What Is Rentvesting? Meaning, Tax Benefits & Cashflow Calculator Explained

Rentvesting is the hybrid strategy that lets you rent the home you want to live in while owning an investment property in a different location. Instead of waiting until you can afford a million-dollar principal place of residence (PPOR), you buy a more affordable asset (say $550k) that stacks up as an investment, keep living in your lifestyle suburb, and let tenants plus the tax office help fund the loan.

This guide covers the rentvesting meaning, the tax benefits (and traps), and a practical way to model the cashflow using the PropMax rentvesting calculator.

Table of Contents

- Rentvesting meaning in plain English

- Rentvesting tax benefits

- How to use a rentvesting calculator

- Worked example

- Pros, cons, and common mistakes

- Action checklist

Rentvesting Meaning in Plain English

Rentvesting = rent lifestyle, own growth. You:

- Rent the inner-city apartment, beach house, or school-zone property that fits your lifestyle.

- Own an investment property in a different location (often interstate or in a growth corridor).

- Use the investment to build equity and leverage while you enjoy flexibility as a renter.

You’re effectively decoupling “where I live” from “where I invest,” which can fast-track portfolio growth if executed well.

Rentvesting Tax Benefits

-

Negative gearing deductions

- Interest on the investment loan, property management, maintenance, and depreciation are deductible against your salary.

- If your rentvesting property runs at a loss, your taxable income falls, which can deliver weekly PAYG credits when you lodge a variation.

-

Depreciation schedules

- Buildings constructed after 1987 can attract 2.5% capital works deductions per year.

- Fixtures and fittings receive accelerated depreciation, further increasing the deductible loss.

-

Remote ownership expenses

- Travel deductions are mostly banned, but technology, accountant fees, legal costs, and landlord insurance remain deductible.

-

CGT considerations

- Unlike a PPOR, the investment will attract capital gains tax when sold. However, the 50% CGT discount applies if you own it for more than 12 months.

- If you eventually move in, you may be able to apply the six-year absence rule to maintain PPOR status (if no other PPOR is claimed).

Important: Your personal rent is NOT deductible. The tax benefits apply to the investment property only.

How to Use a Rentvesting Calculator (PropMax Workflow)

-

Create a property scenario

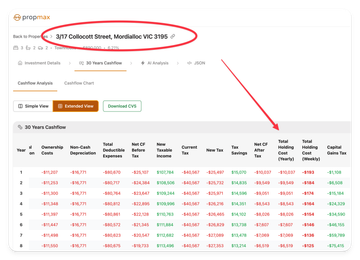

- Enter the purchase price, rent, vacancy, expenses, and depreciation.

- Check “investment property” so PropMax applies the correct tax treatment.

-

Add your personal rent as a separate budget item in the dashboard so you can see total household outflows.

-

Duplicate the scenario to model buying a PPOR instead (switch structure to PPOR, remove rent, and load owner-occupier interest rates).

-

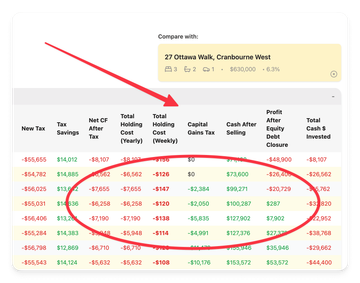

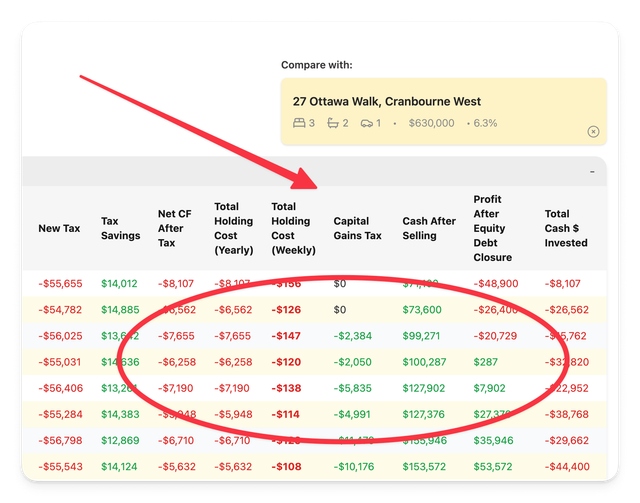

Compare net cashflow, ROI, IRR, and equity after 5–10 years. The calculator makes it obvious whether rentvesting or buying delivers better results for your situation.

-

Export reports for your broker or partner so everyone sees the same numbers.

Worked Example

| Scenario | Lifestyle Rent | Investment Purchase | Upfront Cash | After-Tax Cashflow (Yr 1) | Equity After 10 Years* |

|---|

| Rentvest | $720/wk apartment | $580k townhouse (4.5% cap growth, $560/wk rent) | ~$115k | -$110 per week | ~$360k |

| Buy PPOR | $0 (own home) | $900k apartment | ~$200k | -$1,000 per week | ~$410k (CGT-free) |

*Assumes similar market growth and conservative rent increases; run your own numbers inside PropMax.

Takeaway: Rentvesting uses less upfront cash and offers deductions, but the combined rent + holding costs can still be negative. Buying your PPOR requires far more cash and offers no tax deductions but locks in security and PPOR CGT rules.

Pros, Cons, and Common Mistakes

Pros

- Live anywhere you want without a $1m mortgage.

- Enter the market sooner with a smaller deposit.

- Create a portfolio focus early (multiple investments before upgrading PPOR).

- Tax deductions soften the cashflow impact compared to an equivalent PPOR loan.

Cons

- You still feel like a renter—landlords can sell, increase rent, or restrict pets.

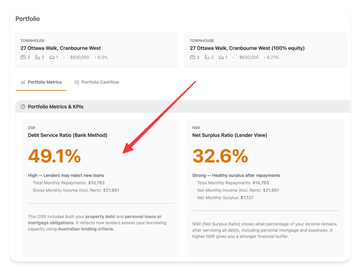

- Holding costs can spike if your rent or interest rates rise simultaneously.

- No automatic PPOR CGT exemption; you must plan exits carefully.

- Emotional fatigue from moving or not being able to customize your home.

Common Mistakes

- No buffer: Underestimating the combined rent + investment shortfall.

- Lifestyle creep: Renting something too expensive “because it’s deductible” (it isn’t).

- Never setting an exit: Rentvesting forever by accident, missing out on PPOR benefits.

- Ignoring land tax: Multiple interstate holdings can trigger land tax surcharges you didn’t budget for.

- Poor lending structure: Mixing PPOR and investment debt on the same loan, muddying deductions.

Action Checklist

- Define the lifestyle rent you’re willing to pay and cap it.

- Run PropMax comparisons (rentvest vs buy) with realistic assumptions.

- Talk to your accountant about PAYG variations so cashflow stays manageable.

- Track buffers—aim for at least six months of combined rent and holding costs.

- Set a milestone (equity, family stage, income) that triggers converting the strategy into a PPOR purchase.

- Review annually. Rents, rates, and personal goals change; keep the model current.

Rentvesting is neither a fad nor a cure-all. It’s a deliberate choice to separate lifestyle from investment so you can build wealth when PPOR prices feel out of reach. If you understand the meaning, respect the tax benefits (and limits), and model the cashflow rigorously, it can be the bridge between renting forever and owning multiple properties on your own terms.