Refinancing for Property Investors: How to Unlock Equity to Buy Investment Property

Refinancing is one of the most powerful tools available to Australian property investors. It allows you to unlock trapped equity, improve borrowing capacity, restructure debt for tax efficiency, and fund deposits for your next investment property — without selling your home.

This guide explains how refinancing works, how equity release is assessed, and how to model the full impact inside PropMax.com.au before making expensive long-term decisions.

We also walk through a real-world refinancing structure based on a property valued at ≈ $1.3M, refinanced to Westpac into three loan splits, including two investment equity-release splits.

🧩 1. What Is Refinancing?

Refinancing simply means replacing your existing home loan with a new one (often with a different lender) to take advantage of:

- Better interest rates

- More flexible loan structures

- Better offset features

- The ability to release equity for investment

When paired with equity release, refinancing becomes the backbone of multi-property portfolio building.

🏦 2. What Is Equity Release and How Does It Work?

Equity release allows you to borrow against the increased value of your home — up to the lender’s maximum loan-to-value ratio (LVR), generally 80% without LMI.

Example

Home value (bank valuation): $1,300,000

Max lend @ 80% LVR: $1,040,000

If your current mortgage is lower (e.g., $740K), the bank may allow you to release the difference as investment borrowing.

Available Equity ≈ $1,040,000 − existing loan payoff

This borrowable amount can be used to fund:

🧾 3. Real Investor Scenario: Refinancing to Westpac Using a Three-Split Structure

You refinanced an owner-occupied home valued at approximately $1.3M with the following structure:

Loan Split 1 — Owner Occupied (P&I)

-

Amount: $725,000

-

Type: P&I

-

Variable rate: 5.35% p.a.

-

Monthly repayment: $4,049

-

Offset-eligible (Rocket Repay)

-

Secured by your home

Loan Split 2 — Investment (Equity Release IO)

-

Amount: $195,000

-

Type: Interest-Only for 5 years

-

IO rate: 5.75% p.a.

-

Monthly interest: ≈ $934 (plus fees)

-

Purpose: Equity release for purchasing a newly built investment dwelling

Loan Split 3 — Investment (Equity Release IO)

Total Facility

$1,040,000 across all three loan splits.

This matches the lender's maximum lend at 80% LVR on a $1.3M valuation.

Why this structure is powerful

| Loan Split | Purpose | Tax Deductible? | Optimisation Benefit |

|---|

| Split 1 | PPOR debt | ❌ No | Keep as small + low-rate as possible |

| Split 2 | Investment equity | ✔ Yes | Used for deposit + costs of IP #1 |

| Split 3 | Investment equity | ✔ Yes | Used for deposit + costs of IP #2 |

This structure cleanly separates deductible vs non-deductible debt, which ATO requires.

PropMax models each split separately for tax and cashflow accuracy.

🧮 4. How to Calculate Available Equity the “PropMax Way”

PropMax automates the equity calculation, but the formula is:

Available Equity = (Home Value × Max LVR) − Current Loan Balance

Using your scenario:

-

Home value: $1,300,000

-

Max LVR: 80%

-

Max lend: $1,040,000

-

Old loan (paid out via refinance): ≈ $740,000

-

New borrowing: $1,040,000

Thus equity released ≈ $300,000 (split into $195K + $120K, minus fees).

PropMax lets you test different valuations (bank valuation vs desktop vs agent estimate) to see best/worst-case outcomes.

💡 5. How Refinancing Impacts Cashflow

Refinancing affects:

-

Owner-occupied repayments (Split 1)

-

Investment interest deductibility (Splits 2 & 3)

-

Cashflow available for new purchases

-

Tax refund from deductible interest

-

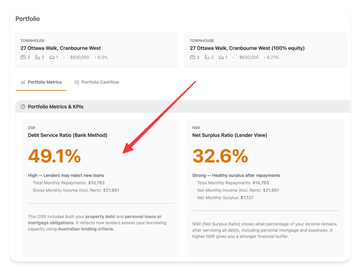

Portfolio serviceability (DSR, NSR)

Example Interest Costs

| Loan | Amount | Rate | Annual Interest | Deductible? |

|---|

| Split 1 | 725,000 | 5.35% | $38,788 | ❌ No |

| Split 2 | 195,000 | 5.75% | $11,212 | ✔ Yes |

| Split 3 | 120,000 | 5.75% | $6,900 | ✔ Yes |

Total new annual interest ≈ $56,900

Deductible portion ≈ $18,112

These values plug directly into PropMax’s Holding Cost and Tax Benefit calculators.

🏗️ 6. Funding Your Next Investment Property Using Released Equity

Many investors mistakenly pay deposits from savings.

Equity release allows the bank to pay the deposit, preserving your cash buffer.

Example

Using Split 2 + Split 3 for a purchase:

-

Total equity released for investments: $315,000

-

Enough for 20% deposits + stamp duty + closing costs for two new townhouses

Inside PropMax, you assign each split to the correct property:

This ensures full tax deductibility and accurate long-term modelling.

