Rentvesting Strategy Modelling: Should You Rent and Buy an Investment First?

Rentvesting is becoming a core strategy among Australian investors who want lifestyle freedom and early exposure to property growth. Instead of asking, “Should I rent or buy?”, the real question is:

Does renting where you want to live, while owning an investment where the numbers work, get you further ahead?

The only meaningful way to answer this is through structured modelling rather than assumptions — exactly what PropMax was built for.

What Is Rentvesting?

Rentvesting separates where you live from where you invest. You rent the lifestyle location you want, and purchase an investment property in a suburb that delivers stronger yield, higher growth, or better affordability.

This allows you to:

- Enter the market sooner with a smaller deposit

- Live in a suburb that may be unattainable to buy into

- Claim investment deductions (interest, expenses, depreciation, LMI)

- Leverage growth markets interstate

It’s a strategy about flexibility, speed, and compounding.

Why You Should Model the Strategy Instead of Guessing

Rentvesting often means tighter cashflow in the first few years. Growth rates vary. Loans behave differently under IO/P&I. Your rent also counts toward your total outgoings.

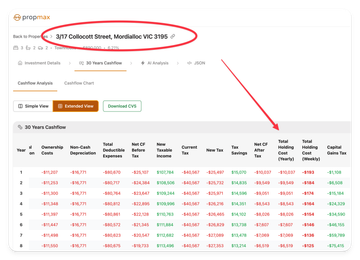

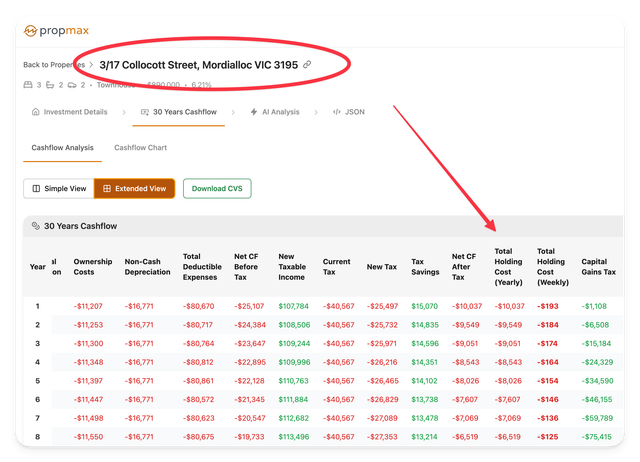

A tool like PropMax lets you model these components properly:

- Holding costs vs rent you’re paying

- After-tax cashflow including depreciation

- Long-term equity build from capital growth

- ROI at 5, 10, 15+ year milestones

- Sensitivity tests: interest rates, vacancies, growth shocks

This transforms rentvesting from a theory into a clearly calculated decision.

Example Scenario Inputs

Here’s a realistic Melbourne couple in their early 30s:

| Item | Value |

|---|

| Household income | $185,000 combined |

| Current savings | $140,000 |

| Current rent | $900/week (3% annual increases) |

| Borrowing capacity | 90% LVR investment, 80% PPOR |

| Target investment | 3-bed townhouse – Everton Park, QLD |

| Purchase price | $720,000 |

| Expected rent | $700/week (2.5% growth) |

| Capital growth assumption | 5.2% p.a. |

| Loan structure | 30-year Interest-Only (5-year IO) at 6.15% |

| Annual ownership costs | $7,800 |

| Depreciation | $9,200 in year 1 (-2% per year) |

Their modelling must also incorporate their personal rent, which is a private cost and non-deductible.

Scenario 1: Rentvest Now (Buy the Investment First)

With $140k saved, they can enter the market immediately.

| Cost | Amount |

|---|

| Deposit (15%) | $108,000 |

| Stamp duty + legals (QLD) | $27,500 |

| LMI (capitalised) | $11,340 |

| Loan setup + inspections | $3,200 |

| Total upfront cash | $138,700 |

Key modelling results (10-year view)

- Average after-tax cashflow (Years 1–5): –$180/week (including their personal rent)

- Net holding cost over 10 years: ~$92k

- Equity after 10 years: ~$420k (property grows to ~$1.19m)

- ROI after 10 years: ~148%

They remain living in Fitzroy, enjoy lifestyle freedom, and still build meaningful wealth via an interstate growth asset.

