Step 1: Property Basics & Growth Assumptions

Every holding cost calculation starts with the fundamentals. In PropMax, click on "1. Investment Details" then navigate to the "Price, Rent & Capital Grow" tab.

From the listing:

- Address: 14 Basque Walk, Cranbourne South VIC 3977

- Property Type: Townhouse

- Beds / Baths / Car: 3 / 2 / 1

- Purchase Price: $630,000

- Property Size: 170 sqm

Rental & Growth Estimates:

- Weekly Rent: $630 (check Domain or REA for comparable rentals)

- Vacancy Rate: 2% (realistic for most suburbs)

- Capital Growth: 4.5% p.a. (PropMax can prefill local market data)

- Rent Growth: 3% p.a. (historical average for the area)

Tax & Ownership Settings:

- Personal Income: $220,000 (determines your marginal tax rate)

- Ownership: Personal (gets 50% CGT discount) vs Trust (no discount)

- Negative Gearing: Enabled (offset losses against your income)

Pro tip: Click "Prefill Market Data" to automatically populate rent estimates and historical growth rates based on actual suburb performance. This removes the guesswork from your projections.

Step 2: Loan Structure & Purchase Costs

Navigate to the "Savings, Loan & Closing Costs" tab. This is where you model how you're financing the purchase and capture ALL upfront costs.

Deposit & Loan Details

For our Cranbourne example:

- Deposit: $38,000 (6% deposit)

- Loan Amount: $600,000

- Interest Rate: 5.75% (current investor rate)

- Loan Type: Interest-only for 30 years

Where Your Deposit Comes From

- Savings: $20,000 (cash in the bank)

- PPOR Equity Release: $0 (not using home equity in this example)

- Equity Loan Interest: N/A

Where to get these numbers:

- Interest rates: Check your broker or current lender rates

- Available equity: Request a property valuation and check available equity with your lender

- LMI: PropMax automatically calculates if your LVR triggers Lender's Mortgage Insurance

Purchase Costs (The Hidden Expenses)

PropMax automatically calculates your state-specific costs:

- Stamp Duty: Varies by state (VIC charges different rates than NSW)

- Conveyancing: $2,500 (typical range $1,500-3,000)

- Building & Pest Inspections: $0 in this example (budget $600-900)

- Other Costs: $1,500 (searches, transfer fees, etc.)

Where to find these:

- Stamp duty: Use PropMax's built-in calculator or check your state revenue office

- Legal fees: Get quotes from conveyancers in your area

- Other costs: Ask your broker or conveyancer for a breakdown

Your Total Purchase Cost gives you the complete upfront capital required, not just the deposit amount agents quote you.

Step 3: Ownership Costs & Depreciation

Click on the "Ownership, Depreciation & Extra Repayments" tab. This is where experienced investors separate themselves from beginners.

Regular Expenses (Annual Costs)

For 14 Basque Walk:

- Body Corporate: $150/year (from the strata report)

- Council Rates: $450/year (ask the agent or check council website)

- Water Rates: $150/year (investor-paid portion)

- Land Tax: $975/year (calculate using our Land Tax Calculator)

- Landlord Insurance: $400/year (get quotes from Terri Scheer, EBM)

- Property Management: 7.70% of rent ($2,380/year for $630/week rent)

- Maintenance Budget: $1,200/year (budget 1% of property value)

Annual Ownership Costs: ~$5,705

Where to find these numbers:

- Body corporate fees: In the Section 32 or Contract of Sale

- Council rates: Ask the selling agent or search the council's property database

- Land tax: Use PropMax's calculator or check State Revenue Office

- Insurance: Get quotes from specialist landlord insurers

- Management fees: Typical range is 6-8% depending on location

Depreciation: The $3,000+/Year Tax Advantage

This is where most investors leave thousands on the table. For our Cranbourne townhouse:

- Capital Works (Div 43): $400,000 building value

- Plant & Equipment (Div 40): $0 (established property, prior owner's assets)

- Low-Value Pool (Div 40): $0

Annual Depreciation Deduction: $10,000

Tax Saving at 37% rate: ~$3,700/year

Breaking it down:

- Capital Works (Div 43): $10,000/year ($400,000 × 2.5%)

- Plant & Equipment (Div 40): $0/year

- Low-Value Pool (Div 40): $0/year

Total Annual Depreciation: $10,000

How to get these numbers:

- Order a depreciation schedule from a quantity surveyor ($600-800)

- For new/recent builds: Capital works = ~2.5% of construction value annually

- For established properties (post-2017): Only claim plant & equipment items you purchased new

Important: The May 2017 rule change means you can't claim depreciation on second-hand plant & equipment (carpets, appliances, etc.) unless you bought them new. Capital works (building structure) is still fully claimable for buildings constructed after September 1987.

