Trust vs Personal Ownership: How Land Tax Can Double Overnight

When investors ask for a trust land tax calculator, what they really want to know is whether a structure that protects assets or shares income will also nuke their cashflow. Each state and territory applies different thresholds and surcharges to trusts, and on a $1 million site value the hit can be dramatic. In this guide we break down the numbers, explain why trust rates exist, and show how PropMax lets you overlay negative gearing calculator outputs with land tax so you can see the full after-tax picture.

Table of Contents

Why Trusts and Land Tax Clash

Land tax thresholds were written long before discretionary trusts became mainstream. States allow a generous tax-free threshold for individuals, but most treat trusts as “foreign” or “special” owners. That means:

- Lower or nil threshold for trusts (NSW, VIC, QLD, TAS).

- Higher marginal rates to discourage asset warehousing.

- Paperwork requirements (beneficiary nominations, tracing rules, SRO disclosures) with penalties if you forget to lodge.

If you place the same property portfolio into a trust, land tax can double overnight. The goal isn’t to scare you away from trusts but to quantify the holding cost so you can decide whether asset protection, estate planning, or income streaming still justify the structure.

National Comparison: $1 Million Site Value

The table below models a single investment property with a $1 million aggregate site value held in each state. Amounts are rounded using each revenue office’s 2025 (or latest available) schedule. Real bills will vary if you own multiple assets, have exemptions, or qualify for primary production rules, so treat the figures as directional guidance.

| State | Personal Ownership (2025) | Trust / Special Trust (2025) | Notes |

|---|

| NSW | $0 (below $1.075 m threshold) | ≈ $16,000 (special trusts taxed at 1.6% from the first dollar) | NSW is the most extreme example of the threshold advantage. |

| VIC | ≈ $4,135 | ≈ $7,050 | Trust threshold drops to $25k and marginal rates are higher. |

| QLD | ≈ $4,500 | ≈ $11,000 | Trusts/companies use the lower $350k threshold. |

| SA | ≈ $3,750 | ≈ $3,750 | SA currently taxes most structures equally, so differences come from grouping rules. |

| WA | ≈ $1,950 | ≈ $1,950 | Western Australia differentiates by landholder type, but a $1 m SV sits in the same bracket for most owners. |

| TAS | ≈ $5,300 | ≈ $7,700 | Trusts pay the premium surcharge unless a beneficiary nomination is accepted. |

| ACT & NT | ≈ $0 – $1,800 | ≈ $0 – $1,800 | Both territories currently apply the same scale to most ownership types. |

Key takeaways

- NSW and QLD are the biggest spread between personal vs trust.

- VIC’s trust surcharge is smaller but still adds ~$60 per week to holding costs.

- SA/WA/territories have minor differences, so the asset protection argument is easier to justify.

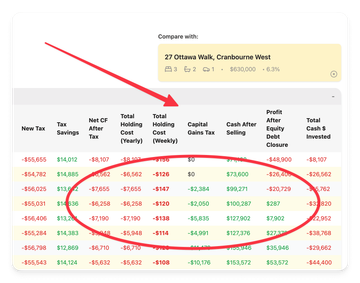

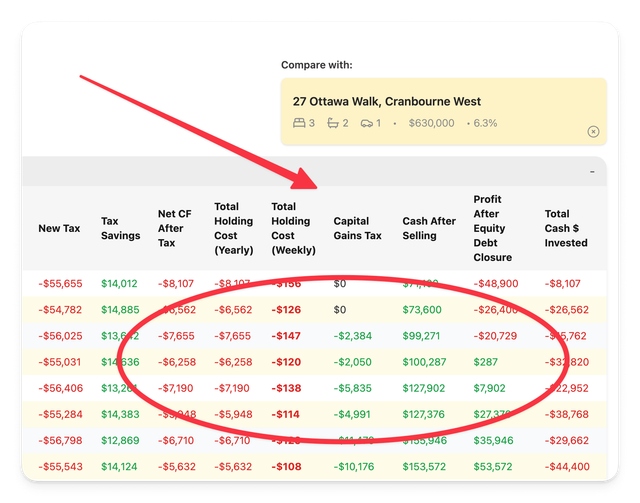

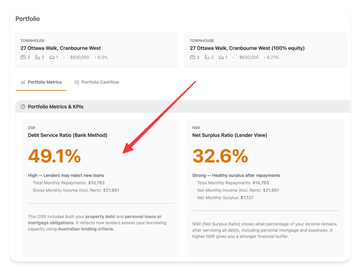

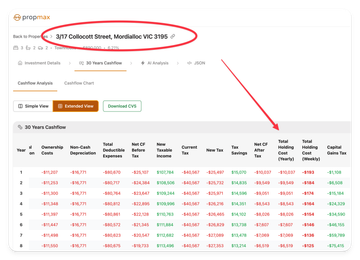

Worked Example Inside PropMax

Let’s model a Victorian townhouse with a $1 million site value and $52,000 annual rent.

- Duplicate the scenario in PropMax.

- Toggle the ownership structure setting between “Personal” and “Discretionary Trust”.

- PropMax pulls the relevant land tax schedule and stamps the correct rate into your expenses:

- Personal name: ~$4,135 per year ($79/week).

- Trust: ~$7,050 per year ($135/week).

- Because PropMax runs the same amortisation, depreciation, and rent numbers in both cases, you instantly see the true delta in net cashflow, IRR, and payback period.

That visibility is impossible in a spreadsheet unless you manually update the land tax line every time you tweak the structure.

Combining Land Tax With Negative Gearing

Many investors lean on a negative gearing calculator to validate their after-tax position. The catch: if your calculator ignores trust surcharges, you could be overstating the benefit by thousands.

Inside PropMax you can:

- Tag expenses as “deductible” so they flow through the tax module.

- Compare PAYG refunds for personal ownership (where losses offset your salary) vs a trust (where losses accumulate until future distributions).

- Export both scenarios to a single client-ready report showing pre-tax and after-tax cashflow with land tax baked in.

When you overlay land tax and negative gearing, the personal name scenario often delivers a bigger immediate tax refund, even if the trust promises an income-splitting advantage later.

When a Trust Still Makes Sense

Despite the higher land tax bill, a trust can still be the right vehicle if:

- You need robust asset protection from operating risk.

- You have adult beneficiaries in lower tax brackets who will receive future distributions.

- Estate planning or succession control requires a corporate trustee.

PropMax makes the trade-off transparent by showing cashflow strain today against the strategic benefits you hope to unlock later.

Action Checklist

- Grab site values for every property (rates notice, Landata, RP Data) and confirm which assets are exempt.

- Model both structures in PropMax so you can see weekly cashflow differences.

- Document trust elections (NSW declaration, VIC LT19A, QLD Form LT23) to avoid penalty rates.

- Track cumulative holdings. Adding interstate property can still tip you over your local threshold.

- Review annually. When valuations jump, revisit whether properties should be shifted out of the trust or left in personal names.

Land tax is unavoidable, but with the right modelling you can decide whether doubling the bill is an acceptable price for the protections and flexibility a trust provides.