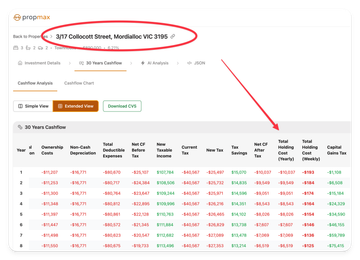

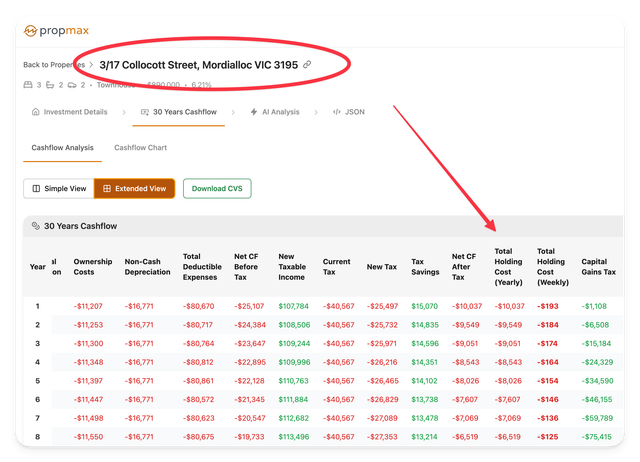

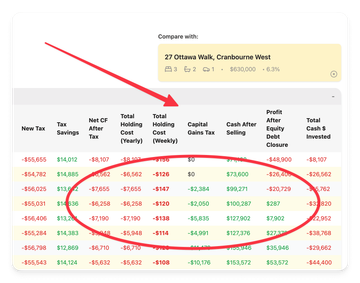

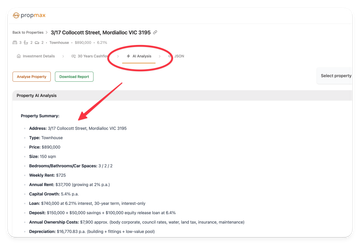

📊 7. Modelling Refinancing Outcomes in PropMax

PropMax gives you a complete before-and-after picture.

PropMax automatically calculates:

-

Revised holding costs after refinancing

-

Interest costs per split

-

Tax deductibility impact

-

New borrowing capacity picture

-

Updated portfolio cashflow

-

Best-case vs worst-case stress tests

Scenario Modelling Examples

| Scenario | What PropMax Models | Why It's Important |

|---|

| Keep current lender | Legacy rates & structures | Baseline comparison |

| Refinance at new rates | New repayments, new interest | Determine savings |

| Release $315K equity | Deposit funding + tax impact | Plan investment purchase |

| Buy 1 or 2 properties | Full 30-year cashflow | Portfolio impact |

| IO vs P&I toggles | Serviceability + tax | Choose optimal structure |

| Offset utilisation | Reduced interest & buffers | Cash safety planning |

🧰 8. Refinancing Checklist for Investors

Before you refinance

-

Check your valuation range (PropMax’s valuation tools help verify)

-

Compare multiple lenders (rate + policy)

-

Identify purpose of each split (PPOR vs investment)

-

Ensure equity release will be considered tax-deductible

-

Confirm exit fees + package fees

During refinancing

-

Structure splits cleanly (e.g., owner-occ vs investment)

-

Link offset to PPOR split

-

Avoid cross-collateralisation

-

Keep clear documentation for the ATO

After refinancing

🚨 9. Common Mistakes Investors Make (and How PropMax Prevents Them)

❌ Mixing deductible and non-deductible debt

PropMax forces you to tag each split → correct tax outcomes.

❌ Using savings instead of equity

PropMax automatically shows how equity-funded deposits improve after-tax cashflow.

❌ Not accounting for rising repayments

PropMax includes stress-testing with +1%, +2%, +3% rate simulations.

❌ Overestimating borrowing capacity

PropMax portfolio ratios (DSR, NSR) simulate lender behaviour.

❌ Not evaluating multiple purchase scenarios

PropMax allows three simultaneous scenarios for a single property.

🧠 10. Why Refinancing Is the Foundation of Multi-Property Wealth

Refinancing + equity release is how Australian investors scale from:

1 property → 2 → 3 → full portfolio.

Your real scenario (splits of 725K + 195K + 120K) is textbook:

- Owner-occupied debt stays in Split 1

- New investment debt goes into Splits 2 & 3

- All interest from investment splits becomes deductible

- Equity funds deposits for multiple new investments

- Cashflow and tax effects are modelled with precision in PropMax

This is exactly how long-term leveraged wealth is created.

✅ Final Takeaway

Refinancing is not just about getting a better rate.

It is a portfolio-building strategy.

PropMax helps you:

- Analyse refinancing options

- Calculate equity safely

- Allocate splits correctly

- Model tax and cashflow impact

- Plan your next purchase with confidence

Before you refinance or buy your next property, run the full modelling inside PropMax — the platform is built for exactly this type of complex planning.