Rentvesting vs Buying: Pros, Cons & When It Actually Makes Sense

Rentvesting is the strategy of renting where you want to live while owning an investment property somewhere else. It sounds like a hack—keep the lifestyle suburb, let tenants pay the mortgage, and ride capital growth in a more affordable market. But does it stack up? This guide breaks down the rentvesting pros and cons, shows how the numbers compare to buying your own home, and outlines when rentvesting is worth it (and when it isn’t).

Table of Contents

- Rentvesting in one sentence

- Rentvesting pros and cons

- Rentvesting vs buying modelling example

- When rentvesting is worth it

- Why rentvesting can be a bad idea

- Action plan for would-be rentvestors

Rentvesting in One Sentence

You rent lifestyle and own growth. Instead of pouring every dollar into a pricey principal place of residence (PPOR), you lease the inner-city apartment you love for $750 per week and buy a $600k townhouse in a growth corridor that could never be your home but may produce superior yields and depreciation.

Rentvesting Pros and Cons

| Rentvesting Pros | Rentvesting Cons |

|---|

| Lifestyle flexibility: Live in your preferred location without a $2m mortgage. | No PPOR security: Landlords can sell or increase rent; you move on their timeline. |

| Borrow sooner: Lower entry price because you’re buying in cheaper markets. | Dual budgets: Rent plus investment property holding costs can stress cashflow. |

| Tax benefits: Interest, depreciation, and expenses are deductible on the investment. | No PPOR CGT exemption: Capital gains are fully taxable when you sell the investment. |

| Portfolio focus: Start compounding equity earlier, even if you can’t afford your dream home. | Less emotional payoff: You still “feel” like a renter despite owning an asset elsewhere. |

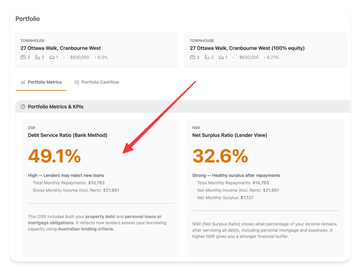

| Option value: You can always convert the investment to a PPOR later if lifestyle needs change. | Serviceability risk: Banks still count your personal rent in living expenses, trimming borrowing capacity. |

Rentvesting vs Buying Modelling Example

| Scenario | Lifestyle Rent | Property Owned | Cash Needed Upfront | After-Tax Cashflow (Year 1) | Equity After 10 Years* |

|---|

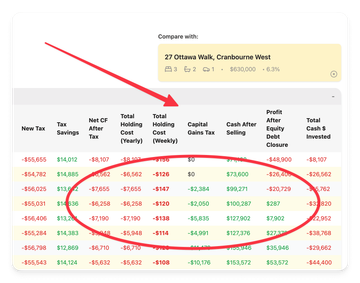

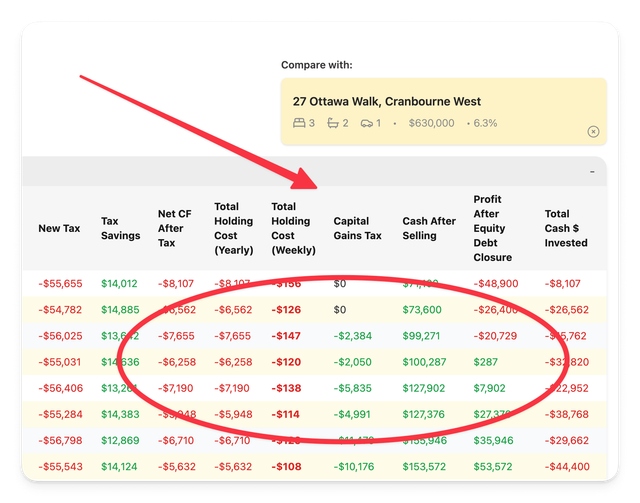

| Rentvest | $750/wk inner-city apartment | $600k townhouse in growth corridor (4.5% cap growth, $560/wk rent) | ~$120k (deposit + costs) | ~-$120 per week (negatively geared) | ~$370k |

| Buy PPOR | $0 (own residence) | $950k inner-city apartment (your home) | ~$220k (deposit + stamp duty) | ~$-1,050 per week (mortgage + strata) | ~$420k (CGT-free if sold) |

*assuming similar market performance; PropMax modelling used for baseline figures.

Key insight: Rentvesting requires less upfront cash, but the after-tax holding cost is still negative. Buying your own home demands nearly double the cash and delivers no tax deductions, yet it locks in lifestyle security and the CGT exemption.

When Rentvesting Is Worth It

- You value lifestyle over ownership but still want exposure to property growth.

- Deposits are limited. Enter the market in a $500k–$700k corridor instead of waiting five years for a $1.5m PPOR.

- You can stomach volatility. Negative gearing plus rent payments require a healthy buffer.

- There’s a defined time horizon. Use rentvesting for 5–7 years to build equity, then recycle into a PPOR when life settles.

- You plan to diversify. Rentvesting can be a springboard into multiple investment properties because rental income supports borrowing capacity.

Why Rentvesting Can Be a Bad Idea

- Limited discipline: Dual commitments (rent + investment loan) can break a budget if you overspend on lifestyle.

- Tax blow-back: “Why rentvesting is bad” headlines often point to the lack of CGT discounts on owner-occupied homes. If you never buy a PPOR, you never receive the exemption.

- Lifestyle fatigue: Constant moves, rental inspections, and the inability to renovate your home can grind down even committed rentvestors.

- Rising rents: During tight rental markets, personal rent can spike faster than your investment rent, shrinking the arbitrage that made the strategy appealing.

- Emotional mismatch: Some people simply sleep better knowing they own their home outright; rentvesting will never satisfy them.

Action Plan for Would-Be Rentvestors

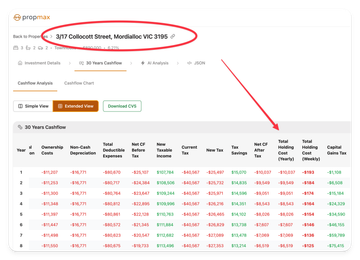

- Model both paths inside PropMax. Duplicate the scenario: one for rentvesting (investment only) and one as a PPOR purchase.

- Stress-test cashflow with realistic personal rent and worst-case vacancy or interest-rate scenarios.

- Build a sinking fund that covers at least six months of rent plus investment holding costs.

- Review tax strategy annually. Ensure depreciation schedules are up to date and PAYG variation is correct so you aren’t starved for cash.

- Define the exit. Post a milestone (e.g., $300k equity) that triggers the upgrade into a PPOR so you don’t rentvest forever by accident.

Final Thoughts

Rentvesting isn’t a magic shortcut, but it is a viable bridge between lifestyle goals and long-term investing. Use the strategy when it accelerates portfolio growth and keeps you in the suburb you love. Abandon it when the emotional toll, tax drag, or cashflow strain outweighs the benefits. The only way to know which side you’re on is to run the numbers with your own rent, borrowing capacity, and risk tolerance.