The combined “rent + investment shortfall” is still cheaper than owning a $1.3m Melbourne home today.

Scenario 2: Save Longer and Buy a PPOR First

If they chase a PPOR before investing:

- Need ~20% deposit + stamp duty → approx $330k upfront

- 4.5+ years of aggressive saving while renting

- Zero exposure to market growth during this time

- Entire mortgage becomes non-deductible

Assuming 4.5% capital growth on a $1.3m Melbourne townhouse:

- Equity after 10 years ≈ $350k, but

- Cash contribution is huge

- No tax benefits

- No rental income

- No diversification

They secure a lifestyle home, but wealth creation is slower because compounding started later.

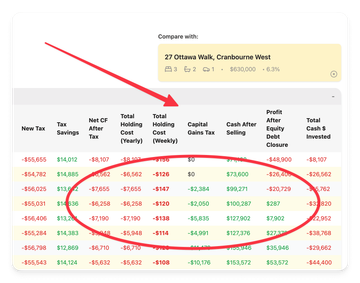

10-Year Head-to-Head Comparison

| Metric | Rentvest Today | Buy PPOR First |

|---|

| Initial cash required | $138.7k | $330k |

| Weekly cashflow (years 1–5) | –$180 | –$1,050 (owner-occupier loan) |

| Net equity after 10 years | $420k | $350k |

| ROI on cash invested | 148% | 106% |

| Market diversification | QLD + future PPOR optionality | 100% tied to one home |

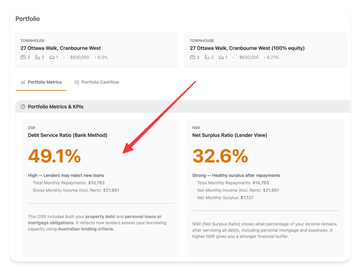

Rentvesting wins primarily because compounding starts earlier and less cash is trapped in a non-deductible home loan.

Essential Sensitivity Tests

When using PropMax, pressure-test your numbers:

-

Lower growth scenario (3%)

Still positive ROI after 10 years—early compounding matters more than perfect growth.

-

Higher interest rates (7% IO or P&I from year 6)

Helps determine your buffer and risk tolerance.

-

Vacancy assumptions

Include 4 weeks every 2 years to model realistic downtime.

-

Renovation uplift modelling

Add capital costs + new rent in PropMax to simulate forced appreciation.

These tests reveal whether the strategy fits your personal risk profile.

When Rentvesting Is Most Effective

- You want to live in a premium suburb but invest in a growth corridor

- Strong income, smaller deposit

- You’re willing to hold the asset for 10+ years

- You plan to use equity later to upgrade to a PPOR

Most successful rentvestors refinance after 5–7 years, extract equity, and use the investment property as a stepping stone toward their eventual home.

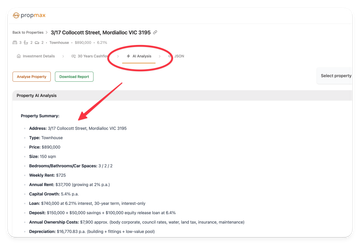

How to Model Rentvesting in PropMax.com.au

- Gather inputs: local rents, suburb medians, growth assumptions.

- Open PropMax Investment Calculator.

- Enter purchase details: deposit %, LMI, stamp duty, IO/P&I settings.

- Add your personal rent as a private expense.

- Analyse 5-, 10-, 15-year ROI and cashflow timelines.

- Export PDF and review with your broker or adviser.

This workflow ensures your decision is based on numbers — not guesswork.

Key Takeaways

- Rentvesting helps you enter the market sooner without sacrificing lifestyle.

- Modelling is crucial: it shows total cash demands, tax impacts, long-term equity, and risk factors.

- Starting compounding earlier often outperforms waiting to buy an expensive PPOR.

- PropMax makes it simple to compare the two paths side-by-side and choose the strategy that accelerates your long-term wealth.