Read more: How Depreciation Can Save You $3,000+ Per Year

If you plan to make extra repayments toward your principal (either lump sums or recurring amounts), add them here. PropMax will show you how faster repayments affect:

- Your loan balance over time

- Weekly holding costs

- Total interest paid

- Equity growth acceleration

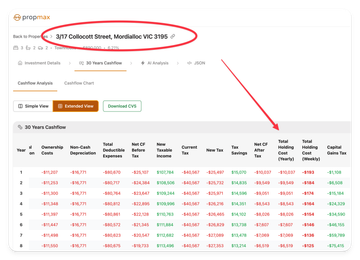

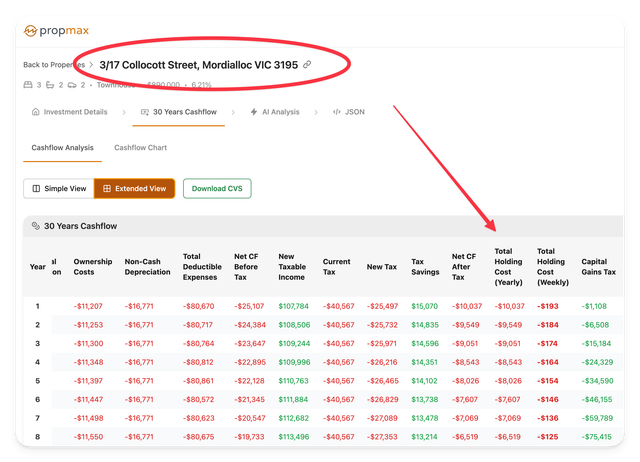

Step 4: Your 30-Year Cashflow Projection

Click on "2. Holding Cost Analysis" to see your complete financial projection.

Understanding the Simple View

The table shows your property's performance year by year. Here's what each column means:

Property Metrics:

- Property Value: Starting at $630,000, growing at 4.5% p.a.

- Loan Balance: Stays at $600,000 (interest-only loan)

- Equity: Property value minus loan = Your wealth growth

- LVR (%): Loan-to-value ratio (important for refinancing)

- Usable Equity: How much you can access (typically 80% LVR minus current loan)

Income & Expenses:

- Ownership Costs: All annual expenses (rates, insurance, management, etc.)

- Net Cashflow Before Tax (Yearly): Rent minus expenses and interest

- Net Cashflow Before Tax (Weekly): Same, but easier to understand weekly

After-Tax Reality:

- Net Cashflow After Tax: After negative gearing tax benefits

- Holding Cost After Tax (Yearly): Your actual out-of-pocket expense

- Holding Cost After Tax (Weekly): The number that matters most

Long-Term Performance:

- Cash After Selling: What you'd walk away with if you sold (after CGT and costs)

- ROI (%): Return on investment including all costs and growth

What This Table Tells You

For 14 Basque Walk, here's the journey:

Year 1 (Purchase):

- Weekly holding cost: -$73/week (you pay $73 out of pocket)

- Annual cashflow after tax: -$3,785

- Property value: $658,350

- Equity: $58,350

Year 3:

- Weekly holding cost: -$52/week (improving!)

- Annual cashflow after tax: -$2,683

- Property value: $718,935

- Equity: $118,935

Year 8:

- Weekly holding cost: $0 (cashflow neutral!)

- Property value: $895,924

- Equity: $295,924

Year 13:

- Weekly holding cost: +$3/week (cashflow positive!)

- Property value: $1,118,454

- Equity: $518,454

- ROI: 575%

Color coding helps you see performance at a glance:

- 🔴 Red numbers: Money you pay out of pocket (negative cashflow)

- 🟢 Green numbers: Positive cashflow or gains

- 🟡 Yellow highlight: Comparison property (when comparing multiple properties)

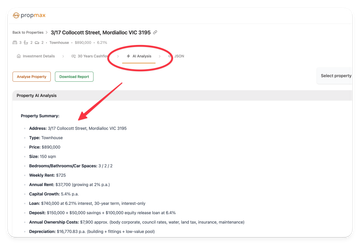

Step 5: Generate Your Professional Report

Click on "3. Investment Report" to access your downloadable analysis.

