30-Year Investment Property Cashflow Forecasting

Plan with precision. Use our free cashflow calculator to forecast rental income, expenses, equity, and loan impact over 30 years. Built for Australian investors.

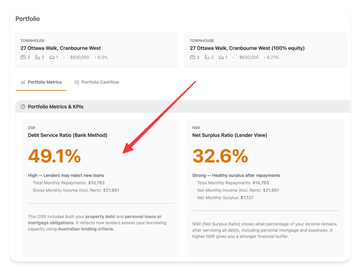

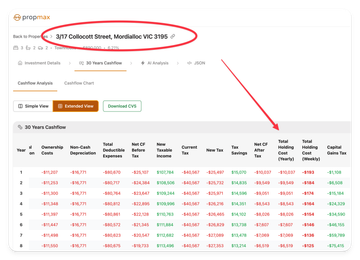

- Interactive 30-year investment property cashflow calculator

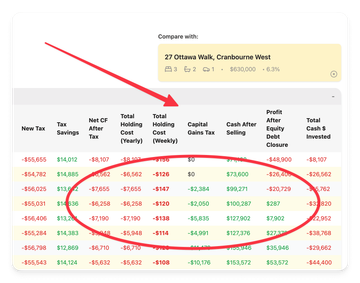

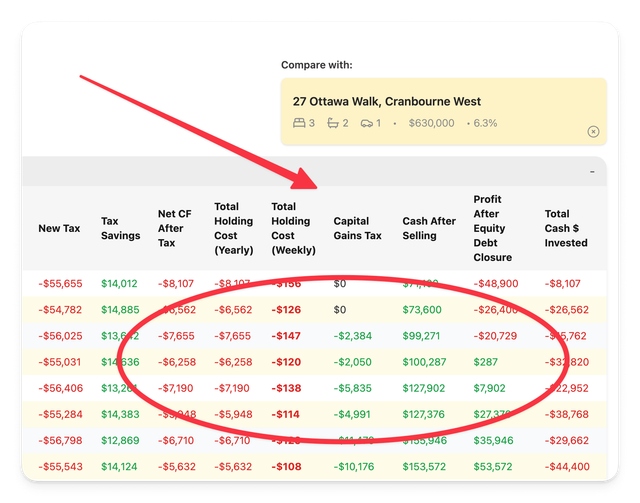

- Visual breakdown of income, outgoings, and capital growth over time

- Includes equity tracking and principal vs interest repayment flows

- See cashflow at weekly, monthly, or annual levels