Trust vs Personal Ownership: Cashflow & Land Tax Modelling for Investors

Buying in your personal name is simple. Buying in a trust can be powerful. But the real question for Australian investors is not “which structure is better?” It is:

Which structure produces better cashflow, borrowing power, land tax efficiency, and long-term wealth for your specific investment property?

PropMax users increasingly model both structures side-by-side because the answer is never one-size-fits-all. The optimal structure depends on land value, rental yield, depreciation profile, borrowing strategy, and your eventual exit plan.

Why Ownership Structure Matters

The holding structure affects several financial levers:

1. Net Cashflow

- Interest deductibility rules differ between personal income vs trust distributions

- Trusts may lose some tax efficiency if beneficiaries are low-income

- Some lenders apply higher rates or reduced LVRs to trust borrowers

2. Land Tax

- Personal ownership receives state-based thresholds (highly valuable in VIC & QLD)

- Discretionary trusts often receive no threshold unless specifically configured

- Corporate trustees can trigger higher flat-rate land tax in some states

- Land tax becomes a major cost as land value grows, especially for townhouses and freestanding homes

3. Depreciation & Capital Works

Both structures can claim:

- Building depreciation

- Plant & equipment deductions (if eligible)

- Loan costs and LMI amortisation

But the impact on taxable income differs depending on who receives distributions.

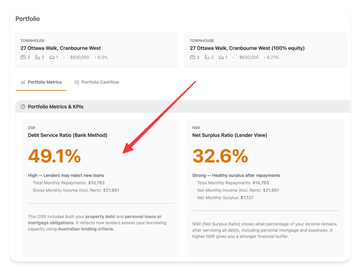

4. Borrowing Power

- Personal ownership typically yields the highest borrowing capacity

- Trust lending is more complex, often with higher buffers

- Some lenders treat trust loans as “business-purpose”, requiring extra documentation

5. Exit Options

- In a trust, you can distribute income flexibly across beneficiaries

- Asset protection from lawsuits or business risks may be materially better

- Capital gains inside a trust can be streamed (in some cases) to adult beneficiaries

- Stamp duty applies again if you ever transfer the property into a trust later — making early decisions crucial

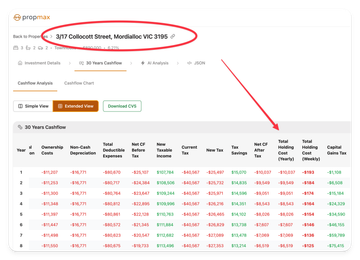

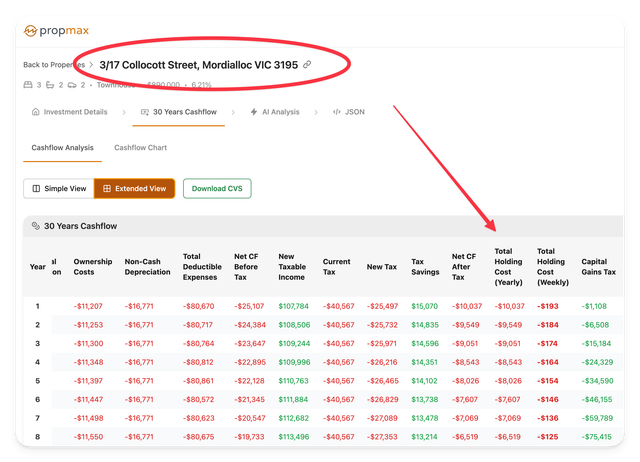

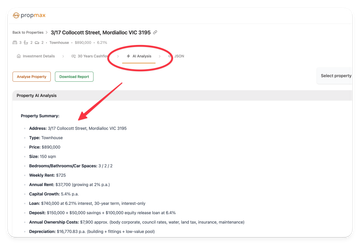

Modelling Trust vs Personal Ownership in PropMax

To demonstrate the differences, we start with a realistic townhouse scenario — typical of a modern build in a growth corridor:

- Purchase price: $620k–$650k

- Rent: $600–$650/week

- Land value component: $260k–$310k (varies by state)

- Depreciation: Strong capital works schedule for the first 10–15 years

- Ownership costs: Rates, insurance, PM fees, maintenance aligned with modern townhouses

These inputs allow us to model the effects of different ownership structures across states such as VIC, QLD, and NSW.

Scenario A: Personal Ownership

Cashflow Key Points

- Full deductibility of interest and expenses

- Depreciation reduces taxable income immediately

- Negatively geared positions reduce personal PAYG tax

Land Tax

- You benefit from state thresholds, e.g.:

- VIC: $0–$50 land value before land tax applies

- QLD: $600k land value threshold (for individuals)

- NSW: No threshold for investment property (land tax applies based on UCV)

For a townhouse with $280k land value in QLD:

- Land tax = $0 in personal name

- In a trust, land tax applies from the first dollar (unless structured as a special trust with exemptions)

Long-Term Outcome

With strong growth and depreciation:

- Net cashflow typically improves after year 5–7

- Equity compounding is identical across structures

- After-tax cashflow is often better in personal name, particularly for high-income earners

Scenario B: Discretionary Trust (Family Trust)

Cashflow Key Points

- Deductions occur inside the trust

- Distributions can be streamed to adult beneficiaries

- Losses cannot be distributed — negative gearing losses are quarantined and carried forward

- Some lenders offer IO and 80% LVR but serviceability is lower

Land Tax

This is the biggest differentiator.

- VIC: Trusts taxed at higher rates with no threshold

- QLD: Trusts taxed from $350k land value

- NSW: Trusts taxed at the special trust rate, with no threshold

For a townhouse with $280k–300k land value:

- VIC & NSW trust structures incur annual land tax immediately

- QLD trust may or may not trigger land tax depending on UCV

- Personal ownership may pay $0, saving thousands annually

When Trusts Win

- Multiple investment properties owned across family members

- Asset protection is a priority

- Beneficiaries in low-tax brackets can receive distributions

- Land values are low enough that land tax does not dominate cashflow

When Trusts Lose

- High land value (townhouses in VIC/NSW) creates ongoing land tax drag

- Investor wants negative gearing immediately

- Borrowing power is already tight

- Only one beneficiary has meaningful income

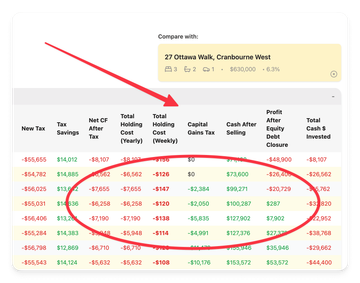

10-Year Cashflow Comparison: Personal vs Trust

Below is a generalised comparison based on the typical townhouse dataset:

| Metric | Personal Ownership | Trust Ownership |

|---|

| Borrowing power | Highest | Lower |

| LVR / interest rate | Standard | Often slightly higher |

| Land tax | Usually lower due to thresholds | Often higher; no thresholds |

| Tax treatment | Negative gearing reduces PAYG | Losses trapped in trust |

| Depreciation impact | Immediate tax offset | Offsets trust income only |

| After-tax cashflow (years 1–5) | Better | Usually worse |

| Flexibility for distributions | Low | Excellent |

| Asset protection | Low | High |

| Best suited for | First/second IP, PAYG investor | Multi-property portfolio, business owners |

Equity & Capital Growth: Identical Across Structures

The ownership structure does not change the fundamental performance of the property:

- Capital growth

- Rent escalations

- Appreciation over 10–20 years

- Equity release potential

However, the tax outcome on the gain differs:

Personal

- 50% CGT discount after 12 months

- Gain taxed at marginal tax rate

Trust

- 50% CGT discount available

- Capital gain can be streamed to adult beneficiaries

- Potential to save 5–20% in tax depending on family structure

PropMax Modelling Workflow

To compare structures:

1. Enter Base Property Inputs

Price, loan settings, rent, depreciation, ownership costs.

2. Duplicate the Scenario

One version for Personal, one for Trust.

3. Add Structure-Specific Adjustments

- Land tax rules

- Trust lender interest rate (if higher)

- Quarantined losses (trust)

- Distribution assumptions

4. Analyse 5-, 10-, 20-Year Metrics

- Net cashflow (before/after tax)

- Cumulative holding cost

- Equity runway

- Peak negative cashflow

- ROI and IRR

5. Model Exit Strategy

- CGT payable

- Distribution to beneficiaries

- Land tax impact on long-term holding

Key Takeaways

When Personal Ownership Is Better

- You want maximum borrowing power

- The property has high land value (VIC/NSW townhouses)

- You rely on negative gearing to manage cashflow

- You plan to hold one or two investment properties

When a Trust Becomes Powerful

- You plan to own multiple properties

- Land tax across multiple assets becomes a major issue

- You want asset protection

- You have multiple adult beneficiaries

- Strong capital gains are expected and CGT streaming is valuable

Final Word

Trusts can be incredibly effective — but only when the tax and land-tax benefits outweigh the extra carrying costs and reduced borrowing capacity. For many new investors, personal ownership delivers stronger early cashflow and keeps options open.

PropMax allows you to model both structures in minutes so you can see the real-world impact on:

- Cashflow

- Land tax

- Depreciation benefits

- Equity growth

- Total ROI

Before you commit to a structure, run the numbers. The right choice can save (or cost) you tens of thousands over the life of the investment.