What's In Your Report

Your report includes:

Property Summary:

- Complete property details (address, type, size, bedrooms)

- Purchase price and loan structure

- Rental income and growth assumptions

- Annual ownership costs

Financial & Investment Analysis:

Key Highlights:

- Initial cash outlay: Includes deposit, legal, stamp duty, and closing costs

- Year 1 cashflow: Shows your immediate post-tax cashflow impact

- Long-term appreciation: Property value growth over 3, 10, 15, and 30 years

- Net ROI trajectory: When you break even and start profiting

- Depreciation benefit: Consistent tax deductions improving cashflow

Performance Table:

A focused summary showing Years 3, 10, and 15:

- Property value and equity growth

- Net cashflow after tax

- Cumulative cash outlay

- ROI (annualized)

- Estimated capital gain

- After-tax cash rent (your real holding cost)

How to Use Your Report

Share with your team:

- Accountant: Verify tax assumptions and depreciation strategy

- Broker: Support your loan application with detailed cashflow projections

- Partner/Spouse: Make joint investment decisions with full transparency

- Buyer's Advocate: Compare properties objectively before making offers

Download options:

- PDF Report: Clean, professional document you can email or print

- CSV Export: Raw data you can manipulate in Excel if needed

- JSON: For developers integrating with other tools

Key Takeaways: Making Smarter Property Decisions

Now that you understand how to calculate holding costs properly, here's what you need to remember:

1. Holding costs improve over time

Even negatively geared properties become cashflow positive within 5-10 years as rent increases and depreciation compounds. In our example, -$73/week in year 1 becomes $0 by year 8.

2. Depreciation is your secret weapon

A $10,000/year depreciation claim saves you $2,900-4,700 in tax annually depending on your tax rate. For our Cranbourne property, it reduces the holding cost from -$122/week to just -$73/week. Get a quantity surveyor's report—it pays for itself in year 1.

3. Don't trust agent projections

Run your own numbers with realistic vacancy rates (2-3%), conservative growth assumptions, and ALL expenses included. Agents often forget to mention body corporate fees, land tax, and maintenance costs.

4. Factor in ALL upfront costs

Stamp duty, legal fees, inspections, and other closing costs can add $50,000+ to your purchase price. These need to be part of your ROI calculation.

5. Model different scenarios

Compare interest-only vs P&I loans, different deposit amounts, or extra repayment strategies to see what works best for your situation. A few clicks in PropMax can save you thousands.

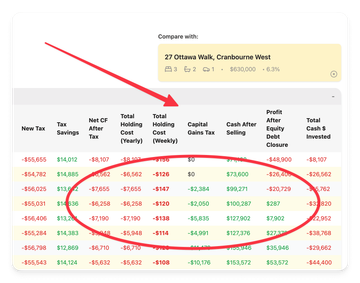

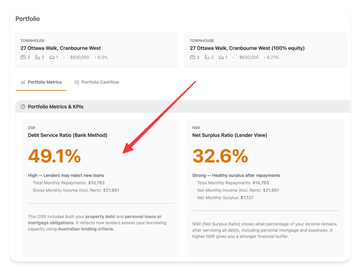

6. Use property comparison to remove emotion

Analyzing properties side-by-side shows you which investment genuinely performs better, not which one has nicer kitchen benchtops.

7. Long-term wealth beats short-term cashflow

A property costing you $73/week in year 1 can deliver $500,000+ in equity by year 13. Focus on total returns (capital growth + cashflow + tax benefits), not just weekly costs.

8. Get a depreciation schedule immediately

Order it as soon as you settle. Missing even one year of depreciation claims means losing that money forever—you can't go back beyond 2 years.

Common Mistakes to Avoid

❌ Forgetting land tax: Many investors don't realize they'll pay land tax once their total Victorian landholdings exceed the threshold. Calculate your Victoria land tax.

❌ Underestimating maintenance: Budget at least 1% of property value annually. Air conditioners fail, hot water systems die, and tenants cause damage.

❌ Ignoring vacancy periods: Even great properties have vacancies. Budget 2-3% minimum.

❌ Overestimating capital growth: Using 10% growth assumptions might feel good, but 4-7% is more realistic long-term for most suburbs.

❌ Not claiming depreciation: This is literally the $3,000/year mistake 90% of investors make. Don't be one of them.

Ready to Run Your Numbers?

Stop guessing. Start calculating.

👉 Try PropMax's Investment Property Calculator (free for single property analysis)

Or dive deeper into specific topics: