Many investors underestimate these essential early-stage expenses.

2.1 Cosmetic Renovations

- Paint, flooring, lighting upgrades

- Often $5k–$25k depending on scope

2.2 Safety & Compliance

- Smoke alarms

- Electrical checks

- Gas safety checks

- Minimum standards (Vic)

2.3 Appliances & Fixtures

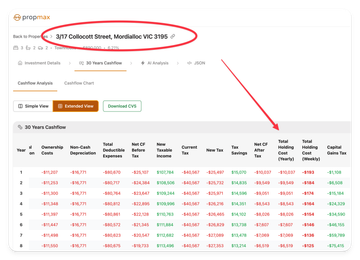

- Fridge, dishwasher, blinds, split-system, etc.

PropMax allows you to add a Year 0 Renovation Budget, fully amortised across your investment timeline.

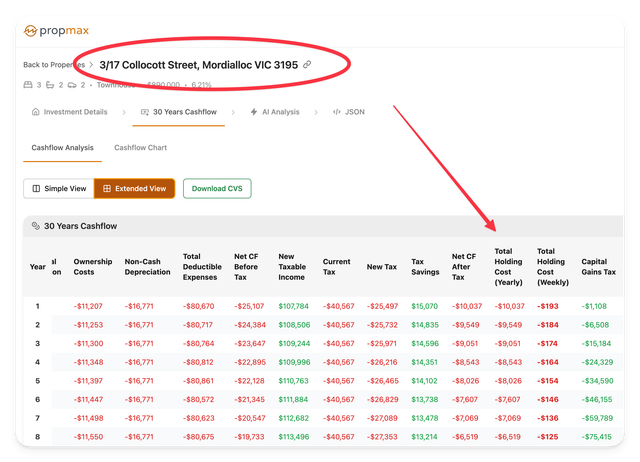

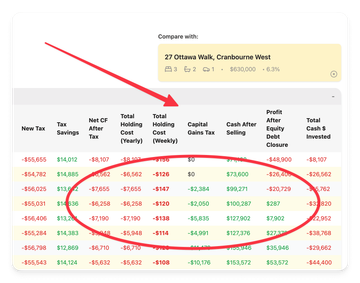

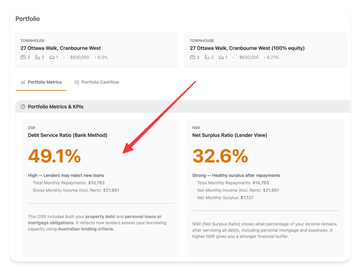

📅 3. Recurring Holding Costs (The Real Cashflow Story)

These determine whether your property is positively geared, neutrally geared, or negatively geared.

PropMax models all of the following:

3.1 Mortgage Interest

- The largest ongoing expense.

- PropMax handles:

- P&I vs Interest-Only modes

- Variable rate changes

- Rate-shock scenarios

3.2 Property Management Fees

- Typically 6–10% of rent.

- Plus leasing fees, inspection fees.

3.3 Council Rates

- Usually $1,500–$3,000 per year.

3.4 Water Service Charges

- $600–$1,000 annually (varies by state).

3.5 Landlord Insurance

3.6 Owners Corporation Fees (If Townhouse or Apartment)

- Ranges from $1,000 to $6,000+ depending on amenities.

3.7 Repairs & Maintenance

- Formula: 0.5%–1% of property value per year

- PropMax uses your custom assumption to forecast 30 years ahead.

3.8 Land Tax

- Different thresholds per state.

- Critical for multi-property investors.

- PropMax includes:

- VIC/NSW/QLD/WA/SA calculators

- Individual vs Trust ownership

🧮 4. Income-Related Calculations That Affect Costs

Costs alone don’t tell the story — income offset matters too.

4.1 Rental Vacancy

- Typical buffer: 2–4 weeks per year.

- PropMax models vacancy rate as a percentage or fixed weeks.

4.2 Maintenance Downtime

- When repairs prevent renting.

- Useful in modelling aggressive renovation strategies.

4.3 Depreciation (Non-Cash Benefit)

- Building allowance

- Fixtures & fittings depreciation

- Low-value pool

- PropMax supports:

- Full QS schedule inputs

- Yearly diminishing value modelling

Depreciation reduces tax payable — effectively improving cashflow.

⚠️ 5. Worst-Case Buffers (The Costs That Kill Beginner Investors)

PropMax lets you stress-test all worst-case scenarios:

5.1 Interest Rate Shock

- Example: +1% or +2% rate increase.

- Instantly see:

- New repayments

- New cashflow

- Danger zones

5.2 Extended Vacancy

- 8–12 weeks vacant?

- Model it in a click.

5.3 Unexpected Major Repairs

- Hot water system

- Roof repairs

- Electrical rewiring

5.4 Tenant Damage

- Bond may not cover everything.

- PropMax lets you enter one-off negative events per year.

5.5 Declining Rent Market

- Model −5% rental drop in specific years.

📊 6. Complete PropMax Checklist of Costs to Model

Upfront Costs

- Stamp duty

- LMI

- Conveyancing

- Pest & building inspection

- Loan fees

- BA fees

- Setup & compliance costs

- Renovations

Recurring Holding Costs

- Mortgage interest

- Property management

- Council rates

- Water service charges

- Landlord insurance

- Owners corporation fees

- Repairs & maintenance

- Land tax

- Bad debt provisioning

Income Buffers

- Vacancy

- Rent reduction

- Downtime during repairs

Risk Buffers

- Interest rate increases

- Emergency repairs

- Legal disputes

- Market downturn scenarios

- Tenancy issues

PropMax gives you the power to adjust each of these, watch the numbers recalculate instantly, and view the exact impact on monthly and annual cashflow.

🖥️ 7. How PropMax Makes This Easy (What You Can Do in Seconds)

✔ Model Year 0: Purchase & Setup Costs

Break down every upfront dollar before you buy.

✔ Model 30 Years of Holding Costs

Smart defaults + editable cost assumptions.

✔ See True Cashflow (Monthly & Annual)

No more guessing or relying on agent brochures.

✔ Run Scenario Comparisons

- Best case

- Realistic case

- Worst case

✔ Compare Equity Growth vs Cashflow Drain

Find out if the property really fits into your 3×650k or multi-property strategy.

✔ Detect Red Flags Early

If the property becomes cashflow-negative beyond your risk threshold, you’ll know before signing the contract.

🚀 Final Takeaway

A property is only as good as the numbers behind it.

Australian investors who model every cost — upfront, ongoing, and unexpected — make smarter decisions and avoid nasty financial surprises. PropMax gives you a complete, professional-grade framework to evaluate any deal with confidence.

Never underestimate a property again.

Model every cost. Stress test every scenario.

And invest like a pro with PropMax.com.au.